- United States

- /

- Aerospace & Defense

- /

- NYSE:CW

Curtiss-Wright Shares Surge 53% as Defense Spending News Fuels Valuation Debate in 2025

Reviewed by Bailey Pemberton

Are you giving Curtiss-Wright a hard look because its stock keeps making headlines? You’re not alone. With a jaw-dropping 468.4% return over the past five years and a 53.5% gain just this year, it’s natural to wonder whether the ride can continue, or if now’s the time to be cautious. In the last month alone, the share price climbed another 6.0%, and even a quiet week still brought a 0.3% uptick. Long-term investors have seen the value of patience, as Curtiss-Wright’s steady ascent reflects not only recent market optimism, but also the company’s ability to capitalize on evolving industrial and defense trends.

But if you’re hunting for a bargain, Curtiss-Wright’s current valuation demands a closer look. Many investors want the numbers to justify the optimism, and there are several methods to check whether a stock is undervalued. According to a score that adds one point for every undervaluation check passed, Curtiss-Wright currently scores 0 out of 6. In other words, it doesn’t look cheap by traditional standards. Still, is the story really that simple?

Let’s unpack how different valuation approaches stack up for Curtiss-Wright, and why looking beyond the usual metrics might be the smartest move you make as an investor.

Curtiss-Wright scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Curtiss-Wright Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is really worth by forecasting the cash it will generate in the future and then bringing those values back to today using a discount rate. This method helps investors understand what the current value of those future dollars is right now.

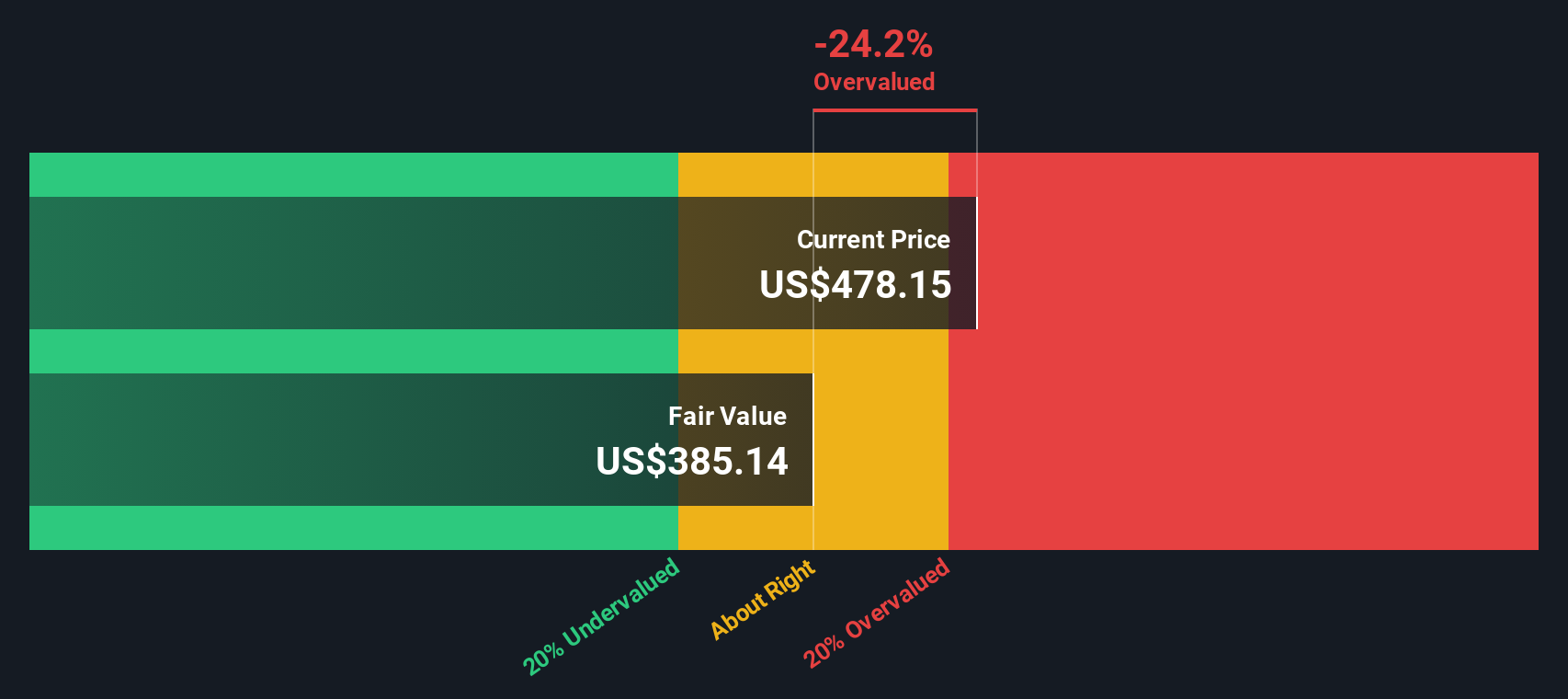

For Curtiss-Wright, the analysis relies on a two-stage Free Cash Flow to Equity approach. The company reported a latest twelve months free cash flow (FCF) of $518 million. Analyst forecasts suggest FCF will climb steadily over the next five years, reaching $701 million by the end of 2029. Beyond those years, cash flow projections are based on a series of gradual growth estimates, with FCF expected to approach $902 million by 2035. These numbers are all in US dollars, which matches the listing currency for Curtiss-Wright shares.

Simply Wall St calculates Curtiss-Wright's intrinsic value at $378.86 per share using this DCF approach. However, the DCF model signals the stock is trading at a 42.4% premium to this estimated fair value. This indicates shares appear significantly overvalued based on this measure.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Curtiss-Wright may be overvalued by 42.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Curtiss-Wright Price vs Earnings (PE)

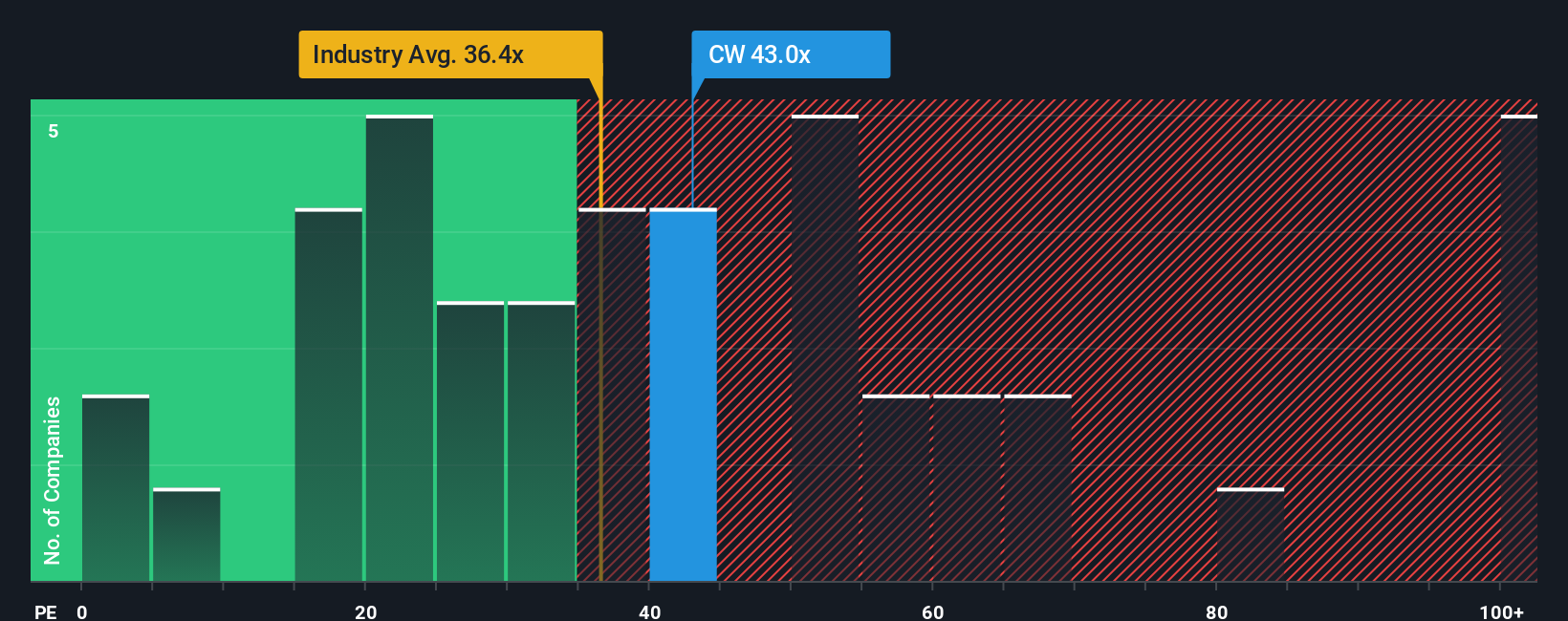

For profitable companies like Curtiss-Wright, the price-to-earnings (PE) ratio is a widely used valuation yardstick. It helps investors see how much they are paying for each dollar of current earnings, making it especially relevant for established companies in stable industries. High-growth prospects, premium profit margins, or lower risks can justify a higher PE, while companies with uncertain outlooks or lower profitability tend to warrant lower PE multiples.

Curtiss-Wright currently trades on a PE ratio of 45x. That is noticeably higher than both the Aerospace & Defense industry average of 39x and the peer group average of 40x. This rapid surge can make investors wonder whether the business truly deserves such a premium, or if the shares are running hot.

This is where Simply Wall St’s proprietary "Fair Ratio" comes in. Rather than just comparing Curtiss-Wright to industry averages, this benchmark calculates the appropriate PE for the company by incorporating its specific earnings growth expectations, profit margins, overall market risks, and even its size. This provides a much sharper, more tailored lens for valuation than a one-size-fits-all industry or peer comparison.

Currently, Curtiss-Wright’s Fair Ratio sits at 25.6x, well below its actual PE of 45x. This disconnect suggests investors are paying a significant premium, not easily justified by the company's expected growth or risk profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Curtiss-Wright Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful tool that lets you connect your personal view of Curtiss-Wright’s story to concrete financial estimates such as future revenue, earnings, and margins. This process ultimately guides you to your own fair value for the company.

This approach recognizes that every investor has a unique perspective. Narratives allow you to express yours by linking the company’s real-world catalysts and risks to a forecast, making the numbers meaningful and dynamic rather than static. On Simply Wall St’s Community page, used by millions of investors, anyone can create, compare, and share Narratives with just a few clicks. This makes sophisticated valuation much more accessible.

Narratives help you decide when to buy or sell by automatically comparing your own Fair Value to the current Price. They are updated continuously as news or earnings releases change the outlook. For example, some Curtiss-Wright Narratives project a fair value as high as $572 if strong defense spending and nuclear tailwinds persist, while others see a lower fair value in the $457 range if industry headwinds or contract risks affect earnings growth. Narratives are an essential way to bridge the gap between numbers and stories, empowering smarter, more flexible investment decisions.

Do you think there's more to the story for Curtiss-Wright? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CW

Curtiss-Wright

Provides engineered products, solutions, and services mainly to aerospace and defense, commercial power, process, and industrial markets worldwide.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives