- United States

- /

- Construction

- /

- NYSE:FIX

Comfort Systems USA (NYSE:FIX) Sees 17% Stock Price Surge Over Last Week

Reviewed by Simply Wall St

Comfort Systems USA (NYSE:FIX) experienced a 17% increase in its share price over the last week, possibly influenced by recent positive developments. Despite there being no significant market trends or events specifically affecting Comfort Systems USA reported during this time, the stock's robust movement stood out against the broader market's 5% rise in the same period. The company's ascent may have been further supported by anticipated growth, as market earnings projections are favorable, suggesting annual growth of 14%. This broader optimistic market outlook could have contributed to the strong confidence seen in Comfort Systems USA’s stock performance.

Every company has risks, and we've spotted 1 risk for Comfort Systems USA you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

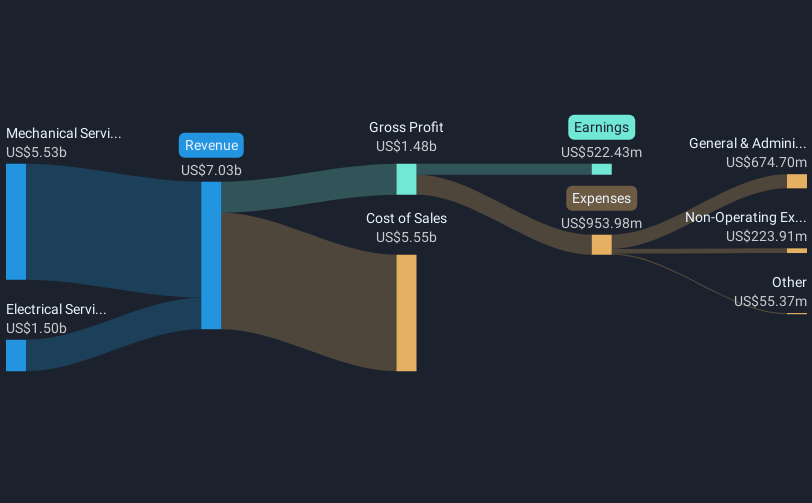

The recent positive developments influencing Comfort Systems USA’s stock price increase of 17% could bolster the company's narrative of sustained growth. This is supported by strategic acquisitions and a robust backlog, estimated at US$6 billion, which are integral to potential revenue augmentation. Despite facing challenges in maintaining high margins and managing execution risks, the company’s focus on operational efficiencies and diversification across various sectors reinforces optimism about future performance.

Over the past five years, Comfort Systems USA's total shareholder return has been exceptionally large at 970.71%. This contrasts with the company's one-year return, which surpassed both the US market's 3.6% and the US construction industry's 6% returns, demonstrating strong performance within a more competitive landscape.

The stock’s price movement, contrasting sharply against a consensus price target of US$493.0, which suggests a potential rise in valuation by 36.7% above the current share price of US$312.21, indicates potential undervaluation per analyst forecasts. Analysts forecast an annual revenue increase of 8.6% and increases in profit margins from 7.4% to 8.2% over the next three years, supported by automation and productivity enhancements. This positions the company favorably for continued earnings growth, although reliance on data centers presents potential risks.

Our valuation report here indicates Comfort Systems USA may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIX

Comfort Systems USA

Provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives