- United States

- /

- Trade Distributors

- /

- NYSE:CTOS

Here's Why We Think Custom Truck One Source (NYSE:CTOS) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Custom Truck One Source (NYSE:CTOS). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Custom Truck One Source

Custom Truck One Source's Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. Which is why EPS growth is looked upon so favourably. It is awe-striking that Custom Truck One Source's EPS went from US$0.015 to US$0.27 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. Could this be a sign that the business has reached an inflection point?

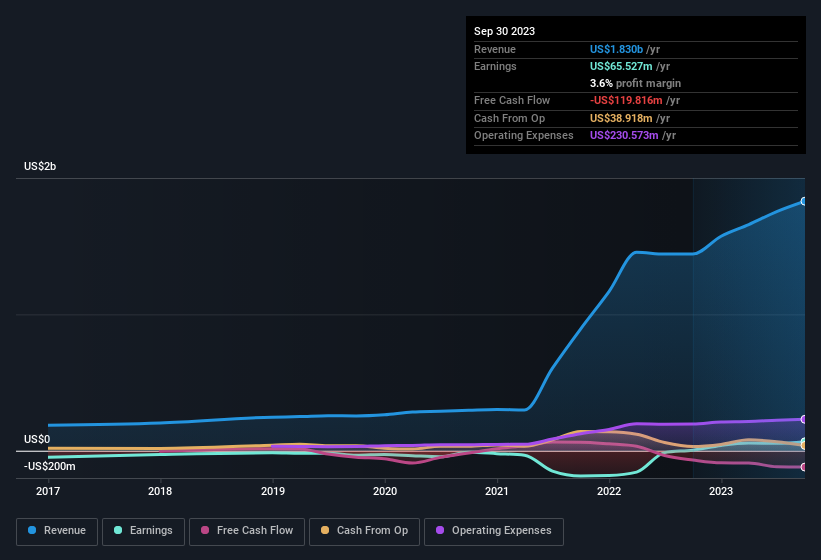

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Custom Truck One Source shareholders can take confidence from the fact that EBIT margins are up from 6.1% to 10%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Custom Truck One Source's forecast profits?

Are Custom Truck One Source Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Shareholders in Custom Truck One Source will be more than happy to see insiders committing themselves to the company, spending US$259k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. Zooming in, we can see that the biggest insider purchase was by Independent Chairman of the Board Marshall Heinberg for US$259k worth of shares, at about US$6.53 per share.

The good news, alongside the insider buying, for Custom Truck One Source bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a significant chunk of shares, currently valued at US$53m, they have plenty of motivation to push the business to succeed. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Custom Truck One Source's CEO, Ryan McMonagle, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Custom Truck One Source, with market caps between US$1.0b and US$3.2b, is around US$5.2m.

Custom Truck One Source's CEO took home a total compensation package worth US$4.0m in the year leading up to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Custom Truck One Source To Your Watchlist?

Custom Truck One Source's earnings per share have been soaring, with growth rates sky high. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Custom Truck One Source deserves timely attention. You should always think about risks though. Case in point, we've spotted 2 warning signs for Custom Truck One Source you should be aware of, and 1 of them shouldn't be ignored.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Custom Truck One Source, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CTOS

Custom Truck One Source

Provides specialty equipment rental and sale services to electric utility transmission and distribution, telecommunications, rail, forestry, waste management, and other infrastructure-related industries in the United States and Canada.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026