- United States

- /

- Aerospace & Defense

- /

- NYSE:HII

Is HII’s ROMULUS Milestone Quietly Rewriting Its AI and Shipbuilding Balance?

Reviewed by Sasha Jovanovic

- Earlier this week, HII reported that construction of its ROMULUS unmanned surface vessel prototype reached 30% completion and remains on track for fourth-quarter 2026 sea trials, while also expanding its partnership with Babcock International to manufacture complex Virginia-class submarine assemblies in Scotland.

- Together, these moves highlight HII’s push into AI-enabled autonomy and distributed production, which could reshape how it balances high-tech systems with large-scale shipbuilding work.

- We’ll now examine how the ROMULUS progress, particularly its AI-enabled autonomy, could influence Huntington Ingalls Industries’ existing investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Huntington Ingalls Industries Investment Narrative Recap

To own Huntington Ingalls Industries, you need to believe its core shipbuilding backlog can keep driving cash flow while Mission Technologies gradually adds higher tech, higher margin work. The ROMULUS update modestly reinforces the autonomy catalyst, but the most important near term swing factor still looks like execution and timing on major submarine programs, while persistent supply chain fragility around big ships such as CVN 80 remains a key operational risk.

The expanded outsourcing deal with Babcock International to build Virginia class submarine assemblies ties directly into HII’s throughput and industrial base story. By broadening suppliers capable of large structure work, the company is trying to support its 20% throughput improvement goal and ease bottlenecks that have historically affected schedules and margins in its largest shipbuilding programs.

Yet even as HII leans into autonomy with ROMULUS, investors should be aware of how ongoing supply chain fragility could still...

Read the full narrative on Huntington Ingalls Industries (it's free!)

Huntington Ingalls Industries' narrative projects $13.6 billion revenue and $785.0 million earnings by 2028. This requires 5.4% yearly revenue growth and a $260.0 million earnings increase from $525.0 million today.

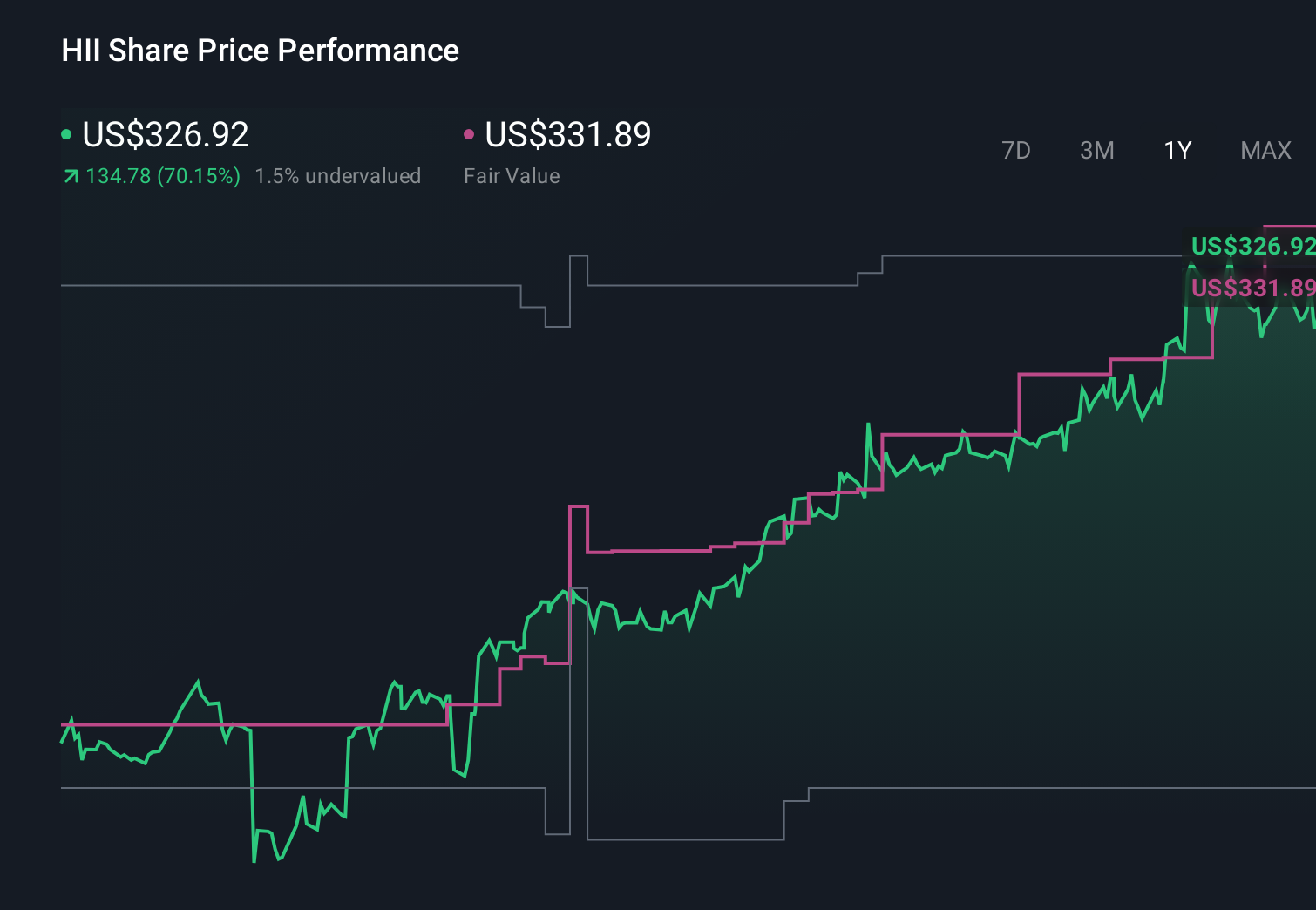

Uncover how Huntington Ingalls Industries' forecasts yield a $331.89 fair value, in line with its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly US$180 to US$448 per share, with several clustered in the low to mid US$300s. Against this wide range, the ROMULUS autonomy program sits alongside HII’s large, multi year shipbuilding backlog as a potential driver of future earnings resilience, so it is worth comparing these different viewpoints before forming your own stance.

Explore 8 other fair value estimates on Huntington Ingalls Industries - why the stock might be worth 45% less than the current price!

Build Your Own Huntington Ingalls Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Huntington Ingalls Industries research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Huntington Ingalls Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Huntington Ingalls Industries' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Huntington Ingalls Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HII

Huntington Ingalls Industries

Designs, builds, overhauls, and repairs military ships in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)