- United States

- /

- Machinery

- /

- NYSE:DE

Tech Innovation and New Farm Rules Might Change the Case for Investing in Deere (DE)

Reviewed by Sasha Jovanovic

- Recent developments in the global agricultural equipment industry highlight the impact of technological innovation and new U.S. sustainable farming regulations, with industry leaders such as John Deere accelerating the adoption of precision agriculture and eco-friendly machinery.

- An important insight is the convergence of regulatory incentives with advancements in automation and sustainability, positioning key manufacturers to influence future market trends and agricultural productivity worldwide.

- We'll explore how increasing regulatory support for sustainable agriculture and Deere's focus on precision technology could influence its investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Deere Investment Narrative Recap

To believe in Deere’s story as a shareholder, you need confidence in a future where technological innovation and tightening regulations create demand for smarter, greener farm equipment. The recent U.S. sustainable agriculture incentives support Deere’s precision farming investment, but near-term outlooks still hinge on North American equipment volumes and volatility in large ag sales. This news reinforces a positive catalyst for long-term product demand, but doesn't materially change the current risk from weak equipment sales in Deere’s key market.

Among Deere’s recent moves, the July launch of Operations Center PRO Service, an advanced digital equipment management tool, directly aligns with the industry’s push for connected, sustainable solutions. By building out digital services that optimize equipment usage, Deere is addressing customer needs shaped by both rising regulatory demands and a global shift toward precision agriculture, keeping this catalyst front and center.

Yet, with all that potential, investors should also be mindful of the sustained pressure North American end-market volatility could place on Deere’s revenue if...

Read the full narrative on Deere (it's free!)

Deere is projected to reach $45.1 billion in revenue and $8.6 billion in earnings by 2028. This outlook assumes a 0.7% annual revenue decline and an earnings increase of $3.4 billion from current earnings of $5.2 billion.

Uncover how Deere's forecasts yield a $525.66 fair value, a 20% upside to its current price.

Exploring Other Perspectives

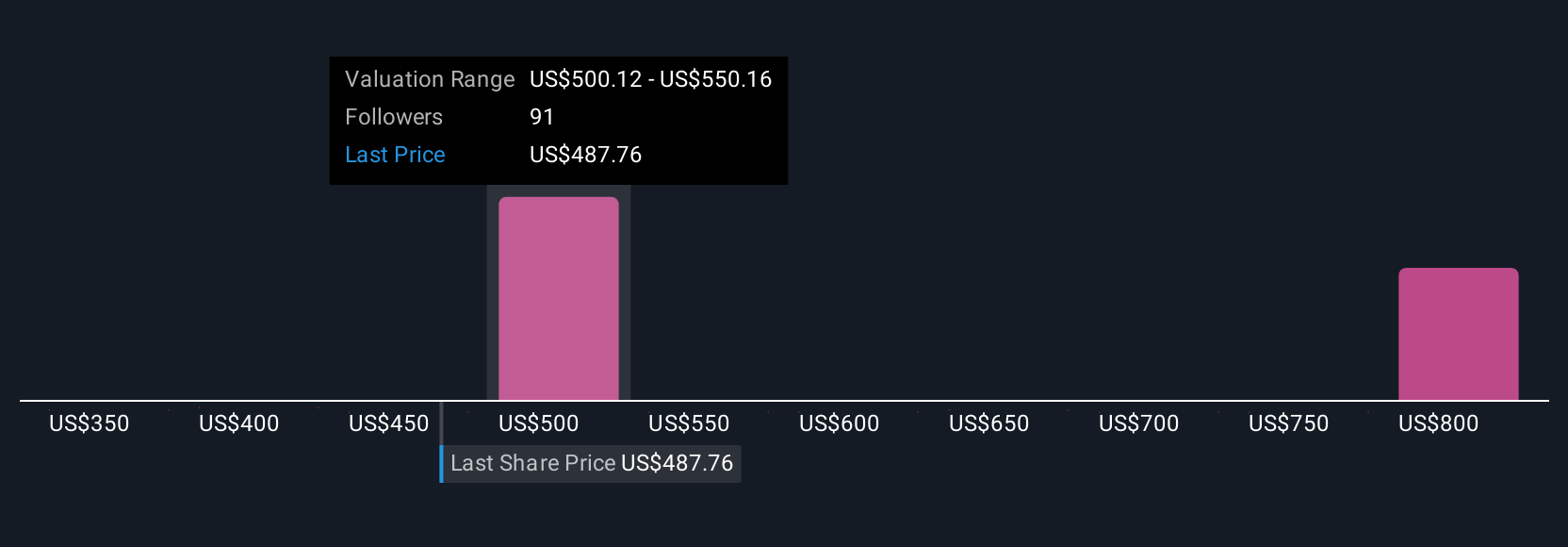

Simply Wall St Community users offered seven fair value estimates for Deere, ranging from US$350 to US$822.13 per share. As opinions differ, remember that ongoing North American market headwinds could weigh on expectations; see how perspectives vary and explore the reasons behind each view.

Explore 7 other fair value estimates on Deere - why the stock might be worth 20% less than the current price!

Build Your Own Deere Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deere research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Deere research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deere's overall financial health at a glance.

No Opportunity In Deere?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DE

Deere

Engages in the manufacture and distribution of various equipment worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives