- United States

- /

- Construction

- /

- NYSE:FIX

Assessing Comfort Systems USA (FIX) Valuation as Modular Expansion Targets Tech and Industrial Demand Growth

Reviewed by Kshitija Bhandaru

Comfort Systems USA (FIX) is expanding its modular construction business, which now represents a larger share of company revenues. The initiative includes boosting modular capacity, as well as investing in productivity and automation enhancements.

See our latest analysis for Comfort Systems USA.

Comfort Systems USA’s modular construction push arrives at a time when momentum in the share price is hard to miss. With a 1-month share price return of 12.3% and a remarkable 97.4% move year-to-date, recent news has clearly struck a chord with investors. Looking longer term, total shareholder returns now top 102% over the past year and a staggering 1,489% over five years. This signals optimism about both near-term growth prospects and the company’s ability to capitalize on evolving demand in technology and industrial construction.

If you’re interested in riding the wave of fast-growing companies, now is a smart moment to broaden your search and discover fast growing stocks with high insider ownership

But with the stock rallying so sharply and modular expansion taking center stage, is there still value left on the table for new investors, or has the market already priced in all that future growth?

Most Popular Narrative: Fairly Valued

With Comfort Systems USA’s latest close at $845.99 and the most widely followed analyst fair value now pegged at $834.40, the market and narrative assessments are converging. This sets up a tight valuation debate driven by the company's aggressive expansion and changing industry demand.

Ongoing modular construction expansion, with modular revenue now 18% of total and more capacity coming online, is capitalizing on industry movement toward integrated and efficient building solutions. This supports higher revenue growth and gross margin expansion.

Want to peek behind the curtain? The fair value hinges on future revenue leaps, growing margins, and a bold earnings per share forecast. What are the game-changing projections the narrative is betting on?

Result: Fair Value of $834.40 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor shortages and intense competition in modular construction could temper growth momentum if these challenges prove more disruptive than expected.

Find out about the key risks to this Comfort Systems USA narrative.

Another View: What Does the DCF Model Say?

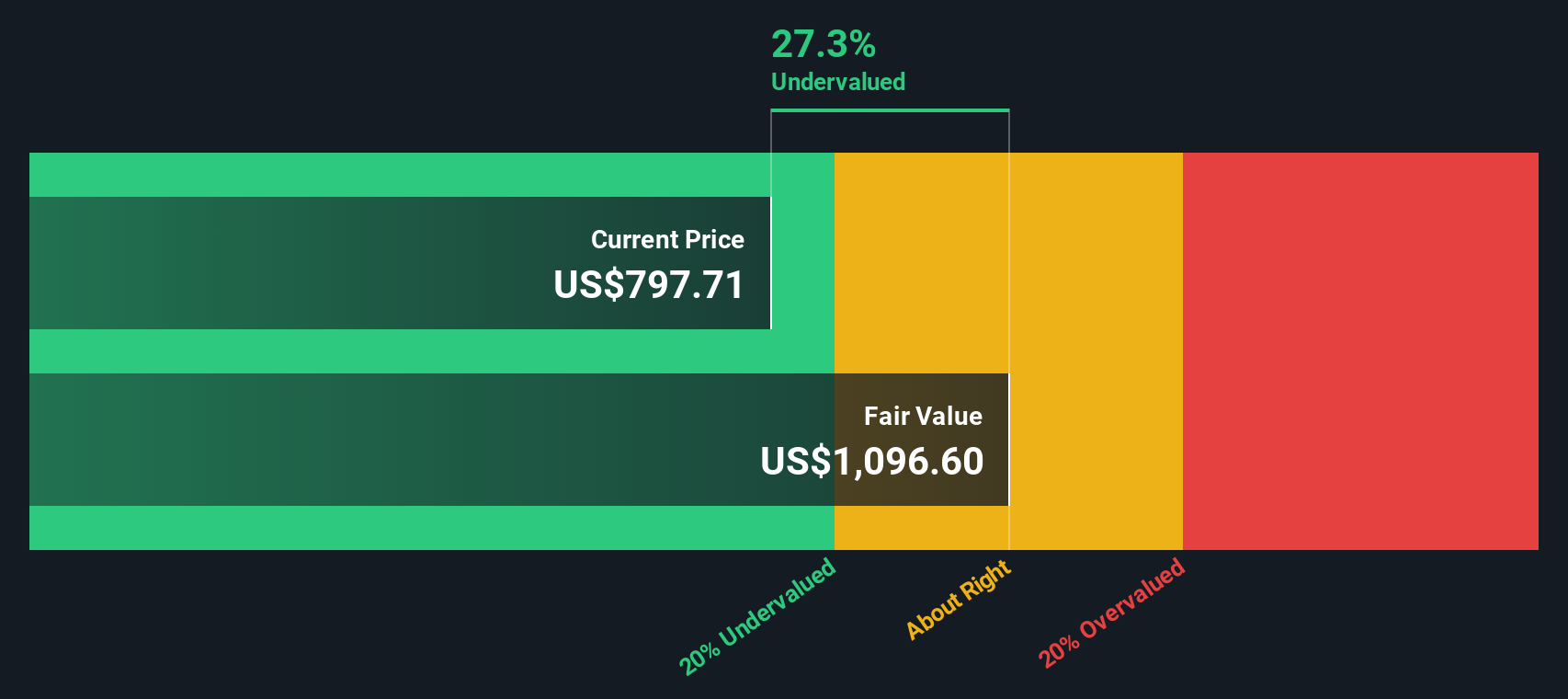

While analysts peg Comfort Systems USA’s fair value close to the current share price, our SWS DCF model presents a different story. According to this discounted cash flow calculation, Comfort Systems USA appears to be undervalued by a notable margin. Could this fundamental perspective indicate more upside potential, or are there hurdles within these estimates?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Comfort Systems USA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Comfort Systems USA Narrative

If these results aren’t quite aligning with your view, you can quickly dive into the numbers yourself and see where your own story leads. Do it your way

A great starting point for your Comfort Systems USA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Make sure you're not missing out on bigger trends and future game-changers by checking out targeted stock ideas with Simply Wall Street:

- Maximize your portfolio's cash flow with these 893 undervalued stocks based on cash flows, where solid fundamentals meet attractive pricing and give you more value for every investment dollar.

- Capture the potential of next-generation healthcare advances by searching these 33 healthcare AI stocks for innovators transforming medicine with artificial intelligence and smart diagnostics.

- Accelerate your return potential with these 25 AI penny stocks to spot growth leaders riding the artificial intelligence wave into tomorrow's markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIX

Comfort Systems USA

Provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives