- United States

- /

- Trade Distributors

- /

- NYSE:CTOS

A Look at Custom Truck One Source (CTOS) Valuation Following Innovative Product Launches at Utility Expo 2025

Reviewed by Kshitija Bhandaru

Custom Truck One Source (CTOS) and its manufacturing partner, Load King Manufacturing, made news at Utility Expo 2025 by unveiling a series of advanced solutions. Taking center stage were new off-road tracked vehicles and a fully electric bucket truck.

See our latest analysis for Custom Truck One Source.

CTOS’s latest innovations come as the stock continues its strong run this year, with a 29.8% year-to-date share price gain and a remarkable 101.9% total return over the past 12 months. While recent launches are drawing attention, momentum is clearly building and is supported by investor enthusiasm for the company’s growing reputation as an innovator, even as broader market jitters remain.

If these kinds of product breakthroughs have you curious about where the next big move could come from, it might be the perfect chance to explore fast growing stocks with high insider ownership.

Yet with shares already up nearly 102% in the past year and analyst targets still showing some upside, the key question is whether there is more room to run or if the market is already pricing in these gains.

Most Popular Narrative: 11.5% Undervalued

With the narrative’s fair value set at $7.10 and the last close at $6.28, the stage is set for bullish voices to challenge whether gains can go even higher on the back of targeted growth strategies.

Strategic and ongoing investments expanding the rental fleet and maintaining high utilization rates (above 75%) are increasing recurring revenue and providing margin stability, supporting consistent adjusted EBITDA growth and improved free cash flow generation.

Want to know what’s fueling this valuation outlook? The real secret is a financial playbook that leans heavily on consistent growth and the promise of stronger margins over time. Will these bold projections be enough to justify the current market optimism? Find out which numbers are driving these expectations.

Result: Fair Value of $7.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures or delayed utility investments could quickly alter the outlook, particularly if demand weakens or borrowing costs remain high.

Find out about the key risks to this Custom Truck One Source narrative.

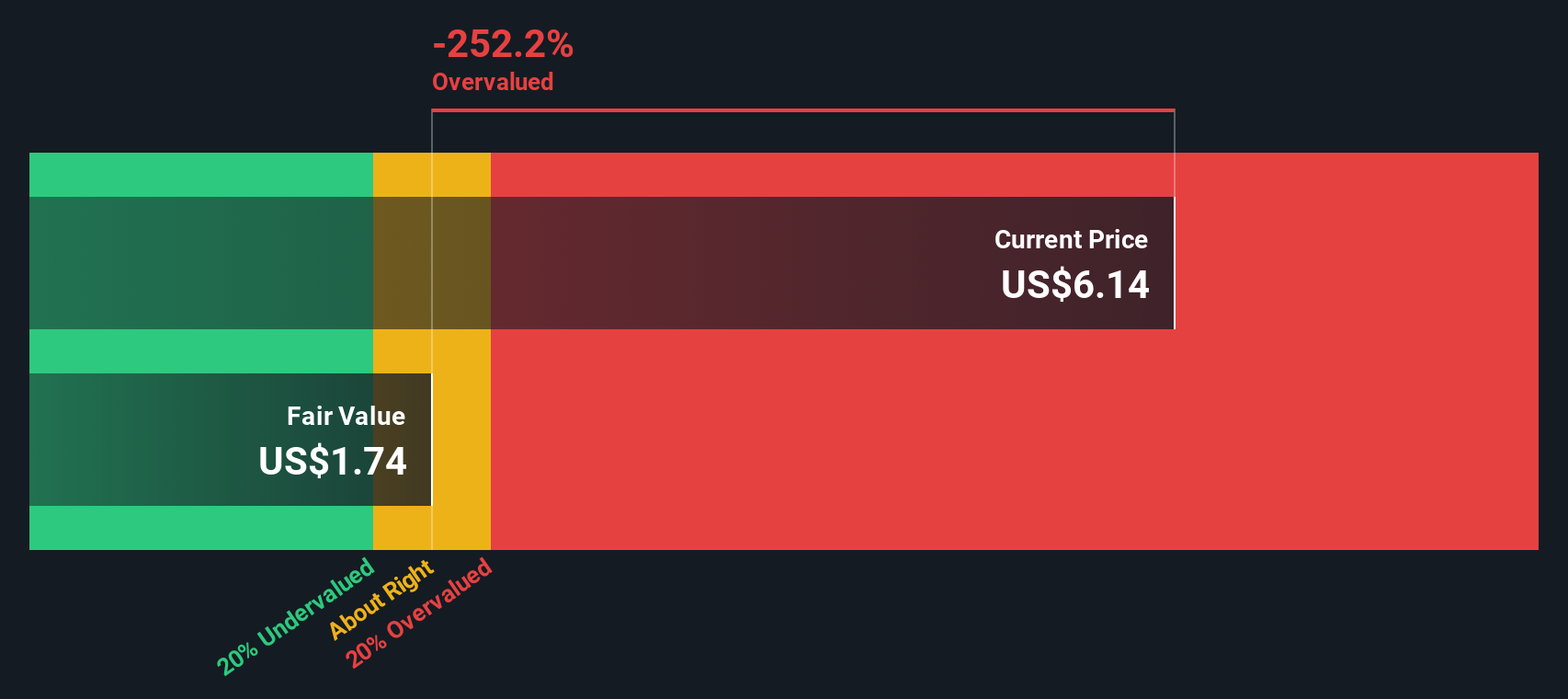

Another View: DCF Model Challenges the Multiple Approach

Looking at Custom Truck One Source through the lens of our DCF model, a different verdict appears. While the current price-to-sales ratio looks attractive compared with both peers and the industry, our DCF estimate suggests the shares might actually be trading above what long-term cash flows justify. Does this suggest hidden risks, or is there more upside yet to come?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Custom Truck One Source for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Custom Truck One Source Narrative

If you see things differently or want to dive into your own research, it takes just minutes to create your personal investment narrative. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Custom Truck One Source.

Looking for More Investment Ideas?

Take the lead in your investing journey, and see how other standout opportunities could fit your portfolio. Don’t let these powerful trends and promising sectors pass you by.

- Tap into digital breakthroughs shaping finance by checking out these 78 cryptocurrency and blockchain stocks for stocks driving blockchain and cryptocurrency innovation.

- Unlock the growth potential of healthcare’s next frontier and see which companies are charting a bold new course with these 32 healthcare AI stocks.

- Boost your passive income by targeting companies with strong yields using these 19 dividend stocks with yields > 3% and strengthen your strategy for steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTOS

Custom Truck One Source

Provides specialty equipment rental and sale services to electric utility transmission and distribution, telecommunications, rail, forestry, waste management, and other infrastructure-related industries in the United States and Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives