- United States

- /

- Machinery

- /

- NYSE:DOV

What Dover (DOV)'s Launch of Segmented Overfill Valve Means For Shareholders

Reviewed by Simply Wall St

- On July 17, 2025, Dover’s OPW Retail Fueling division introduced the 71SO Segmented Overfill Valve, a modular overfill prevention technology designed to simplify installation and logistics while enhancing compliance with industry standards.

- The segmented design allows the valve to be shipped and assembled more efficiently, potentially strengthening its appeal for both new construction and retrofit applications across diverse fueling sites.

- We'll explore how this product innovation could affect Dover's investment outlook, particularly by advancing operational efficiency and customer value in fueling solutions.

Dover Investment Narrative Recap

Belief in Dover as a shareholder centers on consistent execution and operational leadership within industrial equipment markets, especially as the business targets margin expansion and product innovation. The July launch of the 71SO Segmented Overfill Valve highlights ongoing R&D but is unlikely to materially affect short-term catalysts, such as margin improvement initiatives or the primary risk around tariff exposure and trade policy uncertainty.

One earlier announcement of note is Techcon’s release of Side-by-Side Dispensing Cartridges for industrial adhesives in June 2025, further illustrating Dover’s push for new modular product formats. Both launches reinforce management's emphasis on efficiency and differentiation, aligning with broader efforts to defend and grow revenue across segments affected by external risks and changing demand.

However, investors should be aware that, despite operational improvements, potential disruptions from unresolved tariff disputes could...

Read the full narrative on Dover (it's free!)

Dover's outlook anticipates $8.8 billion in revenue and $1.2 billion in earnings by 2028. This reflects a 4.6% annual revenue growth rate and a $0.2 billion increase in earnings from the current $1.0 billion level.

Uncover how Dover's forecasts yield a $197.74 fair value, a 4% upside to its current price.

Exploring Other Perspectives

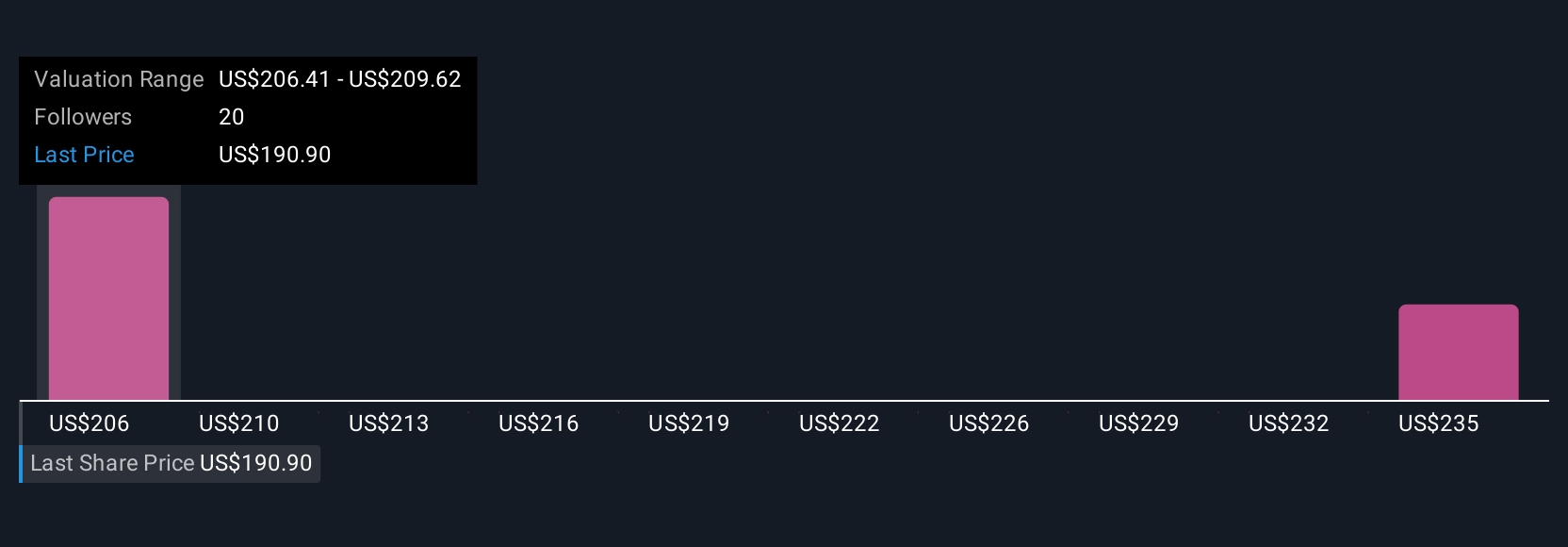

Two estimates from the Simply Wall St Community put fair value for Dover shares between US$197.74 and US$238.46. As the company pursues margin gains and productivity enhancements, your outlook may differ widely from others, check out these varied perspectives to find the view that aligns with your own.

Build Your Own Dover Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dover research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Dover research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dover's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOV

Dover

Provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives