- United States

- /

- Machinery

- /

- NYSE:DDD

3D Systems (DDD): Reassessing Valuation After Convertible Debt-for-Equity Swap and Capital Structure Shake-Up

Reviewed by Simply Wall St

3D Systems (DDD) just shook up its balance sheet, agreeing to swap about $30.8 million of its 2026 convertible notes for roughly 16.6 million new shares, a debt reducing move that immediately hit the stock.

See our latest analysis for 3D Systems.

The sharp reaction to this debt for equity swap fits into a tougher stretch for 3D Systems, with a steep 7 day share price return of minus 19.9 percent and a 1 year total shareholder return of minus 47.5 percent, suggesting fading momentum as investors reassess risk.

If this kind of balance sheet reset has you rethinking where growth might come from, it could be worth exploring high growth tech and AI stocks for other innovation driven names to watch next.

With the stock down sharply and now trading at less than half of consensus price targets, investors face a key question: Is 3D Systems merely a value trap, or is the market underestimating its future growth potential?

Most Popular Narrative Narrative: 51.2% Undervalued

Compared to 3D Systems last close at $1.77, the most followed narrative sees fair value near $3.63, implying a steep upside gap if its thesis holds.

The company's end to end additive manufacturing model (process, parts, printers) positions it to benefit from the shift toward on demand, decentralized production and supply chain resiliency in sectors like aerospace, defense, and industrials. As adoption of additive manufacturing for production parts (beyond prototyping) accelerates, this model is likely to increase revenues and deliver operating leverage over time.

Want to see what kind of revenue reset and margin rebuild underpins that upside, and how a rich future earnings multiple fits in? The full narrative unpacks the exact growth glide path, profitability inflection, and discounting assumptions that have to line up for this valuation to work.

Result: Fair Value of $3.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro uncertainty and delayed customer capex, along with aggressive restructuring that risks crimping innovation, could easily derail that optimistic path.

Find out about the key risks to this 3D Systems narrative.

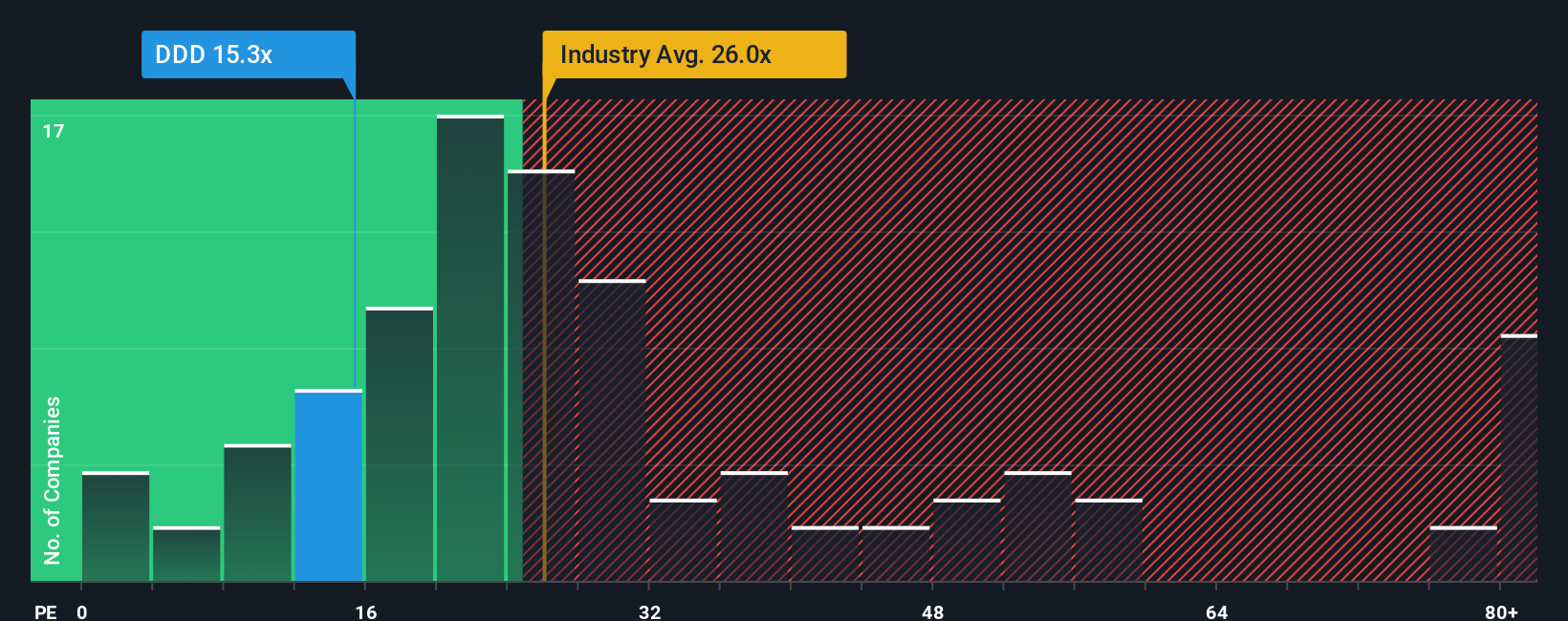

Another Way to Look at Value

On earnings, 3D Systems trades at 14.3 times profit, well below the US Machinery average of 24.9 times and its peers at 27 times. However, it is still far above a fair ratio of 0.4 times. That gap points to both upside potential and real de rating risk. Which side do you believe?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own 3D Systems Narrative

If you see things differently or simply want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your 3D Systems research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before markets move on without you, consider your next opportunity by scanning fresh, data driven ideas tailored to different strategies using the Simply Wall St Screener.

- Explore early stage momentum with these 3607 penny stocks with strong financials that already show stronger financial foundations than many tiny names in the market.

- Position your portfolio in innovative areas by targeting these 25 AI penny stocks involved in automation, analytics, and intelligent software.

- Search for potential mispricings by filtering for these 909 undervalued stocks based on cash flows where cash flow strength differs from current market pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if 3D Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DDD

3D Systems

Provides 3D printing and digital manufacturing solutions in North and South America, Europe, the Middle East, Africa, the Asia Pacific, and Oceania.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026