- United States

- /

- Construction

- /

- NYSE:ECG

A Look at Everus Construction Group’s Valuation After Strong Q2 2025 Earnings Beat and Upgraded Outlook

Reviewed by Simply Wall St

Everus Construction Group (ECG) surged to a new all-time high after its second-quarter 2025 results landed well above Wall Street’s forecasts. The company’s revenue jumped 31% from a year ago, and earnings per share exceeded consensus estimates.

See our latest analysis for Everus Construction Group.

After surging on the back of stellar earnings, Everus Construction Group’s share price momentum has been impressive, with a 1-day gain of 1.09% and a 7-day share price return of 12.08%. This builds on remarkable long-term performance, shown by a 1-year total shareholder return of 73.37%. This is clear evidence that investor enthusiasm is building as business momentum accelerates.

If this kind of performance has you wondering where growth could strike next, consider exploring fast growing stocks with high insider ownership for more opportunities with strong momentum and engaged leadership.

The question now is whether Everus Construction Group’s recent surge has left its shares undervalued, or if the market is already fully factoring in its future prospects. This could leave little room for further upside.

Price-to-Earnings of 28.3x: Is it justified?

Everus Construction Group’s shares trade at a price-to-earnings ratio of 28.3x, putting them below both industry peers and the broader sector. Despite the recent rally, this could signal the market sees some value compared to similar companies.

The price-to-earnings ratio compares the company’s share price with its per-share earnings, allowing investors to assess how much they are paying for current profits. For construction businesses, this multiple is especially telling since earnings may be cyclical and investors often pay a premium for consistent results.

At 28.3x, Everus Construction Group stands noticeably below the US Construction industry average of 34.7x, as well as the average among its peer group, which sits higher still at 37.3x. However, the current multiple is above the estimated Fair Price-to-Earnings Ratio of 25.5x. This suggests there could be less room for further upside if investor sentiment cools and fundamentals come under closer scrutiny. The market could recalibrate towards this fair level if conditions change.

Explore the SWS fair ratio for Everus Construction Group

Result: Price-to-Earnings of 28.3x (ABOUT RIGHT)

However, slower annual revenue and net income growth rates could limit further upside if profit acceleration does not pick up pace in coming quarters.

Find out about the key risks to this Everus Construction Group narrative.

Another View: Discounted Cash Flow Valuation Challenges the Outlook

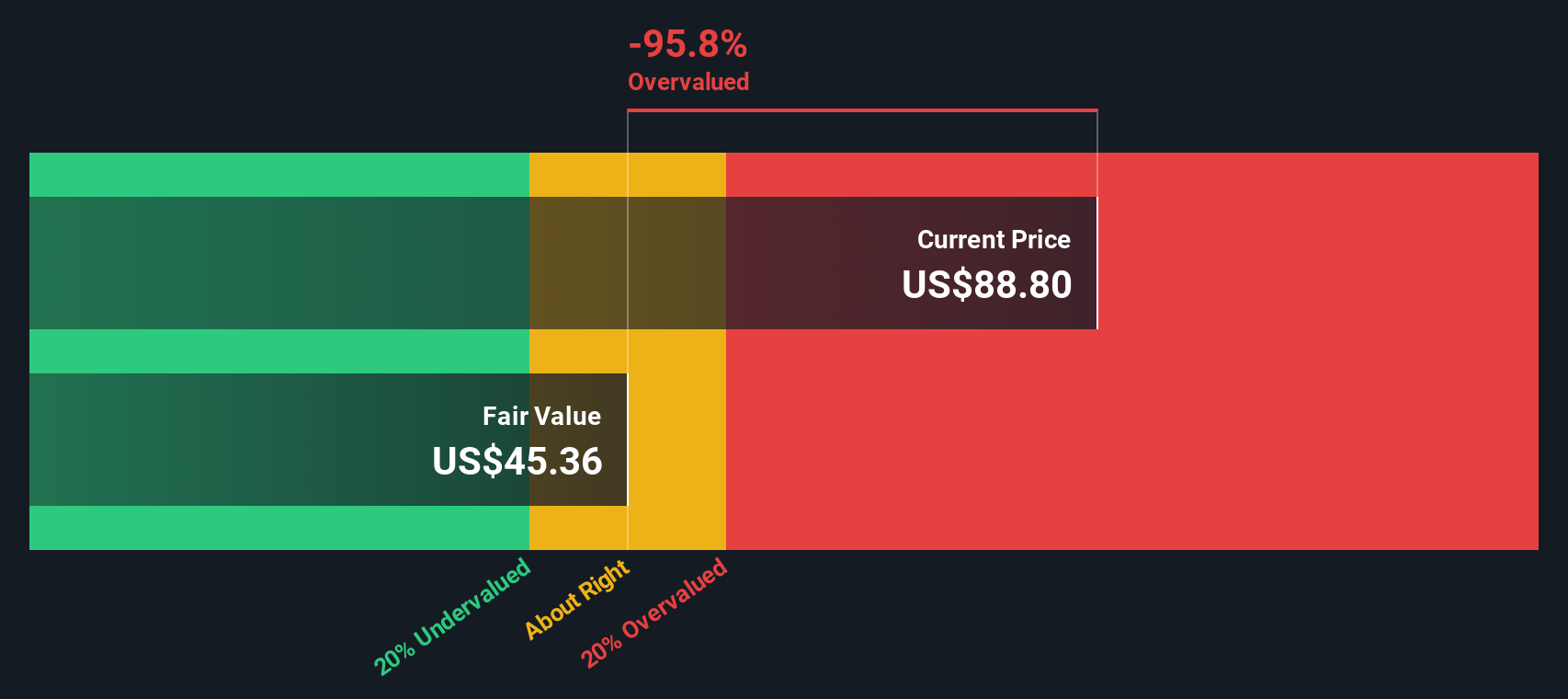

Looking at Everus Construction Group through the lens of our DCF model presents a more cautious picture. The SWS DCF model estimates fair value at $45.16 per share, which is well below the current trading price of $91.94. This suggests the stock could be overvalued and raises concerns that recent momentum may not be supported by long-term cash flow fundamentals. Is the market getting ahead of itself, or do the latest results justify the optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Everus Construction Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 854 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Everus Construction Group Narrative

If you’d like to investigate further or shape a different storyline, you can easily craft your own perspective and analysis in just minutes using our tools, then Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Everus Construction Group.

Looking for More Smart Investment Opportunities?

Don’t limit yourself to just one stock. Now’s your chance to get ahead by using the Simply Wall Street Screener to find trends before others do.

- Fuel your portfolio’s growth by targeting companies with strong cash flow advantages using these 854 undervalued stocks based on cash flows.

- Collect steady income by zeroing in on these 21 dividend stocks with yields > 3% with yields above 3% for reliable payouts.

- Be early on the future of medicine and technology by seeking out these 34 healthcare AI stocks at the forefront of healthcare innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Everus Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECG

Everus Construction Group

Provides contracting services in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)