Last Update04 Sep 25Fair value Decreased 0.23%

Analysts cite increased steel and aluminum tariffs as a margin headwind and lingering weak global ag demand, but also highlight Deere’s strong Q3 Small Ag performance, lower dealer inventories, and an expected cyclical earnings upturn in FY26, resulting in no change to the consensus price target at $534.61.

Analyst Commentary

- Bearish analysts lowered price targets to reflect updated Section 232 tariffs, which significantly increase the cost of steel and aluminum content in imported products, posing a headwind to margins and earnings.

- Bullish analysts note that while global agriculture equipment demand remains weak, Deere appears to be near a cyclical trough and is well-positioned for earnings improvement in FY26, supported by improving inventory levels and optimism in the U.S. market.

- Some analysts point to favorable Q3 earnings driven by better-than-expected demand in Small Ag and Turf and successful progress in reducing North American dealer inventories for large tractors and combines.

- Expectations for better sector growth in 2026 are underpinned by factors including a stronger North American harvest, clarity on biofuels policy, and success in used equipment merchandising.

- Despite tariff-related cost pressures and global end-market weakness, upward bias to sector earnings estimates is supporting further multiple expansion expectations among bullish analysts.

What's in the News

- Deere announced the launch of Operations Center PRO Service, a new digital tool providing enhanced machine diagnostics, repair support, and secure software updates for equipment owners and service providers, with phased replacement of Customer Service ADVISOR through 2026 (Key Developments).

- Deere revised its fiscal 2025 net income guidance downward, narrowing the expected range to $4.75 billion to $5.25 billion (Key Developments).

- From April 28 to June 27, 2025, Deere repurchased 581,000 shares (0.21% of shares outstanding) for $300.28 million, bringing total buybacks under the 2008 program to 53.98% of shares for $31.09 billion (Key Developments).

- Deere was removed from the Russell 1000 Value-Defensive Index and Russell 1000 Defensive Index effective June 28, 2025 (Key Developments).

- MarketWatch opinion article speculates Deere has a 10% chance of being Warren Buffett’s undisclosed $5 billion “mystery stock” industrial investment, but views Caterpillar as more likely (MarketWatch/Periodicals).

Valuation Changes

Summary of Valuation Changes for Deere

- The Consensus Analyst Price Target remained effectively unchanged, at $534.61.

- The Consensus Revenue Growth forecasts for Deere remained effectively unchanged, at 0.7% per annum.

- The Discount Rate for Deere remained effectively unchanged, at 9.25%.

Key Takeaways

- Rapid adoption of advanced precision agriculture and automation tech is increasing higher-margin product sales and recurring software revenue for Deere.

- Global farm market improvements and disciplined inventory management position Deere for margin gains and accelerated earnings as agricultural demand rebounds.

- Rising tariffs, volatile demand, competitive pricing, and overreliance on incentives threaten Deere's profitability and margin sustainability amid cost pressures and market uncertainty.

Catalysts

About Deere- Engages in the manufacture and distribution of various equipment worldwide.

- Rapid adoption of Deere's precision agriculture and automation solutions (e.g., JDLink Boost, Precision Essentials bundles, See & Spray tech, and new automation features) is driving higher-value product sales and increased software engagement globally, positioning Deere to benefit from shifts toward high-efficiency, technology-enabled farming; this should lift both future revenue and net margins through higher-margin recurring software and data services.

- Global improvements in farm fundamentals outside North America-such as strong dairy profitability and crop yields in Europe, expanding acreage and profits in Brazil, and stable acreage with favorable credit in India-signal a demand recovery for advanced farm equipment, which could reaccelerate Deere's revenue and earnings as end markets inflect positively.

- Structural reductions in global inventory levels across all major product lines (e.g., 45% reduction in NA large tractor inventory, 50%+ down in Brazil) and a disciplined "build-to-retail" strategy allow Deere to respond rapidly to any upturn in demand, minimizing risk of production inefficiency and supporting margin improvement.

- Expansion and increased effectiveness of John Deere Financial, including innovative rate-buydown products for equipment purchasers even in a high-rate environment, are enabling customers to continue investing in equipment and supporting more resilient revenue streams and stable earnings in down cycles.

