- United States

- /

- Construction

- /

- NYSE:FIX

3 Companies Including TransMedics Group That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a mixed performance, with major indices like the Dow Jones and S&P 500 mostly rising while technology shares face pressure, investors are keenly observing opportunities amidst fluctuating economic indicators such as retail sales and consumer confidence. In this environment, identifying undervalued stocks can be crucial for those looking to capitalize on potential market inefficiencies, with companies like TransMedics Group offering intriguing possibilities for consideration.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WEBTOON Entertainment (WBTN) | $14.28 | $28.22 | 49.4% |

| Sotera Health (SHC) | $16.78 | $33.29 | 49.6% |

| Peraso (PRSO) | $0.8763 | $1.72 | 48.9% |

| Nicolet Bankshares (NIC) | $122.61 | $242.17 | 49.4% |

| Huntington Bancshares (HBAN) | $15.91 | $31.35 | 49.3% |

| Freshworks (FRSH) | $12.06 | $23.98 | 49.7% |

| First Busey (BUSE) | $23.21 | $45.34 | 48.8% |

| Fifth Third Bancorp (FITB) | $42.33 | $83.68 | 49.4% |

| Elastic (ESTC) | $69.07 | $135.32 | 49% |

| Crocs (CROX) | $80.33 | $157.15 | 48.9% |

Let's dive into some prime choices out of the screener.

TransMedics Group (TMDX)

Overview: TransMedics Group, Inc. is a commercial-stage medical technology company focused on transforming organ transplant therapy for end-stage organ failure patients globally, with a market cap of approximately $4.47 billion.

Operations: The company generates its revenue primarily from the Surgical & Medical Equipment segment, which amounted to $566.35 million.

Estimated Discount To Fair Value: 39.2%

TransMedics Group is trading at US$140.21, significantly below its estimated fair value of US$230.71, indicating it may be undervalued based on cash flows. The company reported strong earnings growth with net income rising to US$24.32 million in Q3 2025 from US$4.22 million a year prior, and raised its full-year revenue guidance to between US$595 million and US$605 million, reflecting robust financial performance despite slower forecasted revenue growth compared to historical rates.

- Our expertly prepared growth report on TransMedics Group implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of TransMedics Group with our detailed financial health report.

Fifth Third Bancorp (FITB)

Overview: Fifth Third Bancorp is the bank holding company for Fifth Third Bank, National Association, offering a variety of financial products and services across the United States, with a market cap of $28.04 billion.

Operations: The company's revenue segments include Commercial Banking at $3.37 billion, Wealth and Asset Management at $633 million, and Consumer and Small Business Banking at $4.84 billion.

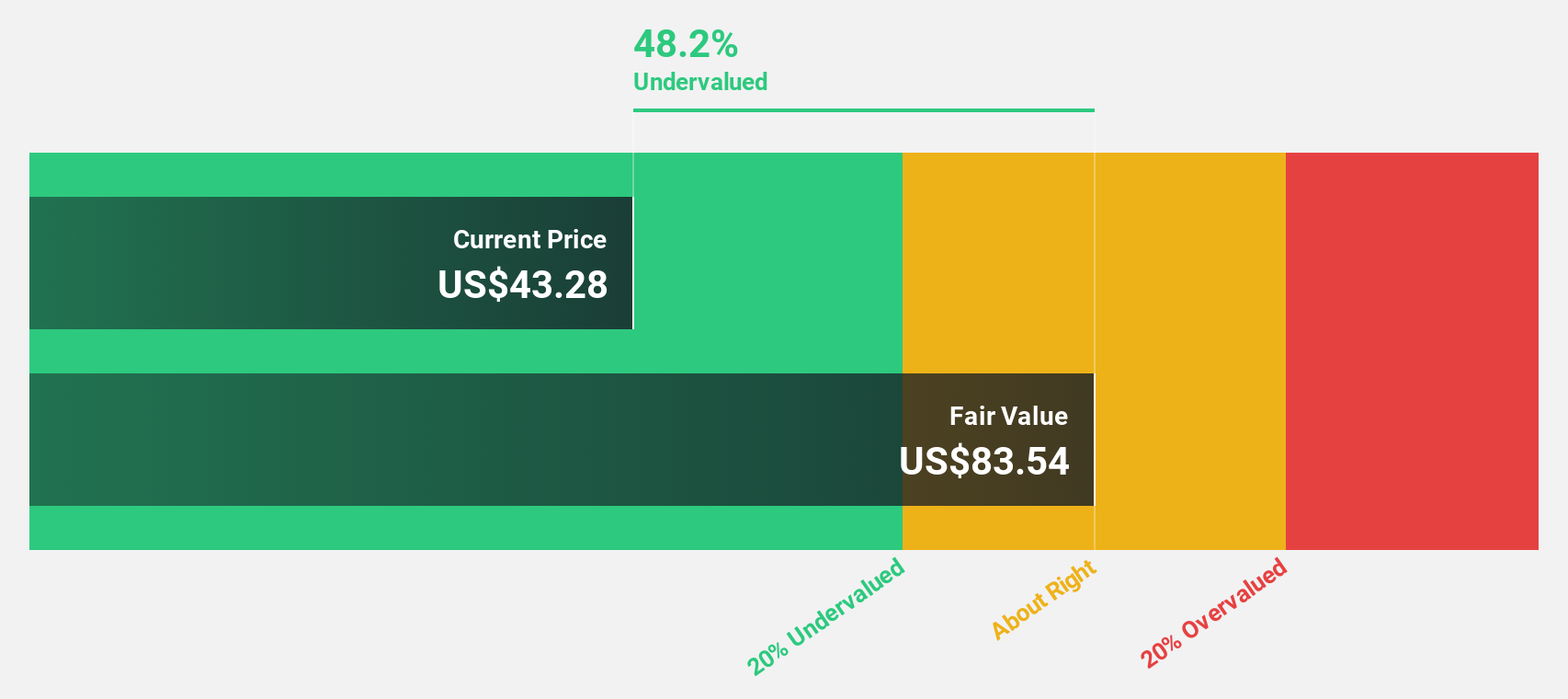

Estimated Discount To Fair Value: 49.4%

Fifth Third Bancorp, trading at US$42.33, is significantly below its estimated fair value of US$83.68, highlighting potential undervaluation based on cash flows. The company's earnings and revenue are forecast to grow faster than the US market over the next three years. Recent Q3 2025 results showed net income rising to US$649 million from US$573 million a year ago. However, challenges include a recent impairment charge due to alleged external fraud affecting financials by up to US$200 million.

- The growth report we've compiled suggests that Fifth Third Bancorp's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Fifth Third Bancorp's balance sheet health report.

Comfort Systems USA (FIX)

Overview: Comfort Systems USA, Inc. offers mechanical and electrical installation, renovation, maintenance, repair, and replacement services in the United States with a market cap of $31.47 billion.

Operations: The company's revenue is derived from two primary segments: Electrical Services, contributing $2.02 billion, and Mechanical Services, generating $6.30 billion.

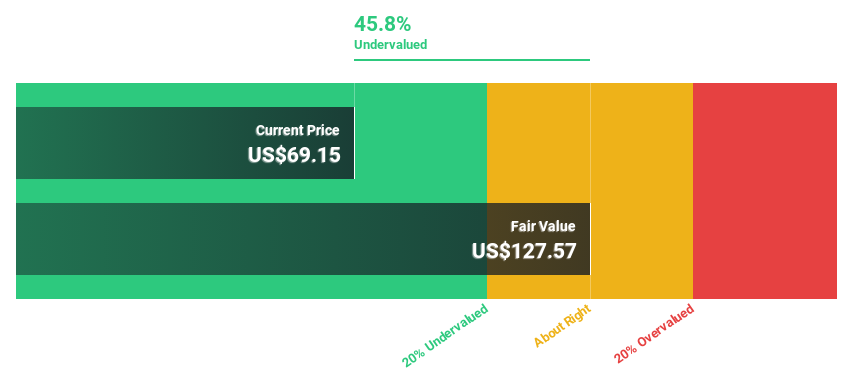

Estimated Discount To Fair Value: 36.3%

Comfort Systems USA is trading at US$945.07, significantly below its estimated fair value of US$1,483.09, underscoring potential undervaluation based on cash flows. The company's earnings and revenue are projected to grow faster than the US market. Recent Q3 2025 results revealed a substantial increase in net income to US$291.62 million from US$146.24 million a year ago, despite insider selling in the past three months and modest buyback activity.

- Insights from our recent growth report point to a promising forecast for Comfort Systems USA's business outlook.

- Get an in-depth perspective on Comfort Systems USA's balance sheet by reading our health report here.

Seize The Opportunity

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 208 more companies for you to explore.Click here to unveil our expertly curated list of 211 Undervalued US Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIX

Comfort Systems USA

Provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success