- United States

- /

- Electrical

- /

- NYSE:GEV

Is It Too Late to Consider GE Vernova After Its 100% Plus Share Price Surge?

Reviewed by Bailey Pemberton

- Wondering if GE Vernova's huge run up is already over, or if there is still value left on the table? This article will walk through what the numbers actually say about the stock.

- The share price has been on a tear, up 9.7% over the last week, 18.7% over the last month, and 102.5% year to date, with a 109.5% gain over the past year reshaping how the market views its prospects.

- Those gains have come as investors focus on GE Vernova's role in the energy transition and the broader push toward grid modernization and lower carbon power, which has kept the stock in the spotlight for long term growth themes. At the same time, regular updates around large scale infrastructure spending and policy support for renewables have helped reinforce the narrative that the company could be a key beneficiary in this multi year shift.

- Despite the excitement, our valuation framework currently gives GE Vernova a 0/6 valuation score. This suggests the recent rally may have pushed the price ahead of traditional value markers. Next we will unpack what different valuation approaches say about the stock and hint at an even richer way to think about its true worth by the end of this article.

GE Vernova scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: GE Vernova Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth today by projecting its future cash flows and discounting them back to a present value. For GE Vernova, the model uses recent Free Cash Flow of about $2.54 billion and builds a two stage forecast based on analyst estimates, then extrapolates beyond their 5 year horizon.

Analysts currently expect Free Cash Flow to rise to around $4.44 billion in 2026 and $5.59 billion in 2027, with projections climbing further to roughly $8.25 billion by 2029. Beyond that, Simply Wall St extends the trend, resulting in ten year projections that continue to grow but at a moderating pace as the business matures.

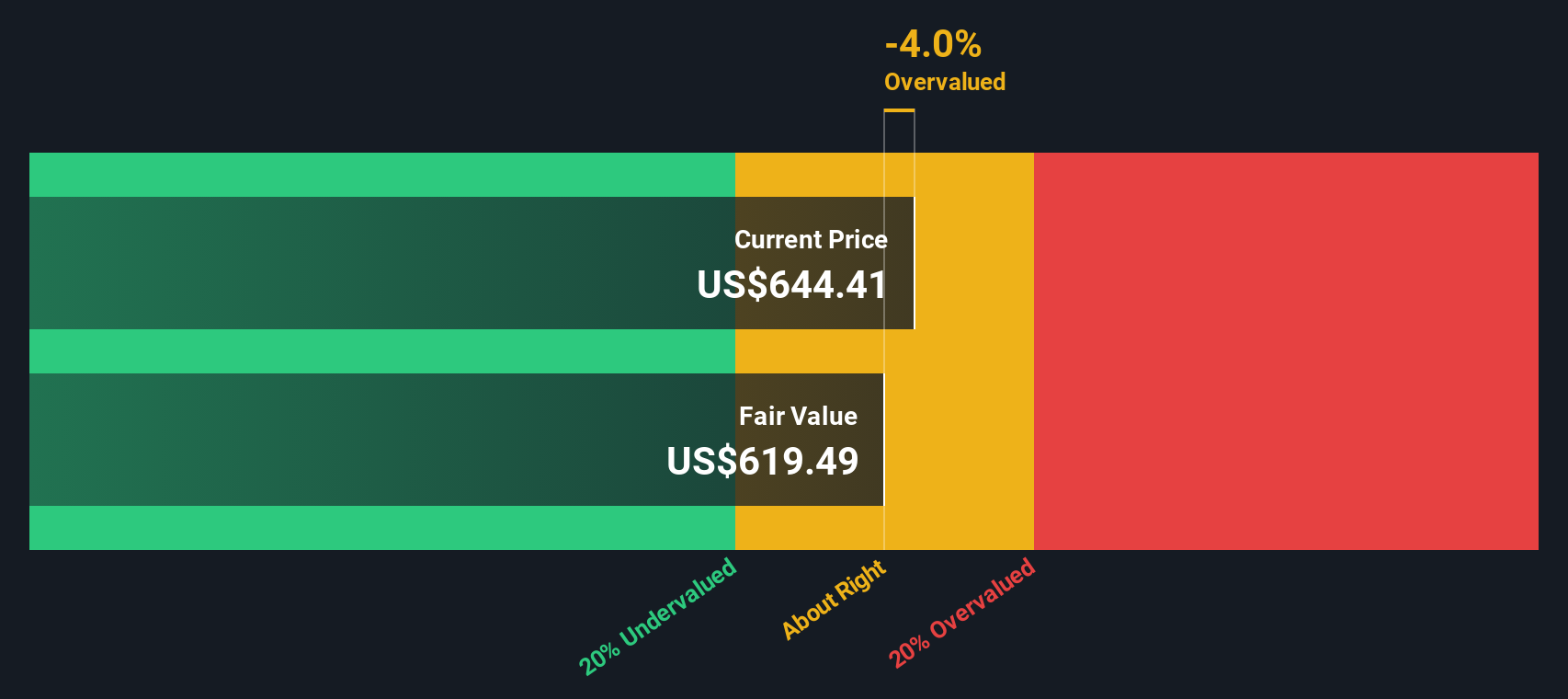

When all of these future cash flows are discounted back to today in dollars, the model arrives at an estimated intrinsic value of about $577.31 per share. With the DCF implying the stock is roughly 18.9% above the current market price, the recent share price surge appears to have moved ahead of what the cash flow outlook currently justifies.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GE Vernova may be overvalued by 18.9%. Discover 908 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: GE Vernova Price vs Earnings

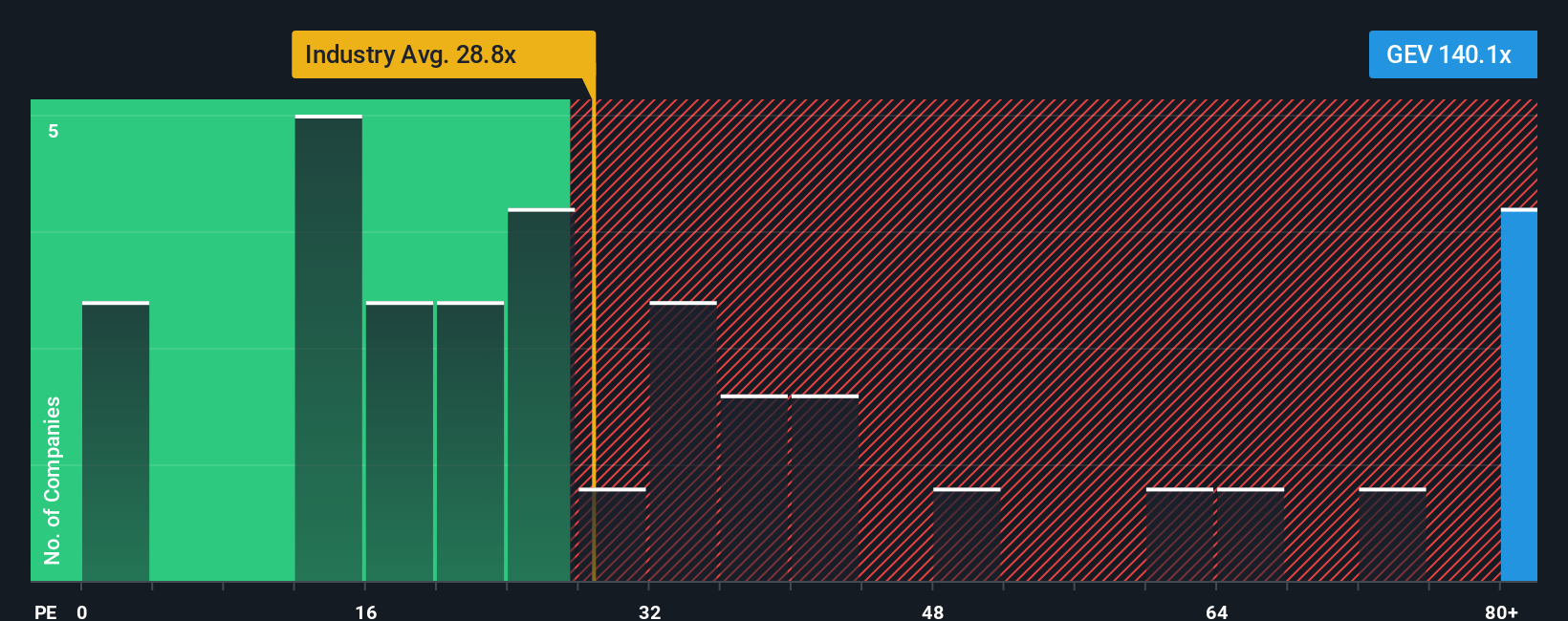

For a profitable business like GE Vernova, the price-to-earnings (PE) ratio is a helpful way to gauge how much investors are paying for each dollar of current earnings. In general, faster-growing and lower-risk companies can justify higher PE ratios, while slower or riskier names usually trade at lower multiples.

Right now, GE Vernova trades on a PE of about 109.3x, which is far above both the Electrical industry average of roughly 31.6x and the broader peer group average of around 28.7x. To move beyond those blunt comparisons, Simply Wall St uses a Fair Ratio, its proprietary view of what a reasonable PE should be once factors like earnings growth, industry characteristics, profit margins, market cap and specific risks are taken into account. For GE Vernova, that Fair Ratio is estimated at about 79.1x.

Even allowing for its growth profile and positioning in the energy transition, the current 109.3x PE still sits well above the 79.1x Fair Ratio, pointing to a valuation that already reflects a lot of optimism.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1457 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GE Vernova Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an approach on Simply Wall St where you attach a clear story about a company to your numbers by stating what you believe about its future revenue, earnings and margins. You can then see how that story translates into a Fair Value you can compare to today’s price to inform your decision on whether to buy, hold or sell.

A Narrative is simply your perspective written down and quantified. It links what you think will drive GE Vernova’s business, like demand for grid upgrades or risks in wind, to a financial forecast and then to a fair value estimate.

On Simply Wall St’s Community page, used by millions of investors, Narratives are easy to create and update. They automatically refresh as new information such as earnings reports, major contracts or policy changes comes in.

For example, one GE Vernova Narrative on the platform assumes strong electrification demand, rising profit margins to about 13.7 percent and a fair value near $681 per share. A more cautious Narrative might focus on wind losses, tariff headwinds and project risks, leading to a much lower fair value and a very different conclusion about whether the current price leaves enough upside.

Do you think there's more to the story for GE Vernova? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)