Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Eaton Corporation plc (NYSE:ETN) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Eaton

How Much Debt Does Eaton Carry?

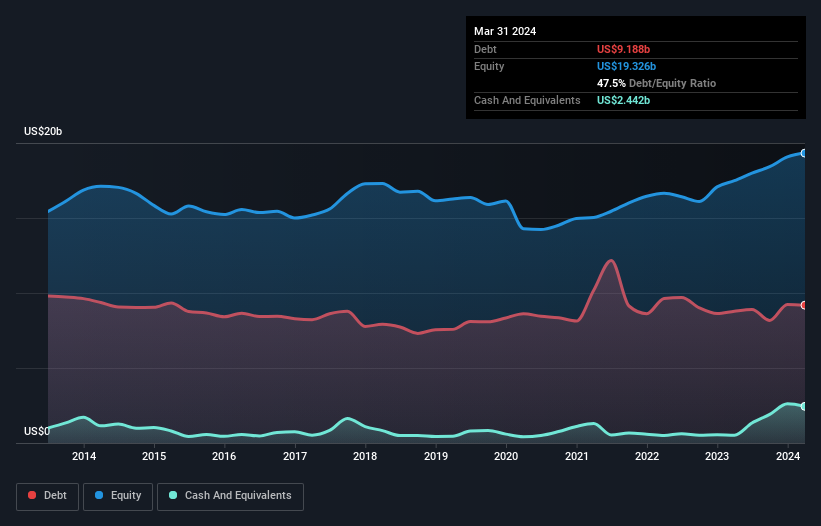

You can click the graphic below for the historical numbers, but it shows that as of March 2024 Eaton had US$9.19b of debt, an increase on US$8.79b, over one year. However, it does have US$2.44b in cash offsetting this, leading to net debt of about US$6.75b.

How Strong Is Eaton's Balance Sheet?

We can see from the most recent balance sheet that Eaton had liabilities of US$7.61b falling due within a year, and liabilities of US$11.6b due beyond that. On the other hand, it had cash of US$2.44b and US$4.98b worth of receivables due within a year. So it has liabilities totalling US$11.8b more than its cash and near-term receivables, combined.

Since publicly traded Eaton shares are worth a very impressive total of US$129.0b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Eaton has a low net debt to EBITDA ratio of only 1.3. And its EBIT covers its interest expense a whopping 21.0 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Also positive, Eaton grew its EBIT by 30% in the last year, and that should make it easier to pay down debt, going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Eaton can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Eaton produced sturdy free cash flow equating to 66% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Happily, Eaton's impressive interest cover implies it has the upper hand on its debt. And the good news does not stop there, as its EBIT growth rate also supports that impression! Looking at the bigger picture, we think Eaton's use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. Another factor that would give us confidence in Eaton would be if insiders have been buying shares: if you're conscious of that signal too, you can find out instantly by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Eaton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETN

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives