- United States

- /

- Machinery

- /

- NYSE:HLIO

Helios Technologies (NYSE:HLIO) stock falls 5.4% in past week as three-year earnings and shareholder returns continue downward trend

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of Helios Technologies, Inc. (NYSE:HLIO) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 54% drop in the share price over that period. Furthermore, it's down 32% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

After losing 5.4% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Helios Technologies

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

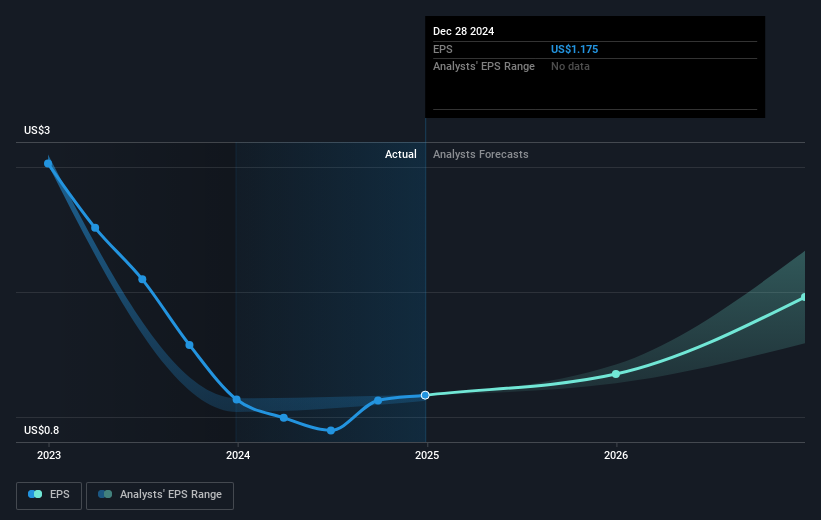

Helios Technologies saw its EPS decline at a compound rate of 29% per year, over the last three years. In comparison the 23% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Helios Technologies' earnings, revenue and cash flow.

A Different Perspective

Investors in Helios Technologies had a tough year, with a total loss of 17% (including dividends), against a market gain of about 8.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Helios Technologies , and understanding them should be part of your investment process.

We will like Helios Technologies better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade Helios Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Helios Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HLIO

Helios Technologies

Provides engineered motion control and electronic controls technology solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives