- United States

- /

- Office REITs

- /

- NYSE:PGRE

Undervalued Small Caps With Insider Buying Across Regions

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.8%, contributing to a 9.5% increase over the past year, with earnings anticipated to grow by 14% annually in the coming years. In this environment, identifying small-cap stocks that are undervalued and exhibit insider buying can present intriguing opportunities for investors seeking potential growth within diverse regions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.0x | 2.8x | 49.65% | ★★★★★☆ |

| MVB Financial | 11.8x | 1.6x | 32.76% | ★★★★★☆ |

| Flowco Holdings | 6.5x | 1.0x | 37.12% | ★★★★★☆ |

| West Bancorporation | 12.6x | 4.0x | 39.69% | ★★★★☆☆ |

| Shore Bancshares | 9.4x | 2.3x | -14.58% | ★★★★☆☆ |

| S&T Bancorp | 10.5x | 3.6x | 45.91% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 37.42% | ★★★★☆☆ |

| Columbus McKinnon | 45.7x | 0.4x | 41.41% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.4x | -3921.36% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -18.19% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Centuri Holdings (NYSE:CTRI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Centuri Holdings operates in the energy infrastructure sector, focusing on U.S. and Canadian gas services as well as union and non-union electric services, with a market cap of $2.5 billion.

Operations: Centuri Holdings generates revenue primarily from U.S. Gas, Canadian Gas, Union Electric, and Non-Union Electric segments. The company experienced fluctuations in its net income margin over recent periods, with a notable decline to -8.81% in late 2024 before improving to -0.25% by early 2025. Operating expenses have varied but remained significant across the same timeframe, with general and administrative expenses consistently contributing a substantial portion of these costs.

PE: -247.2x

Centuri Holdings, a smaller company in the U.S., is gaining attention for its potential value. Despite a net loss of US$6.72 million in 2024, significantly improved from the previous year's US$186.18 million loss, insider confidence is evident with share purchases over recent months. Recent announcements include over US$850 million in new and renewed contracts across diverse sectors like utility and energy infrastructure, indicating robust growth prospects with revenue expected to reach up to US$2.80 billion in 2025.

- Click here and access our complete valuation analysis report to understand the dynamics of Centuri Holdings.

Assess Centuri Holdings' past performance with our detailed historical performance reports.

Paramount Group (NYSE:PGRE)

Simply Wall St Value Rating: ★★★☆☆☆

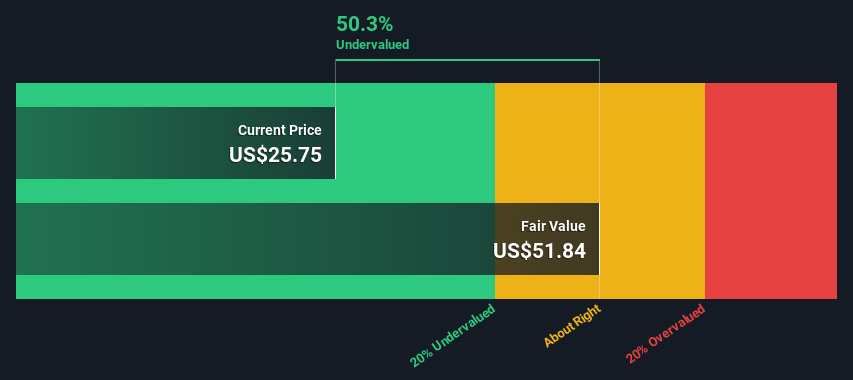

Overview: Paramount Group is a real estate investment trust (REIT) focused on owning, operating, and managing high-quality office properties in select urban markets with a market capitalization of approximately $1.11 billion.

Operations: Paramount Group's revenue model primarily involves generating income from its core operations, with a notable gross profit margin that has seen significant fluctuations, reaching as high as 95.83% and dropping to 37.68%. The company's cost structure includes substantial operating expenses and non-operating expenses, with depreciation and amortization being a significant component of these costs.

PE: -15.2x

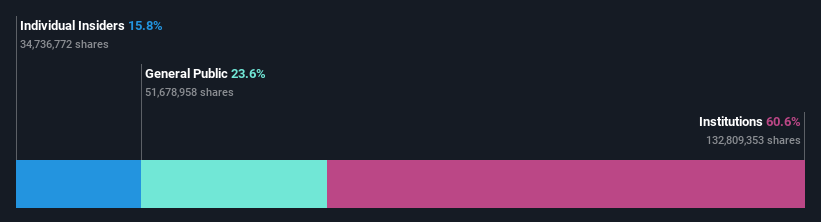

Paramount Group, a smaller player in the market, faces challenges with profitability and growth. Their Q1 2025 results showed a net loss of US$10 million compared to last year's profit. Despite this, insider confidence is evident as an executive recently purchased 100,000 shares for approximately US$403,850. The company relies on external borrowing for funding and anticipates continued losses through 2025. With earnings expected to decline by 18% annually over the next three years, potential investors should weigh these factors carefully.

- Unlock comprehensive insights into our analysis of Paramount Group stock in this valuation report.

Examine Paramount Group's past performance report to understand how it has performed in the past.

PROG Holdings (NYSE:PRG)

Simply Wall St Value Rating: ★★★★★★

Overview: PROG Holdings operates primarily through its Progressive Leasing segment, offering lease-to-own solutions, with a focus on providing flexible payment options for consumers, and has a market capitalization of approximately $1.43 billion.

Operations: Progressive Leasing is the primary revenue stream, generating $2.40 billion, complemented by contributions from Vive and other segments. The company experienced fluctuations in its gross profit margin, reaching 34.55% at its peak and dipping to 11.65% during challenging periods. Operating expenses are primarily driven by general and administrative costs, which consistently exceed $400 million across recent periods.

PE: 5.1x

PROG Holdings, a small company in the U.S., showcases insider confidence with Independent Director Douglas Curling purchasing 10,000 shares for US$298,800. Despite high debt levels and reliance on external funding, recent earnings report shows an increase in net income to US$34.72 million from US$21.97 million a year ago. The company is actively seeking M&A opportunities and has repurchased 935,992 shares for US$26.12 million this year, reflecting strategic capital allocation amidst revised lower annual revenue guidance of up to US$2.5 billion.

- Take a closer look at PROG Holdings' potential here in our valuation report.

Gain insights into PROG Holdings' past trends and performance with our Past report.

Summing It All Up

- Discover the full array of 91 Undervalued US Small Caps With Insider Buying right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGRE

Paramount Group

Paramount Group, Inc. ("Paramount" or the "Company") is a fully-integrated real estate investment trust that owns, operates, manages, acquires and redevelops high-quality, Class A office properties located in select central business district submarkets of New York and San Francisco.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives