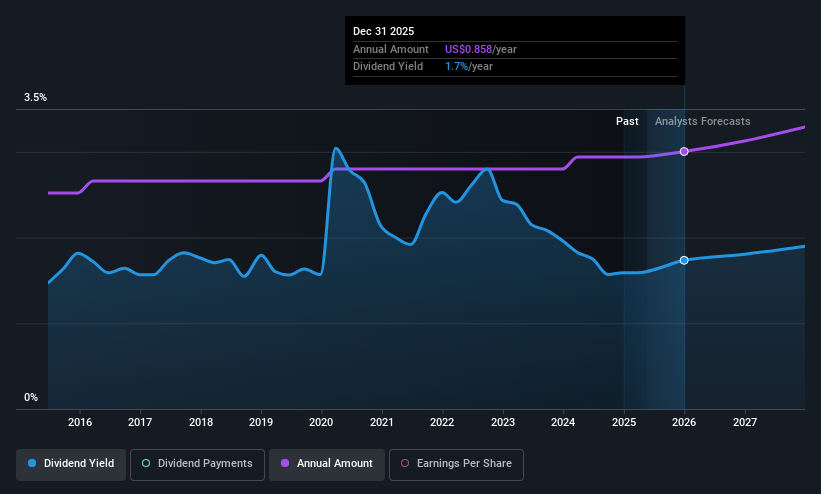

Flowserve Corporation's (NYSE:FLS) investors are due to receive a payment of $0.21 per share on 11th of July. This means that the annual payment will be 1.7% of the current stock price, which is in line with the average for the industry.

Our free stock report includes 1 warning sign investors should be aware of before investing in Flowserve. Read for free now.Flowserve's Payment Could Potentially Have Solid Earnings Coverage

Unless the payments are sustainable, the dividend yield doesn't mean too much. Before making this announcement, Flowserve was easily earning enough to cover the dividend. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share is forecast to rise by 79.4% over the next year. If the dividend continues on this path, the payout ratio could be 22% by next year, which we think can be pretty sustainable going forward.

See our latest analysis for Flowserve

Flowserve Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The annual payment during the last 10 years was $0.64 in 2015, and the most recent fiscal year payment was $0.84. This implies that the company grew its distributions at a yearly rate of about 2.8% over that duration. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

The Dividend Has Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. Flowserve has seen EPS rising for the last five years, at 7.9% per annum. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

Flowserve Looks Like A Great Dividend Stock

Overall, we like to see the dividend staying consistent, and we think Flowserve might even raise payments in the future. Earnings are easily covering distributions, and the company is generating plenty of cash. All of these factors considered, we think this has solid potential as a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 1 warning sign for Flowserve that investors should know about before committing capital to this stock. Is Flowserve not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FLS

Flowserve

Designs, manufactures, distributes, and services industrial flow management equipment in the United States, Canada, Mexico, Europe, the Middle East, Africa, and the Asia Pacific.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.