- United States

- /

- Electrical

- /

- NYSE:EAF

GrafTech International (EAF): Net Losses Deepen, Forecasts Call for 116% Earnings Growth Turnaround

Reviewed by Simply Wall St

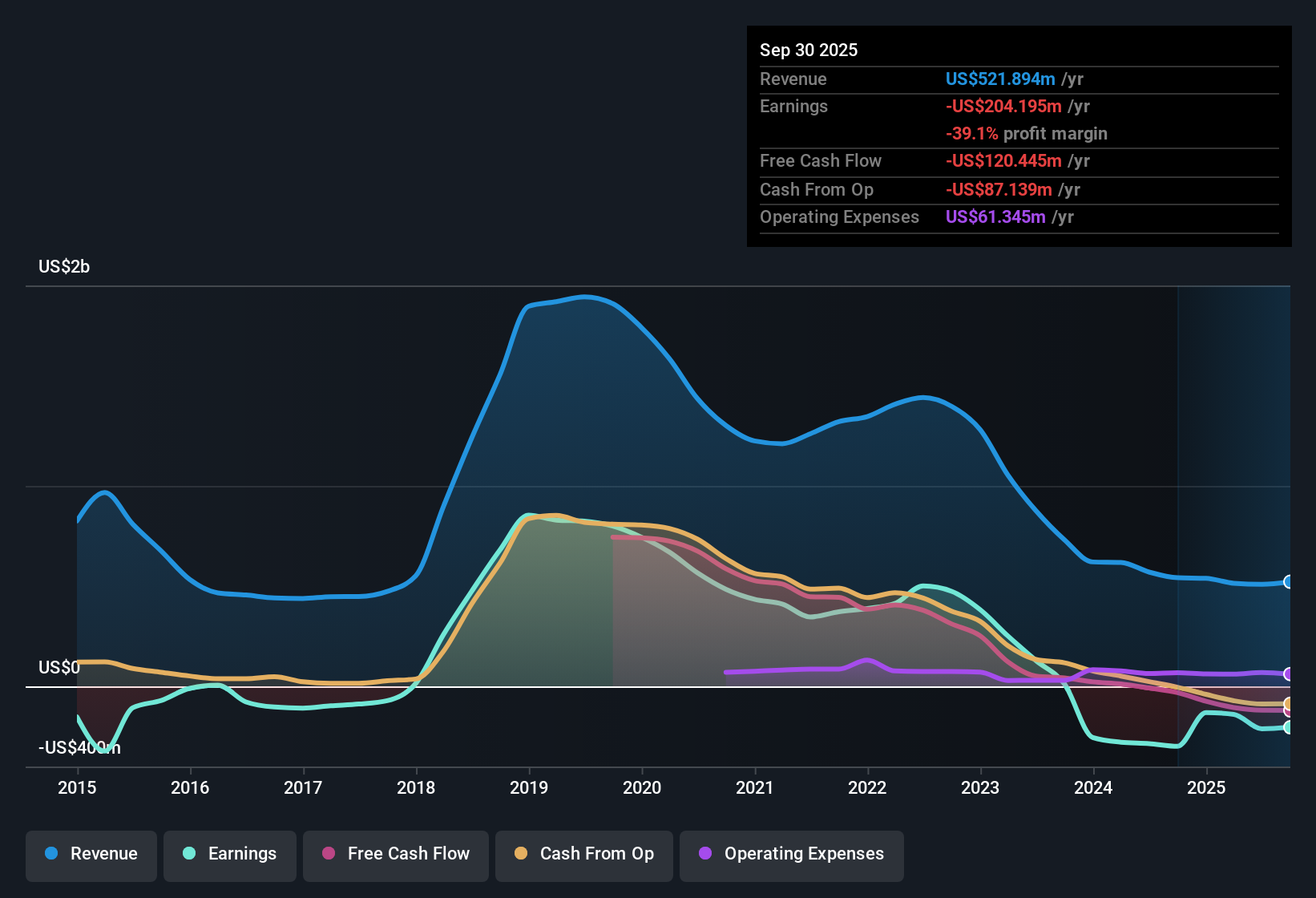

GrafTech International (EAF) posted another tough year as net losses deepened at a 59.2% annual rate over the past five years and profitability remains elusive, with negative earnings and no improvement in net profit margin during the last twelve months. Despite these ongoing losses, management projects a dramatic shift in the next three years, with forecasts calling for earnings growth of 116.12% per year and revenue to accelerate 21.6% annually. This compares to the US market’s 10% pace. With a price-to-sales ratio significantly lower than both its peers and the broader industry, investors are weighing potential turnaround rewards against continued financial stress and weak balance sheet fundamentals.

See our full analysis for GrafTech International.Next up, we’ll stack these headline results against the market’s dominant narratives to see which themes hold up and which might get a reality check.

See what the community is saying about GrafTech International

Margin Turnaround Hinges on Pricing Recovery

- Net profit margin remains negative and has not improved over the past year, despite company targets for margins to eventually converge toward the industry average of 10.2% within three years.

- The analysts' consensus narrative notes that margin recovery is possible if ongoing price increases for graphite electrodes hold, but also flags a continued risk:

- Persistent global oversupply and weak market pricing, especially due to low-priced Chinese exports, may hinder efforts to lift margins to sustainable levels.

- Management's ability to navigate cost pressures and shift more sales toward higher-priced US and Western European customers will be decisive for any durable rebound in profitability.

- What's pivotal to the consensus view: if price gains stabilize, margins could move much higher. Otherwise, cost improvements may be overwhelmed by sluggish pricing power.

- If you want the analysts' full balanced take on these margin dynamics and why consensus remains cautious despite bullish forecasts, check the complete Consensus Narrative for GrafTech International. 📊 Read the full GrafTech International Consensus Narrative.

Share Count Growth Remains Modest

- Analysts expect GrafTech’s share count to rise by just 0.38% per year over the next three years, indicating shareholder dilution risk is limited for now based on available projections.

- The consensus narrative highlights that with limited new share issuance and current management guidance, attention stays focused on operational improvements and margin expansion rather than capital raises:

- Bearish critics point to heavy US sales exposure (over 50% of revenues) as a factor that could drive future strategic shifts, including buybacks or new share offerings, if profitability goals are not met.

- The modest forecast for shares outstanding offers some reassurance for bullish investors hoping value is preserved in the turnaround effort.

Valuation Screens Cheaper Than Peers

- GrafTech’s price-to-sales ratio stands at 0.9x, lower than the peer group average (1.4x) and well below the US electrical industry average (2.5x), while the stock trades at $17.02 versus an analyst price target of $13.80.

- The consensus narrative suggests that the discounted valuation may attract value-focused investors in the near term:

- A potential rebound scenario sees future profit margins rising and the company trading on a forward PE of 4.9x, well below the industry’s 29.6x, if analyst projections materialize.

- However, reliance on sharply improved future profitability means the current low multiple alone should not be mistaken for an all-clear, especially given ongoing losses and negative equity.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for GrafTech International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the numbers tell another story? Share your perspective and craft your unique narrative in just a few minutes by Do it your way.

A great starting point for your GrafTech International research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

GrafTech’s persistent net losses, negative margins, and weak balance sheet fundamentals raise real concerns about ongoing financial strength and resilience.

If you want to put your capital behind companies with healthier finances and less downside risk, check out solid balance sheet and fundamentals stocks screener (1977 results) built for exactly that purpose.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EAF

GrafTech International

Research, develops, manufactures, and sells graphite and carbon-based solutions worldwide.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)