- United States

- /

- Aerospace & Defense

- /

- NYSE:CW

Curtiss-Wright (CW) Declares US$0.24 Quarterly Dividend Payable October 2025

Reviewed by Simply Wall St

Curtiss-Wright (CW) has reaffirmed its commitment to shareholders with a quarterly dividend declaration of $0.24 per share, set to be paid on October 10, 2025. During the last quarter, the company's stock price increased by 4%. This rise aligns closely with the broader market upticks, as the Dow Jones and S&P 500 achieved record highs amid stabilized inflation expectations and potential interest rate cuts. CW's strong earnings performance and positive corporate guidance revisions likely supported this price movement, in addition to its ongoing partnerships and strategic initiatives, despite record market events stealing the headlines.

Buy, Hold or Sell Curtiss-Wright? View our complete analysis and fair value estimate and you decide.

The recent dividend announcement from Curtiss-Wright underscores its ongoing commitment to shareholder returns. While the immediate effect of the news is a steady confidence boost, it also aligns with the company's broader strategy of maximizing shareholder value through disciplined capital allocation and expanding returns. Over a five-year period, Curtiss-Wright's total shareholder return, including share price appreciation and dividends, has been substantial at 429.32%. This performance highlights the company's resilience and effective management, contrasting with its one-year performance where it exceeded the US Aerospace & Defense industry's return of 32.1%.

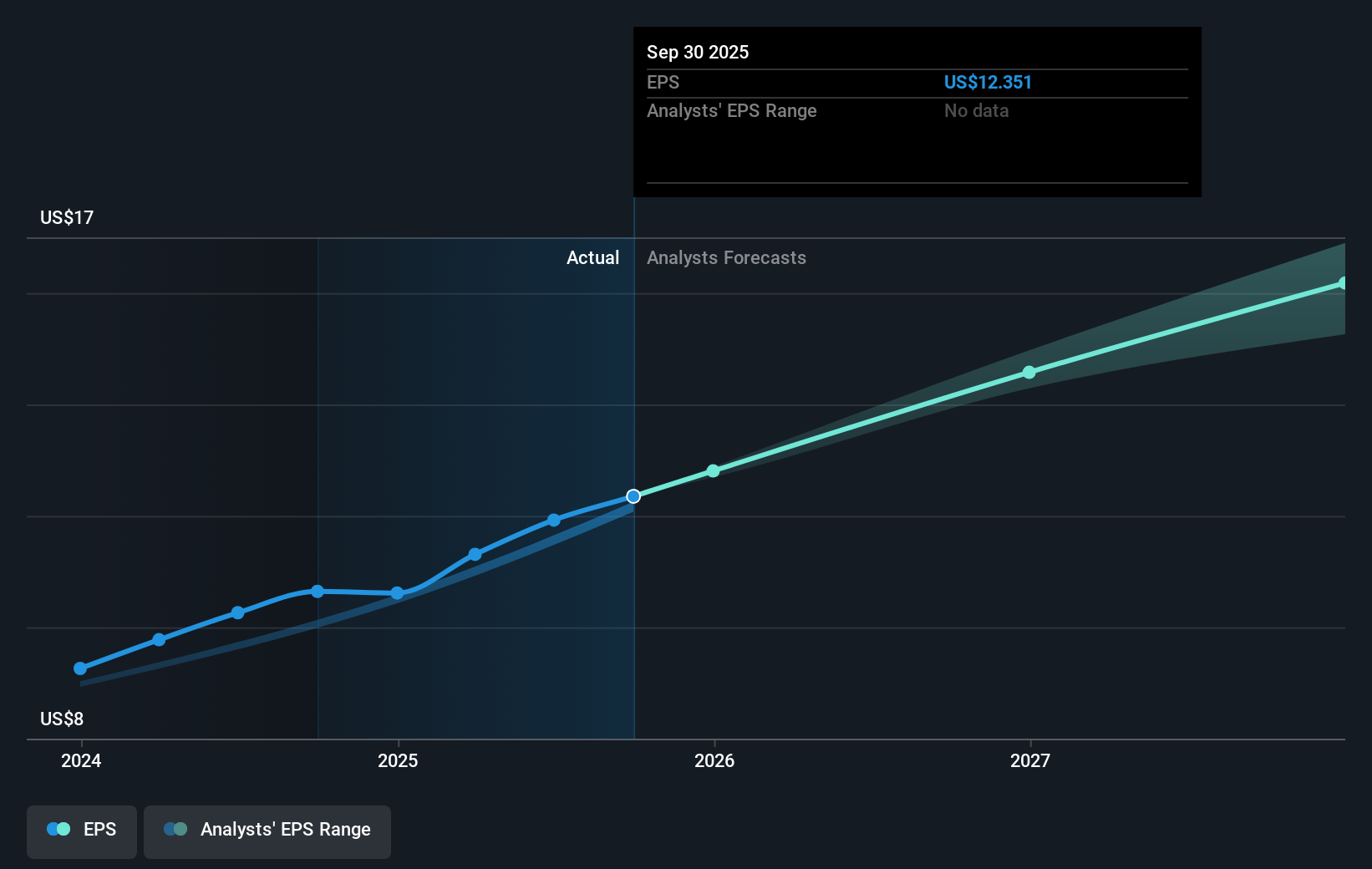

The current share price of $495.48, compared against the analyst consensus price target of $520.33, reflects a potential upside. The relatively narrow discount of approximately 5% suggests that analysts view the stock as fairly valued based on the forward earnings and growth assumptions. Nevertheless, it's important to consider that Curtiss-Wright's focus on advanced technologies and high-value contracts in defense and nuclear sectors could enhance revenue and earnings forecasts. These targeted growth areas could effectively offset any potential headwinds, thereby supporting a favorable long-term outlook if the company's strategic initiatives are successfully realized.

Our valuation report unveils the possibility Curtiss-Wright's shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CW

Curtiss-Wright

Provides engineered products, solutions, and services mainly to aerospace and defense, commercial power, process, and industrial markets worldwide.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)