- United States

- /

- Banks

- /

- NasdaqGS:CASH

Three Undiscovered Gems in the US Market with Promising Potential

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a slight dip of 1.0%, yet it remains robust with a 30% increase over the past year and an expected annual earnings growth of 15%. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can uncover promising opportunities for investors seeking to capitalize on these trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| AirJoule Technologies | NA | nan | 127.67% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Pathward Financial (NasdaqGS:CASH)

Simply Wall St Value Rating: ★★★★★★

Overview: Pathward Financial, Inc. is a bank holding company for Pathward, National Association, offering a range of banking products and services in the United States with a market cap of approximately $1.96 billion.

Operations: Pathward Financial generates revenue primarily through its banking products and services. The company's net profit margin was reported at 25.4% in the latest financial period, reflecting its ability to manage costs effectively relative to income.

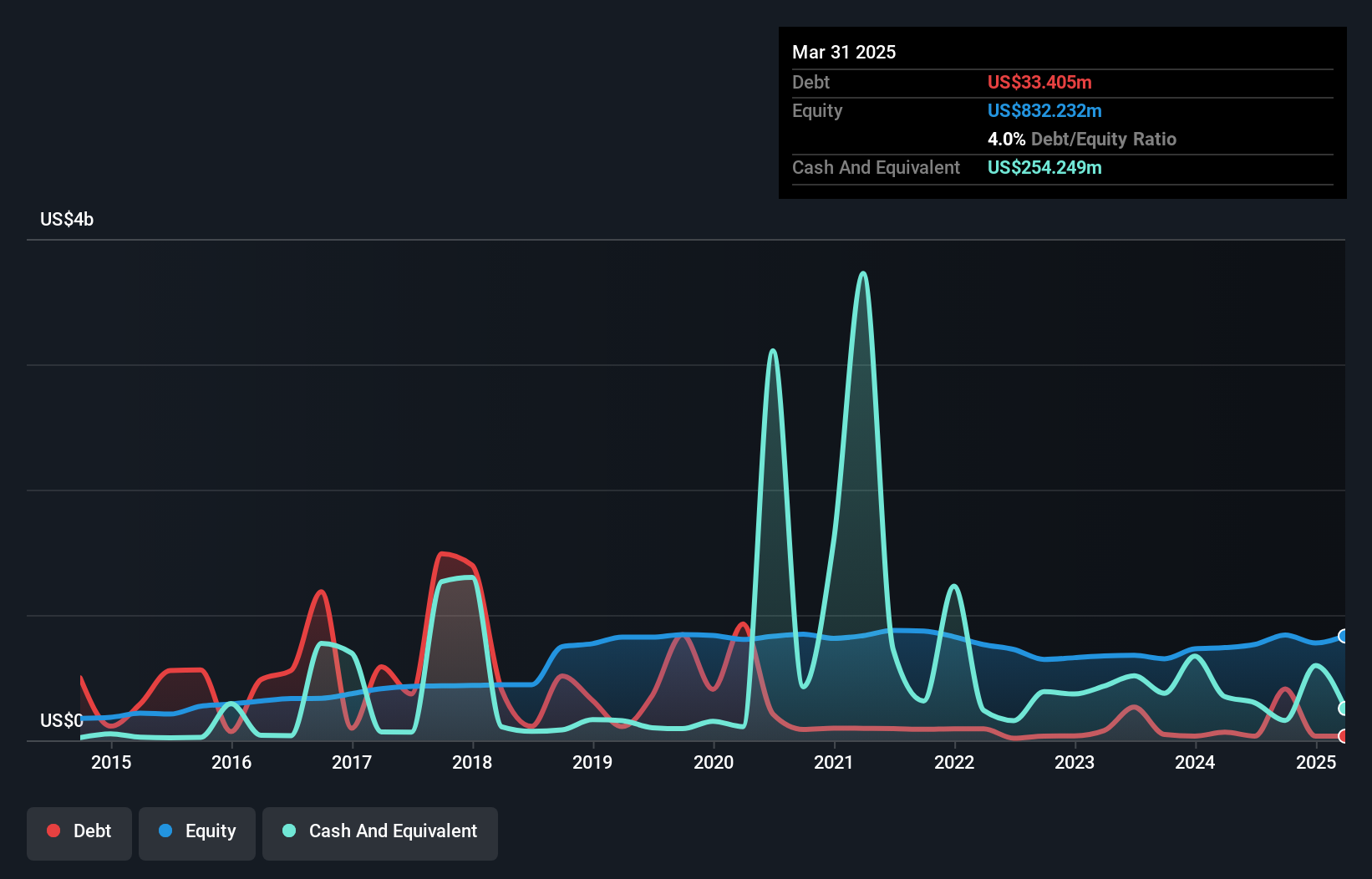

Pathward Financial, with assets totaling US$7.5 billion and equity of US$839.6 million, presents an intriguing opportunity in the financial sector. Its total deposits stand at US$5.9 billion against loans of US$4 billion, reflecting a robust balance sheet backed by a net interest margin of 6.1%. The company maintains a sufficient allowance for bad loans at 109%, with non-performing loans at just 1%, indicating prudent risk management. Recent earnings guidance suggests GAAP earnings per share between $7.10 to $7.60 for fiscal 2025, excluding certain impacts, while it has repurchased over 236K shares recently for $14.99 million, enhancing shareholder value amidst competitive pressures and economic uncertainties.

Global Industrial (NYSE:GIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Global Industrial Company is an industrial distributor specializing in a wide range of MRO products across North America, with a market cap of approximately $1.04 billion.

Operations: Global Industrial generates revenue primarily from its Industrial Products Group, which reported $1.33 billion in sales. The company's financial performance includes a focus on managing costs to optimize profitability, with particular attention to its gross profit margin trends over recent periods.

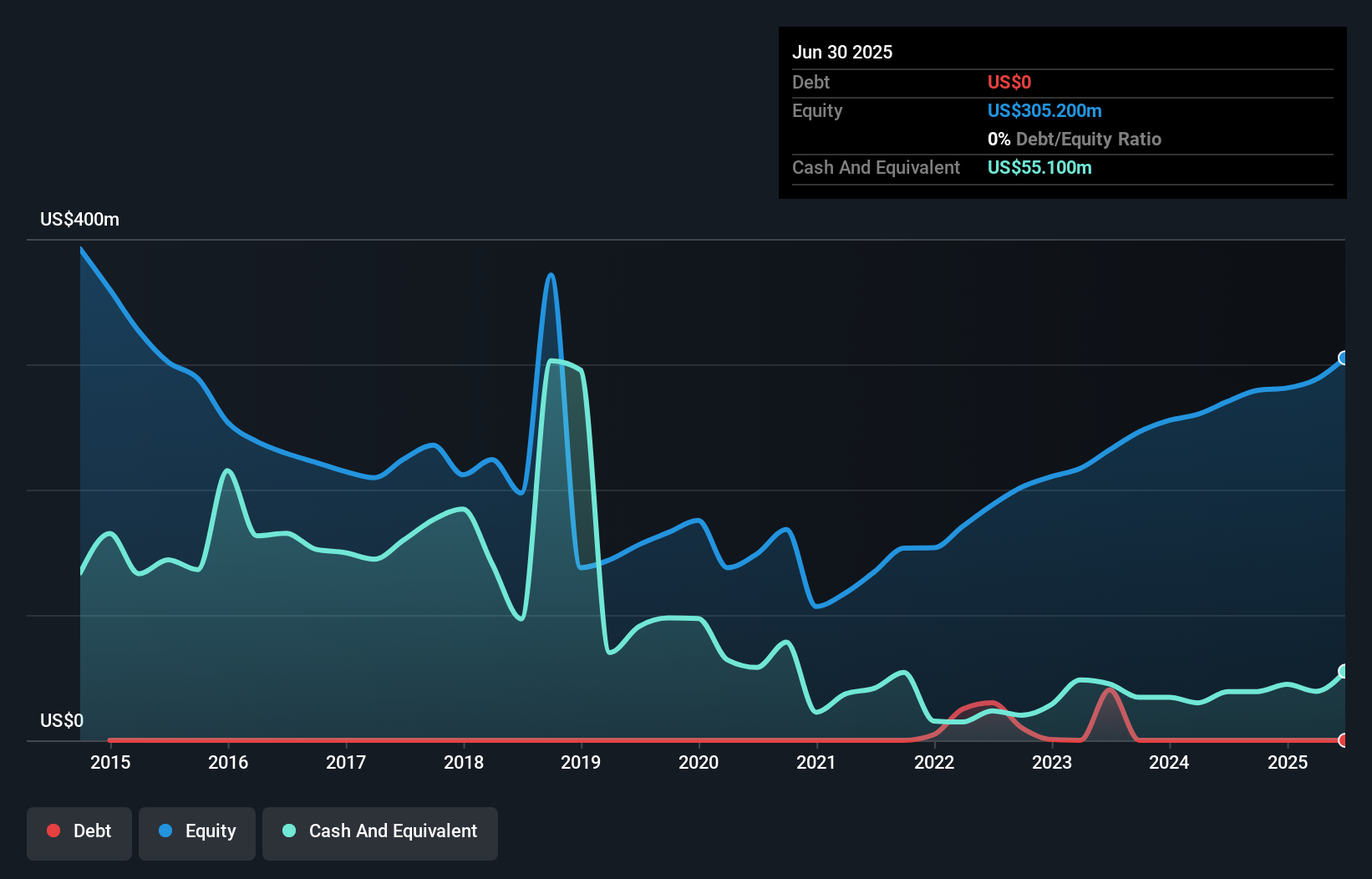

Global Industrial, a nimble player in the MRO distribution space, showcases a robust balance sheet with zero debt, providing ample room for strategic investments. Recent earnings reveal sales of US$342 million for Q3 2024, down from US$355 million last year, while net income dropped to US$17 million from US$21 million. Despite these challenges and negative earnings growth of -5.4% over the past year, the company trades at nearly 70% below fair value estimates and is forecasted to grow earnings by 12% annually. This positions it as an intriguing prospect amidst its industry peers.

La-Z-Boy (NYSE:LZB)

Simply Wall St Value Rating: ★★★★★★

Overview: La-Z-Boy Incorporated is engaged in the manufacturing, marketing, importing, exporting, distribution, and retailing of upholstery furniture products across the United States, Canada, and internationally with a market cap of approximately $1.76 billion.

Operations: La-Z-Boy generates revenue primarily through the sale of upholstery furniture products. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

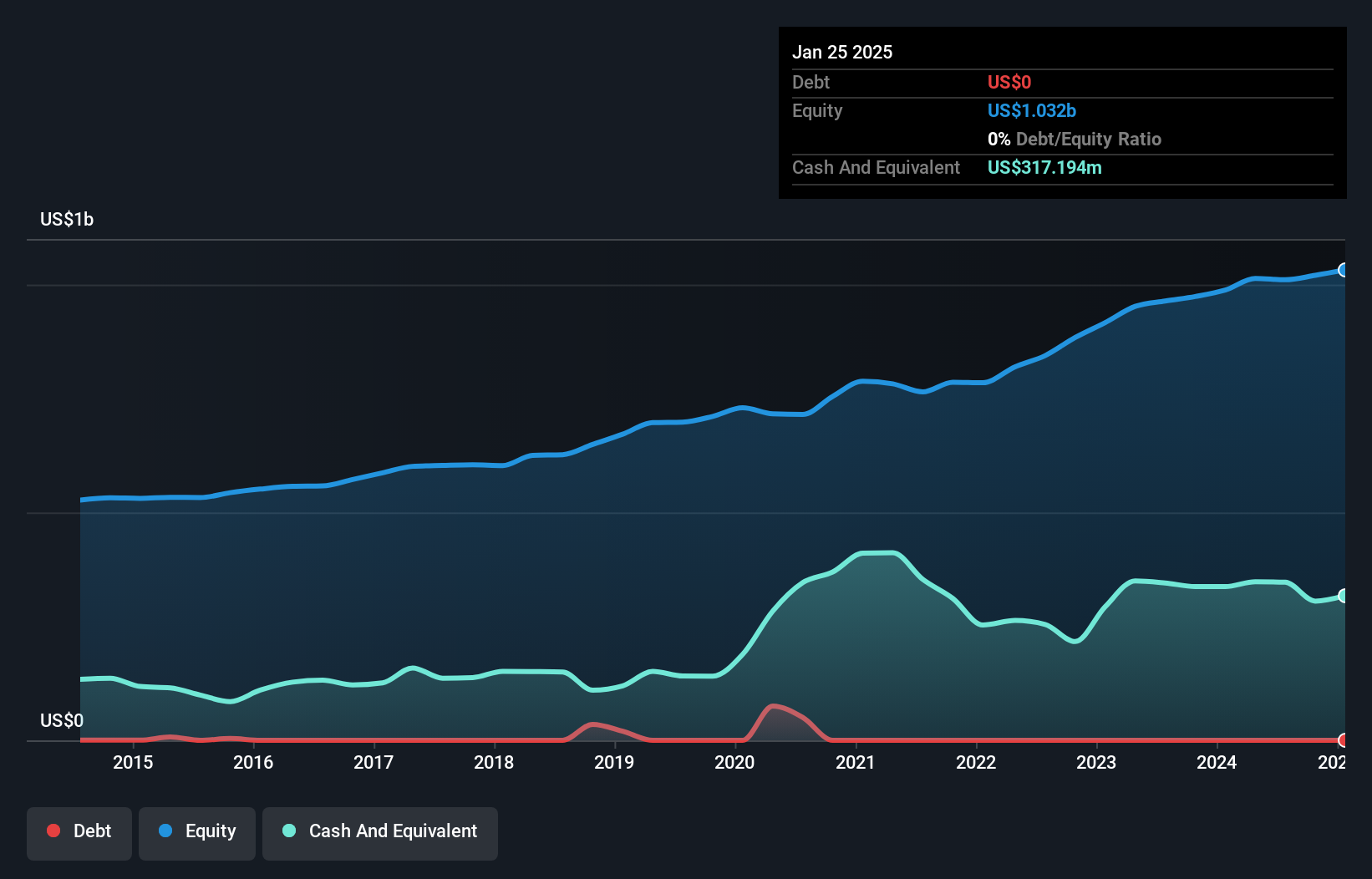

La-Z-Boy, a recognized name in furniture, is making strategic moves to bolster its market presence. The company reported sales of US$521 million for the recent quarter, up from US$511 million last year, with net income rising to US$30 million from US$27.2 million. Earnings per share increased to US$0.72 from US$0.63, reflecting its strong performance despite industry challenges like high mortgage rates and sluggish demand. With no debt on its books and trading 31.5% below estimated fair value, La-Z-Boy seems well-positioned for growth as it expands through acquisitions and new store openings while maintaining robust free cash flow of over US$109 million recently.

Turning Ideas Into Actions

- Click this link to deep-dive into the 229 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CASH

Pathward Financial

Operates as the bank holding company for Pathward, National Association that provides various banking products and services in the United States.

Flawless balance sheet and undervalued.