- United States

- /

- Construction

- /

- NYSE:FLR

How Investors Are Reacting To Fluor (FLR) Winning New Army Contract Amid Lowered Earnings Guidance

Reviewed by Simply Wall St

- Fluor Corporation recently announced it has won a three-year logistics support contract from the U.S. Army's Regional Contracting Office in Bavaria, providing training and operational support for the 7th Army Training Command in Europe.

- While this new award reflects ongoing client trust, recent financial results show pressure in Fluor’s core markets, adding complexity to its outlook.

- We’ll explore how weak quarterly results and reduced earnings guidance may affect Fluor’s investment narrative, despite the new Army contract.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

Fluor Investment Narrative Recap

To invest in Fluor, you have to believe the company can convert a strong backlog and new project awards into reliable profits, even as core markets remain weak. The recent U.S. Army logistics contract highlights ongoing customer trust but does not materially change near-term catalysts or offset the biggest risk, pressure on earnings from delayed client investments and sluggish energy and resources markets.

Among recent announcements, the launch of LNG exports from the Canada facility stands out as most relevant, signaling Fluor’s ability to deliver on multi-year megaprojects. This achievement supports the business case for continued backlog conversion, but the timing and magnitude of new business wins remain tied to client confidence and economic stability.

Yet, in contrast to these headline wins, investors should be aware of ongoing risks tied to project delays and...

Read the full narrative on Fluor (it's free!)

Fluor's narrative projects $19.6 billion in revenue and $511.6 million in earnings by 2028. This requires 6.2% annual revenue growth and a steep earnings decrease of $3.6 billion from current earnings of $4.1 billion.

Uncover how Fluor's forecasts yield a $49.89 fair value, a 20% upside to its current price.

Exploring Other Perspectives

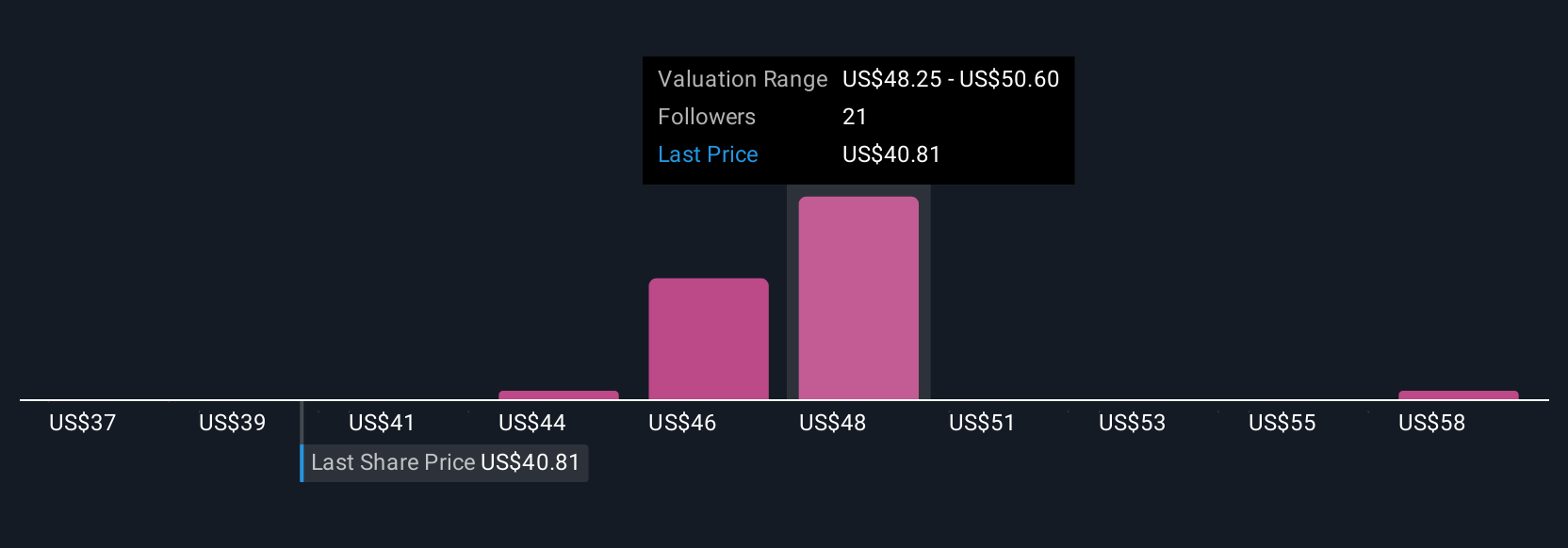

Seven Simply Wall St Community members estimate fair value for Fluor between US$36.50 and US$60, showing wide opinion divergence. While many highlight future growth catalysts, the slow pace of new client investment decisions can shift the outlook in either direction, be sure to compare multiple viewpoints before forming your own.

Explore 7 other fair value estimates on Fluor - why the stock might be worth as much as 44% more than the current price!

Build Your Own Fluor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fluor research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fluor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fluor's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLR

Fluor

Provides engineering, procurement, and construction (EPC); fabrication and modularization; and project management services worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives