- United States

- /

- Electrical

- /

- NYSE:ETN

Eaton (ETN): Revisiting Valuation After Breakthrough EV Charging and Electrification Innovations

Reviewed by Simply Wall St

If you’re tracking the rapid evolution of electric vehicle infrastructure, the latest move from Eaton (NYSE:ETN) with ChargePoint is one you can’t ignore. Together, the companies have rolled out an ultrafast EV charging solution that not only pushes the boundaries on power delivery, but also addresses industry-wide grid constraints by integrating renewables and storage. Eaton’s announcement also includes plans to bring solid-state transformer technology to market, underscoring an aggressive approach to electrification and the broader energy transition. For investors, these steps could mean Eaton is placing itself at the center of a massive, fast-growing market.

Zooming out, Eaton has been riding a steady wave of momentum. Over the last year, the stock has returned 22%, while its three-year return stands out at 147%. In recent months, the company has seen a short-term bump with a 7% increase in the past three months, even as the shares have eased back slightly in the last month. Against a backdrop of double-digit annual revenue and net income growth, this mix of new product launches, acquisitions, and strong performance continues to fuel market interest in Eaton’s future.

With such a strong run, the question remains whether Eaton is set for another increase, or if the stock price already reflects anticipated growth from these electrification efforts.

Most Popular Narrative: 10.6% Undervalued

According to the most widely referenced narrative, Eaton shares are considered undervalued against future earnings expectations and industry transformative trends.

Strategic wins and technology leadership in the rapidly expanding data center end market are deepening Eaton's penetration and raising content per megawatt. Major partnerships (for example, NVIDIA and Siemens Energy) and acquisitions (such as Fibrebond and Resilient Power) are positioning Eaton as the go-to provider for next-generation high-density and AI-centric infrastructure. This supports outsized revenue growth and structurally higher margins due to a richer, more sophisticated product mix.

Want to know what is fueling this bullish outlook? The narrative hinges on a bold mix of growth signals, from aggressive earnings forecasts to margin leaps and ambitious market share grabs. Ready to see which financial assumptions put Eaton’s valuation in the spotlight? Unpack the calculation that puts this stock ahead of the curve.

Result: Fair Value of $390.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Eaton’s gains hinge on sustained data center demand and successful integration of recent acquisitions. Both of these factors could become stumbling blocks if conditions shift.

Find out about the key risks to this Eaton narrative.Another View: Multiples Tell a Different Story

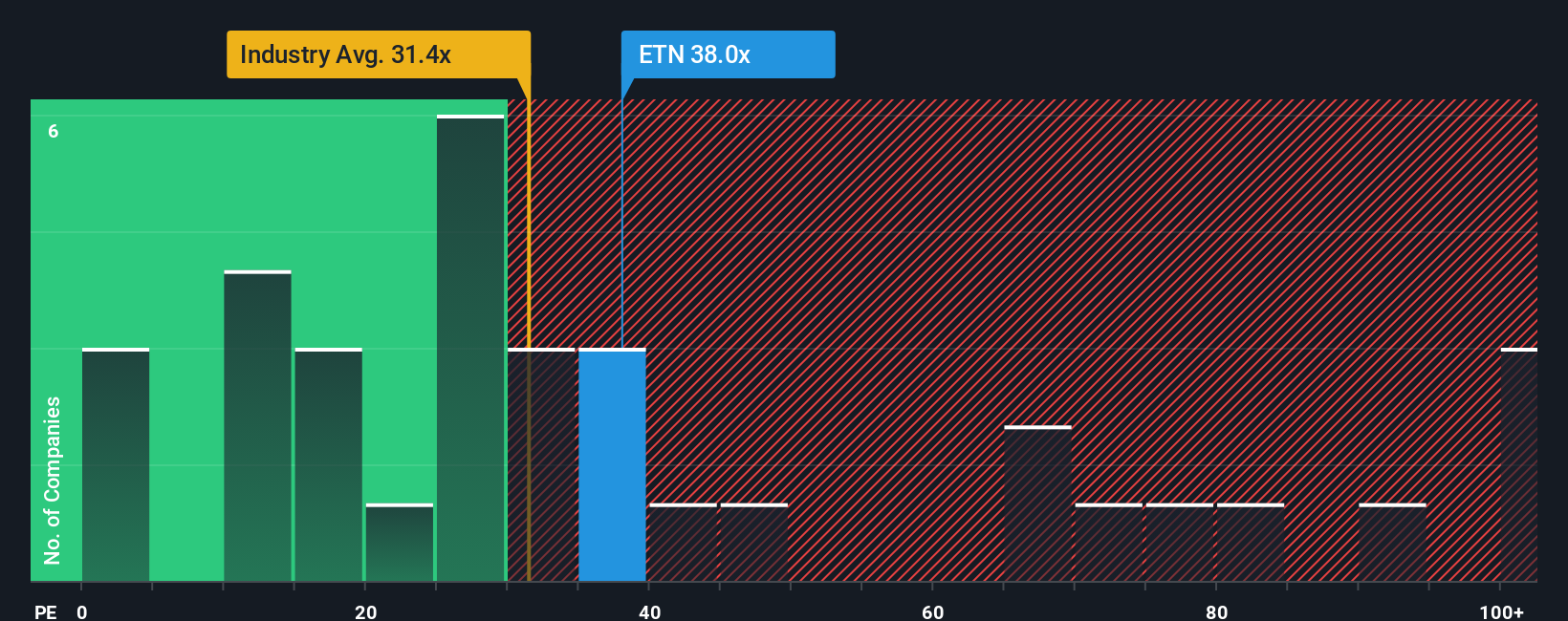

While the first valuation points to upside, the most common comparison tool in the industry suggests Eaton’s shares are more expensive than similar companies. It’s a classic market puzzle. Which approach has it right?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eaton Narrative

If you see things differently or want to dig into the numbers your own way, you can piece together your own perspective in just a few minutes. Do it your way

A great starting point for your Eaton research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by. With the Simply Wall Street Screener, you can quickly zero in on standout stocks perfectly matched to your strategy. Check out these handpicked routes to your next investment:

- Unlock the potential of up-and-coming companies with penny stocks with strong financials, featuring fresh growth stories ready for a breakout year.

- Uncover tomorrow’s technological powerhouses by exploring AI penny stocks, which are shaping breakthroughs in artificial intelligence and automation.

- Tap into value-packed opportunities by discovering undervalued stocks based on cash flows stocks trading at compelling prices compared to future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eaton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:ETN

Eaton

Operates as a power management company in the United States, Canada, Latin America, Europe, and the Asia Pacific.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)