- United States

- /

- Construction

- /

- NYSE:VATE

Some HC2 Holdings (NYSE:HCHC) Shareholders Have Copped A Big 68% Share Price Drop

Taking the occasional loss comes part and parcel with investing on the stock market. Anyone who held HC2 Holdings, Inc. (NYSE:HCHC) over the last year knows what a loser feels like. The share price is down a hefty 68% in that time. To make matters worse, the returns over three years have also been really disappointing (the share price is 58% lower than three years ago). Shareholders have had an even rougher run lately, with the share price down 15% in the last 90 days.

View our latest analysis for HC2 Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

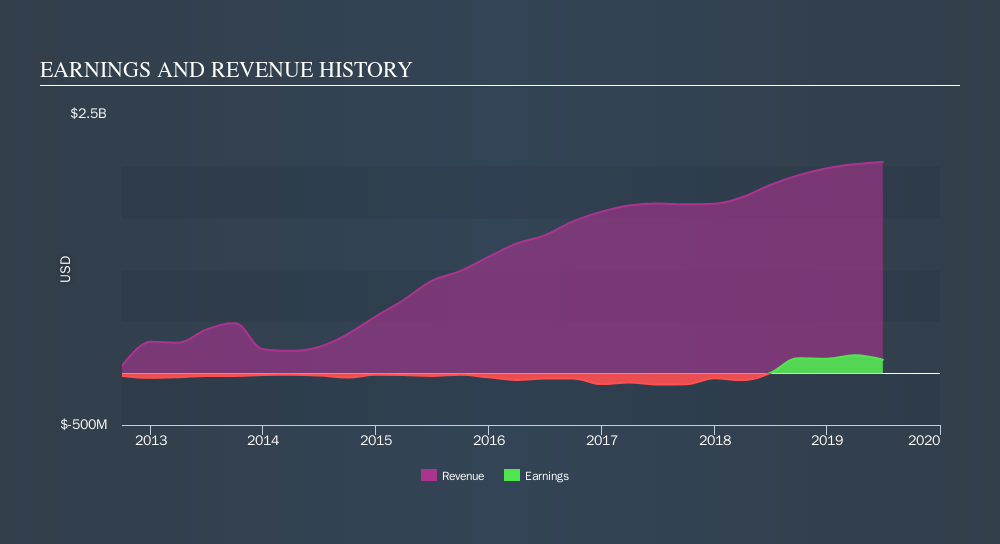

HC2 Holdings stole the show with its EPS rocketing, in the last year. While the business is unlikely to sustain such a high growth rate for long, it's great to see. As you can imagine, the share price action therefore perturbs us. So it's worth taking a look at some other metrics.

HC2 Holdings managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling HC2 Holdings stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While the broader market gained around 2.2% in the last year, HC2 Holdings shareholders lost 68%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of HC2 Holdings by clicking this link.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:VATE

INNOVATE

Through its subsidiaries, operates in infrastructure, life sciences, and spectrum areas in the United States.

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives