- United States

- /

- Machinery

- /

- NYSE:GTES

Does Gates Industrial (NYSE:GTES) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Gates Industrial (NYSE:GTES). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Gates Industrial with the means to add long-term value to shareholders.

Check out our latest analysis for Gates Industrial

How Fast Is Gates Industrial Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Gates Industrial's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 48%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

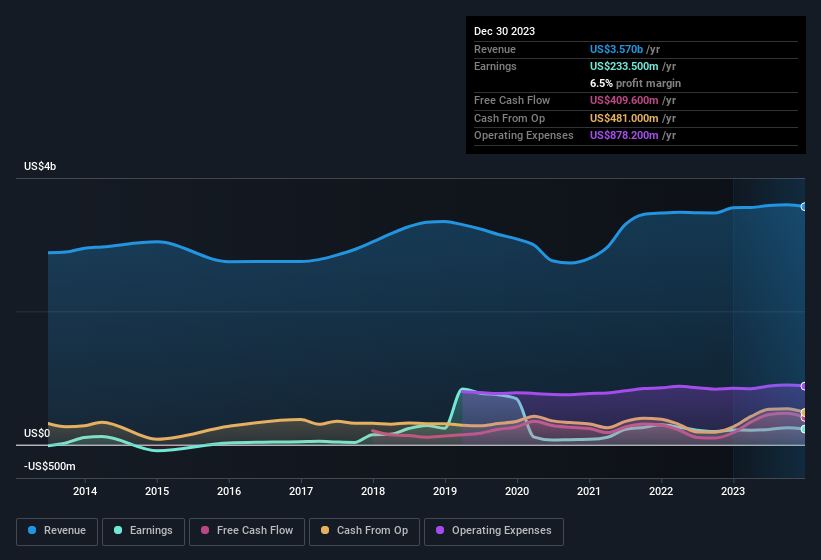

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. This approach makes Gates Industrial look pretty good, on balance; although revenue is flattish, EBIT margins improved from 11% to 13% in the last year. Which is a great look for the company.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Gates Industrial?

Are Gates Industrial Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's pleasing to note that insiders spent US$14m buying Gates Industrial shares, over the last year, without reporting any share sales whatsoever. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. It is also worth noting that it was Independent Chairman of Board Neil Simpkins who made the biggest single purchase, worth US$12m, paying US$12.20 per share.

Along with the insider buying, another encouraging sign for Gates Industrial is that insiders, as a group, have a considerable shareholding. To be specific, they have US$42m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 0.9%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Gates Industrial's CEO, Ivo Jurek, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations between US$2.0b and US$6.4b, like Gates Industrial, the median CEO pay is around US$6.7m.

Gates Industrial offered total compensation worth US$5.0m to its CEO in the year to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Gates Industrial To Your Watchlist?

Gates Industrial's earnings per share have been soaring, with growth rates sky high. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Gates Industrial belongs near the top of your watchlist. You should always think about risks though. Case in point, we've spotted 1 warning sign for Gates Industrial you should be aware of.

The good news is that Gates Industrial is not the only growth stock with insider buying. Here's a list of growth-focused companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GTES

Gates Industrial

Manufactures and sells engineered power transmission and fluid power solutions worldwide.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives