Narratives are currently in beta

Key Takeaways

- Shift of capital towards higher-yielding finance loans and optimizing assets is expected to increase return on assets and net interest margin.

- Expansion in SBA and USDA loan markets, along with new partnerships, supports potential revenue growth and enhanced service offerings.

- Economic uncertainties, competitive pressures, and interest rate fluctuations threaten Pathward Financial's revenue growth and financial stability, requiring effective risk management and strategic execution.

Catalysts

About Pathward Financial- Operates as the bank holding company for Pathward, National Association that provides various banking products and services in the United States.

- The sale of the commercial insurance premium finance business is expected to free up capital that can be redeployed into higher-yielding commercial finance loans and leases, offering higher risk-adjusted returns and increasing return on assets (ROA), which should positively impact earnings.

- Pathward Financial's expansion in the SBA market and strong pipelines in SBA, USDA, and working capital loans suggest potential for revenue growth, as these categories typically offer active secondary markets and opportunities for fee income generation.

- The ongoing strategy to optimize the balance sheet and asset rotation towards higher return categories aims to increase the net interest margin (NIM) and improve earnings, with an emphasis on assets that provide optionality such as SBA and USDA loans.

- The effect of new partner agreements and extensions, such as the extended contract with H&R Block and new partnerships with companies like Rain, indicate potential for increased revenue through expanded Banking as a Service and other embedded finance solutions.

- Continued investment in technology and infrastructure is aimed at enhancing efficiency and scalability, potentially improving net margins by supporting partner growth more effectively and reducing operational costs.

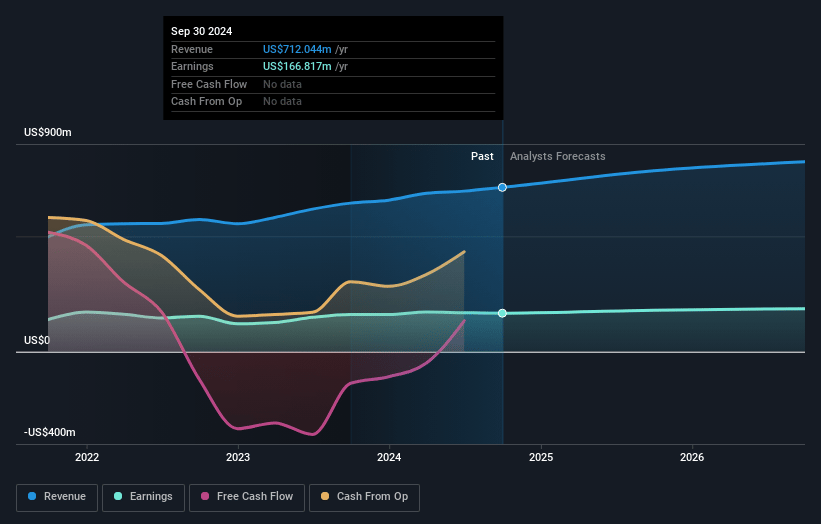

Pathward Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pathward Financial's revenue will grow by 7.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 23.5% today to 22.3% in 3 years time.

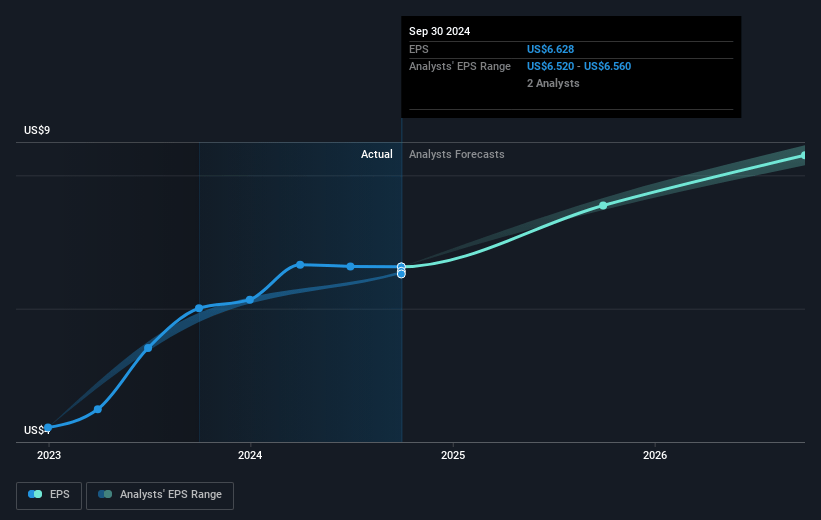

- Analysts expect earnings to reach $196.9 million (and earnings per share of $9.23) by about December 2027, up from $166.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.9x on those 2027 earnings, up from 10.8x today. This future PE is lower than the current PE for the US Banks industry at 12.5x.

- Analysts expect the number of shares outstanding to decline by 4.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Pathward Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces risks related to fluctuations in interest rates, particularly if the middle part of the yield curve changes more than expected, which could impact net interest income and overall earnings.

- There is declining noninterest income attributed to decreases in card and deposit fee income, which could affect revenue if these trends continue or worsen.

- The dependence on a strong pipeline from Partner Solutions and commercial finance for future growth includes execution risks and timing challenges that might delay revenue realization and earnings growth.

- Uncertainties in the economic environment, particularly concerning credit markets and potential credit losses, could affect the company's net margins and financial stability if not managed properly.

- Increased competition in the investment tax credit and other market segments might lead to reduced market share or profit margins, impacting future revenue streams and overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $86.0 for Pathward Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $883.0 million, earnings will come to $196.9 million, and it would be trading on a PE ratio of 10.9x, assuming you use a discount rate of 5.9%.

- Given the current share price of $74.84, the analyst's price target of $86.0 is 13.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives