- United States

- /

- Electrical

- /

- NYSE:ENS

EnerSys (ENS): Exploring Valuation After Steady Gains and Renewed Investor Interest

Reviewed by Simply Wall St

EnerSys (ENS) is back on investors' watchlists after a recent move that, while not tied to any specific news development, has sparked fresh questions about what’s next for the company. Sometimes, it’s these quieter moments that deserve the most attention, especially when the market starts shifting direction without an obvious headline. This situation can reveal as much about sentiment as a splashy announcement.

Over the past year, EnerSys shares have moved steadily higher, gaining 10% and building momentum over the past month with nearly a 9% lift. While there have not been headline-grabbing developments, steady gains and positive trends in both annual revenue and net income growth suggest that investors are reconsidering the company’s long-term potential, perhaps in response to shifting outlooks for the industrial sector. The stock continues to trade above its level from the start of the year and sits well above where it was three years ago, underscoring interest in the company’s execution even in the absence of major news.

With that in mind, is EnerSys trading at a bargain based on its fundamentals, or is the market already factoring in the next phase of growth?

Most Popular Narrative: 12.8% Undervalued

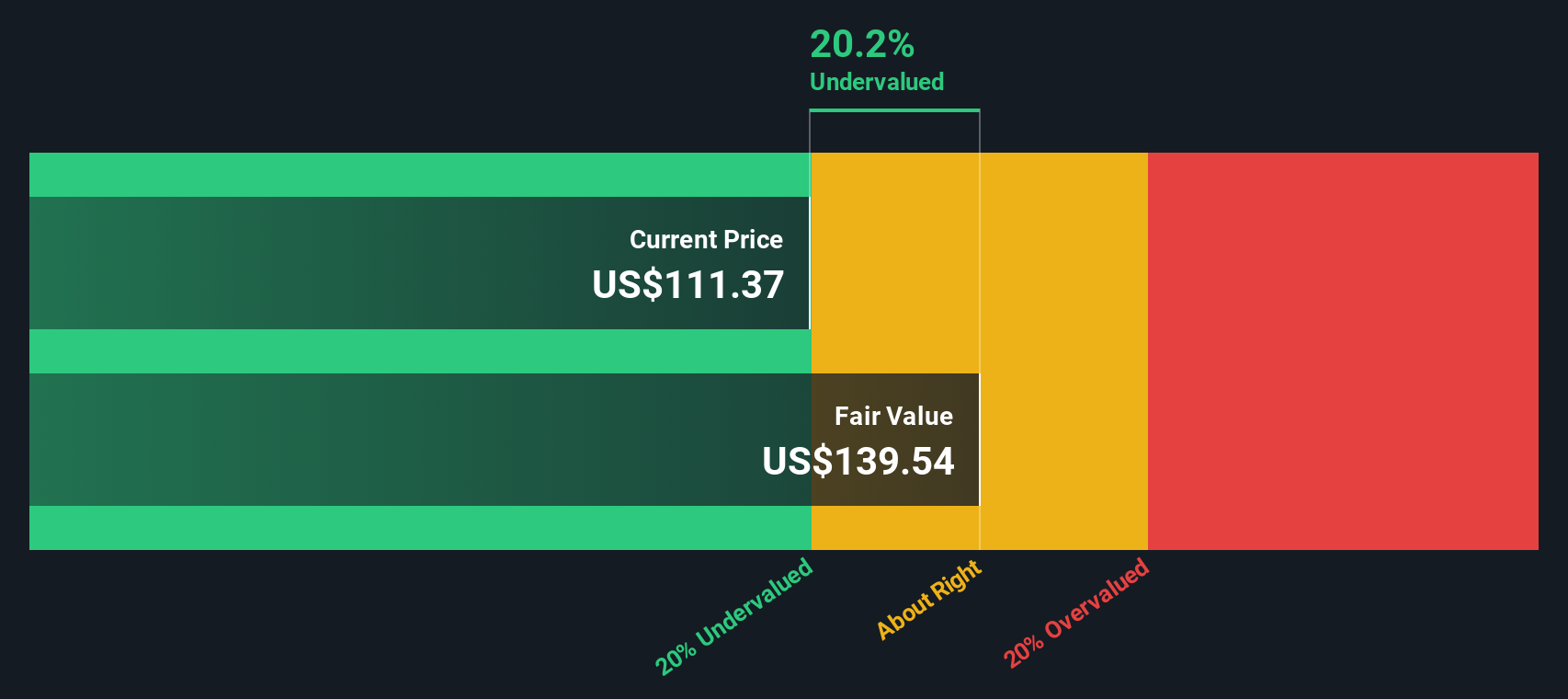

According to the most widely followed narrative, EnerSys is currently trading below its estimated fair value, with room for potential upside based on earnings and margin expansion forecasts.

Major cost-reduction initiatives, including a strategic realignment and transition to Centers of Excellence (CoEs), are expected to generate $80 million in annualized savings starting in fiscal 2026. These measures are projected to structurally expand net and operating margins. The electrification of industrial equipment (for example, forklifts and lift trucks) and automation trends are driving increased demand for maintenance-free batteries and advanced charger solutions. This positions Motive Power for a rebound in volumes and margin expansion as macro and tariff headwinds abate.

Curious about what's fueling that discounted valuation? The growth story hinges on transformative margin improvements and ambitious financial targets that set this forecast apart. What bold projections are analysts betting on, and how do they stack up against industry standards? Explore the full narrative to uncover the crucial numbers shaping this undervalued call.

Result: Fair Value of $120 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, policy uncertainty around tariffs and reliance on acquisitions rather than organic growth could quickly change the outlook if conditions worsen.

Find out about the key risks to this EnerSys narrative.Another View: What Does Our DCF Model Suggest?

Taking a different approach, our SWS DCF model also points toward undervaluation for EnerSys. This echoes the earlier optimism but relies on its own set of assumptions about future cash flows. Could both methods be missing key risks or signals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out EnerSys for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own EnerSys Narrative

Whether you see things differently or want to dig deeper into the numbers yourself, you can craft your own take in just a few minutes. Do it your way.

A great starting point for your EnerSys research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investing Opportunities?

Turn market curiosity into action. The Simply Wall Street Screener puts powerful ideas at your fingertips. Now is the moment to find what others might miss.

- Spot tomorrow’s tech giants early by targeting AI penny stocks leading advancements in artificial intelligence and automation for outsized return potential.

- Unlock pockets of value by pursuing undervalued stocks based on cash flows that boast strong financial fundamentals and have been overlooked by the broader market.

- Capture lasting income streams through dividend stocks with yields > 3% designed for stability and reliable payouts above the usual 3% threshold.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if EnerSys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:ENS

EnerSys

Engages in the provision of stored energy solutions for industrial applications worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)