- Deere's continued investment in cost reductions, factory efficiency, and parts/service supports ongoing margin improvement, while announced price increases for 2026 models (2-4%) are expected to help offset tariff and input cost headwinds, supporting net margin and future earnings growth.

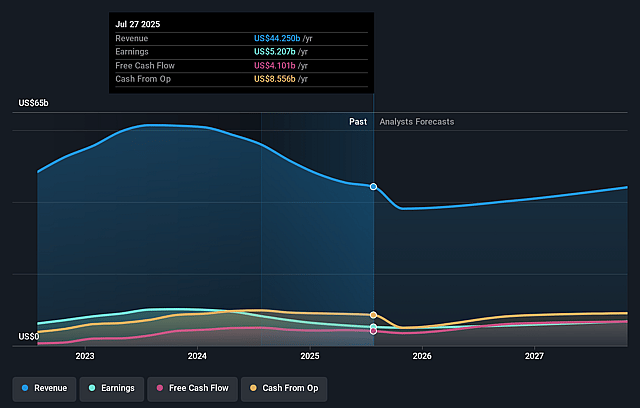

Deere Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Deere's revenue will decrease by 0.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.8% today to 19.0% in 3 years time.

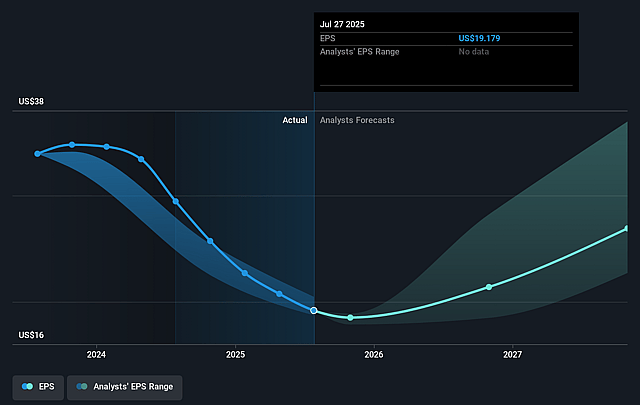

- Analysts expect earnings to reach $8.6 billion (and earnings per share of $33.21) by about September 2028, up from $5.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $9.8 billion in earnings, and the most bearish expecting $5.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.1x on those 2028 earnings, down from 24.7x today. This future PE is lower than the current PE for the US Machinery industry at 24.7x.

- Analysts expect the number of shares outstanding to decline by 1.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.25%, as per the Simply Wall St company report.

Deere Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing tariff and trade uncertainties, especially higher tariffs on Europe, India, and steel/aluminum, are materially increasing costs ($600 million forecast for FY25), which could compress operating margins and constrain future earnings if not fully offset by price realization.

- North America, Deere's largest market, is experiencing significant end-market volatility, marked by a projected 30% decline in large ag equipment sales for FY25, elevated used equipment inventories, high interest rates, and cautious sentiment-indicating risk of sustained pressure on revenue and market share if these headwinds persist.

- Aggressive competitive pricing, especially in construction and earthmoving equipment, is forcing Deere to deploy more incentives and accept negative price realization in segments; failure to reverse this trend could erode net margins and limit profitability over the long term.

- Over-reliance on incentives and financial services (e.g., John Deere Financial split rate tools and dealer pool funds) to stimulate demand in the face of high interest rates may prop up sales in the short-term but risks future revenue quality, credit losses, and margin sustainability if underlying demand does not recover.

- Growing costs from environmental, regulatory (tariff), and input inflation are requiring relentless execution on cost controls and supply chain adaptation; any misstep, inflation surprise, or inability to further reduce costs could materially impact net margins and ultimately earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $533.375 for Deere based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $724.0, and the most bearish reporting a price target of just $460.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $45.1 billion, earnings will come to $8.6 billion, and it would be trading on a PE ratio of 21.1x, assuming you use a discount rate of 9.3%.

- Given the current share price of $475.6, the analyst price target of $533.38 is 10.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.