- United States

- /

- Aerospace & Defense

- /

- NYSE:GD

General Dynamics (NYSE:GD) Reports Q1 Sales of US$12 Billion; Earnings Rise 23% Year-Over-Year

Reviewed by Simply Wall St

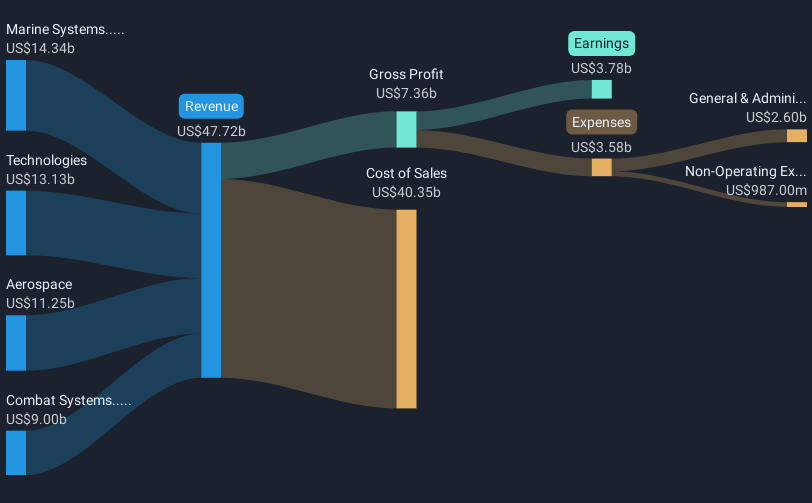

General Dynamics (NYSE:GD) recently reported a significant boost in financial metrics for Q1 2025, with sales increasing to USD 12,223 million and net income growing to USD 994 million. The company's strong earnings performance, including an increase in EPS, underscores its profitability despite the broader market rally led by tech stocks. While General Dynamics' stock price remained flat over the past month, diverging from the market's upswing, its robust financial results likely provided stability amid investor excitement over promising sector-specific earnings reports and tariff developments driving broader market movements.

Every company has risks, and we've spotted 1 risk for General Dynamics you should know about.

The recent financial boost reported by General Dynamics (NYSE:GD) in Q1 2025 could have significant implications on its future narrative and performance. The increase in sales to US$12.22 billion and net income to US$994 million indicate stronger profit margins, potentially enhancing investor confidence despite short-term share price stagnation. Over the past five years, General Dynamics has delivered a total shareholder return of 118.68%, reflecting robust growth in both price and dividends. This performance is noteworthy considering the sector's dynamics, especially as the company's stock underperformed compared to the broader US Aerospace & Defense industry's 15.9% return over the last year.

The certification of the G800 and improved supply chain efficiencies are expected to positively impact future revenue and earnings. Analysts forecast revenue to grow 4.2% annually over the next three years, highlighting potential upside driven by increased demand and operational improvements. Despite liquidity pressure from negative free cash flow of US$290 million last quarter, the company has a fair value consensus price target of US$287.67, a slight premium over the current share price of US$274.80. The modest 4.5% gap to the price target indicates analysts perceive General Dynamics to be fairly priced, suggesting minimal downside risk barring unforeseen operational challenges.

Understand General Dynamics' track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GD

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives