- United States

- /

- Building

- /

- NYSE:CSW

What Recent Share Slump Means for CSW Industrials’ True Value in 2025

Reviewed by Bailey Pemberton

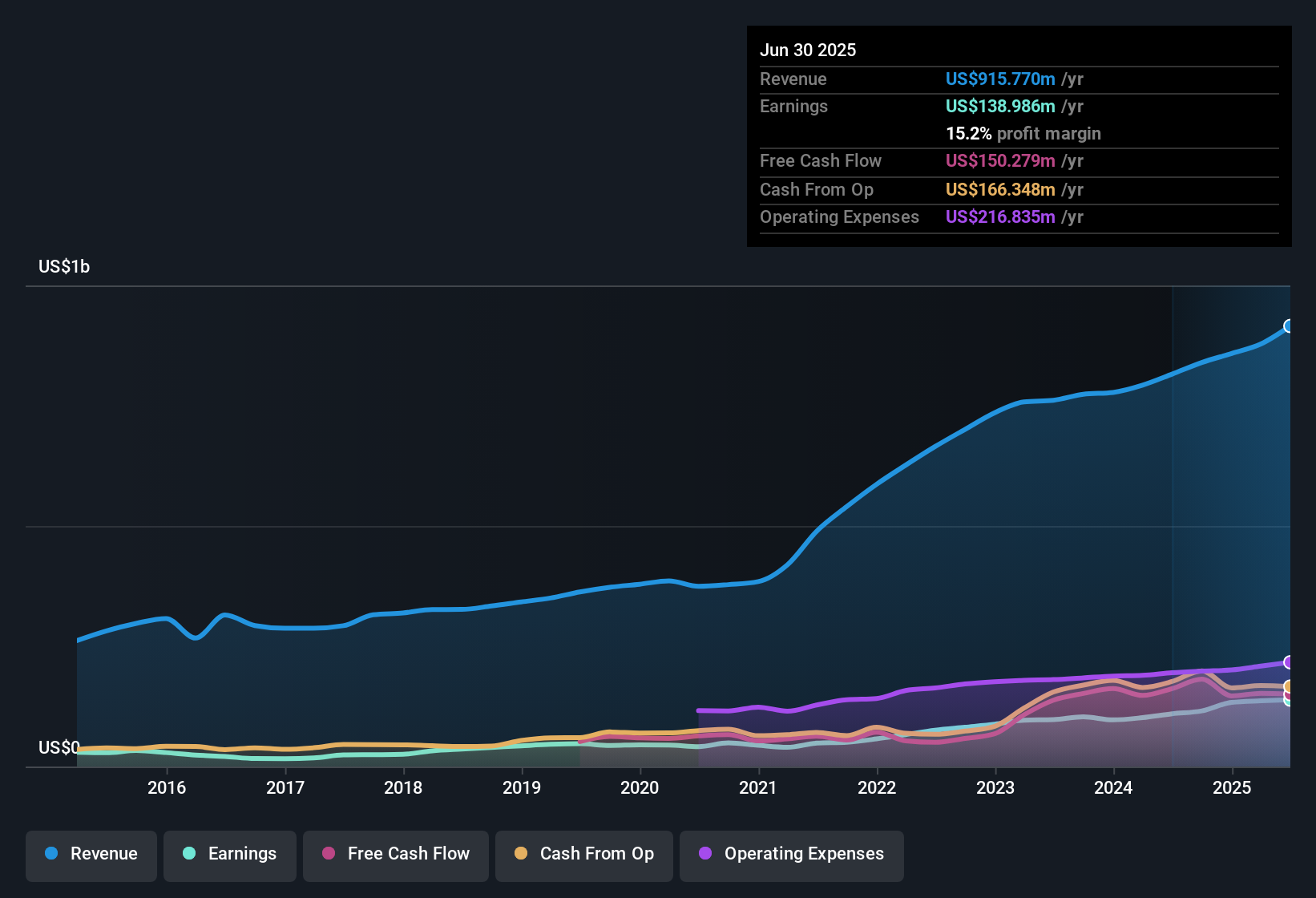

If you are weighing what to do with CSW Industrials stock right now, you are certainly not alone. After a truly impressive multiyear run, with shares rising over 216.0% in five years and a massive 105.1% over three, CSW Industrials has hit a rough patch lately. The stock closed most recently at $242.77 and has dropped 5.5% in the past week, falling 10.1% over the last month. Year to date, shares are down 30.9%, and on a 1-year view, they are off by 34.1%. With this kind of shift, it is no wonder investors are asking whether the dip signals opportunity or risk.

Part of the recent decline can be traced to broader market developments reshaping investors’ perception of risk and opportunity. As capital has rotated out of some industrial names, volatility has spiked for stocks with robust long-term performance like CSW Industrials. But after such a long stretch of growth, the latest moves raise an even bigger question: Is the market rewriting how much the business is really worth?

That is where valuation comes in. By looking at how CSW Industrials stacks up across different valuation checks, we get a clearer sense of whether the stock is priced for a comeback or still has further to fall. Using six distinct measures, CSW Industrials earns a value score of 3. The stock is considered undervalued in half of the standard checks investors watch. Let’s break down what those numbers mean and explore why traditional valuation might not always tell the whole story.

Why CSW Industrials is lagging behind its peersApproach 1: CSW Industrials Discounted Cash Flow (DCF) Analysis

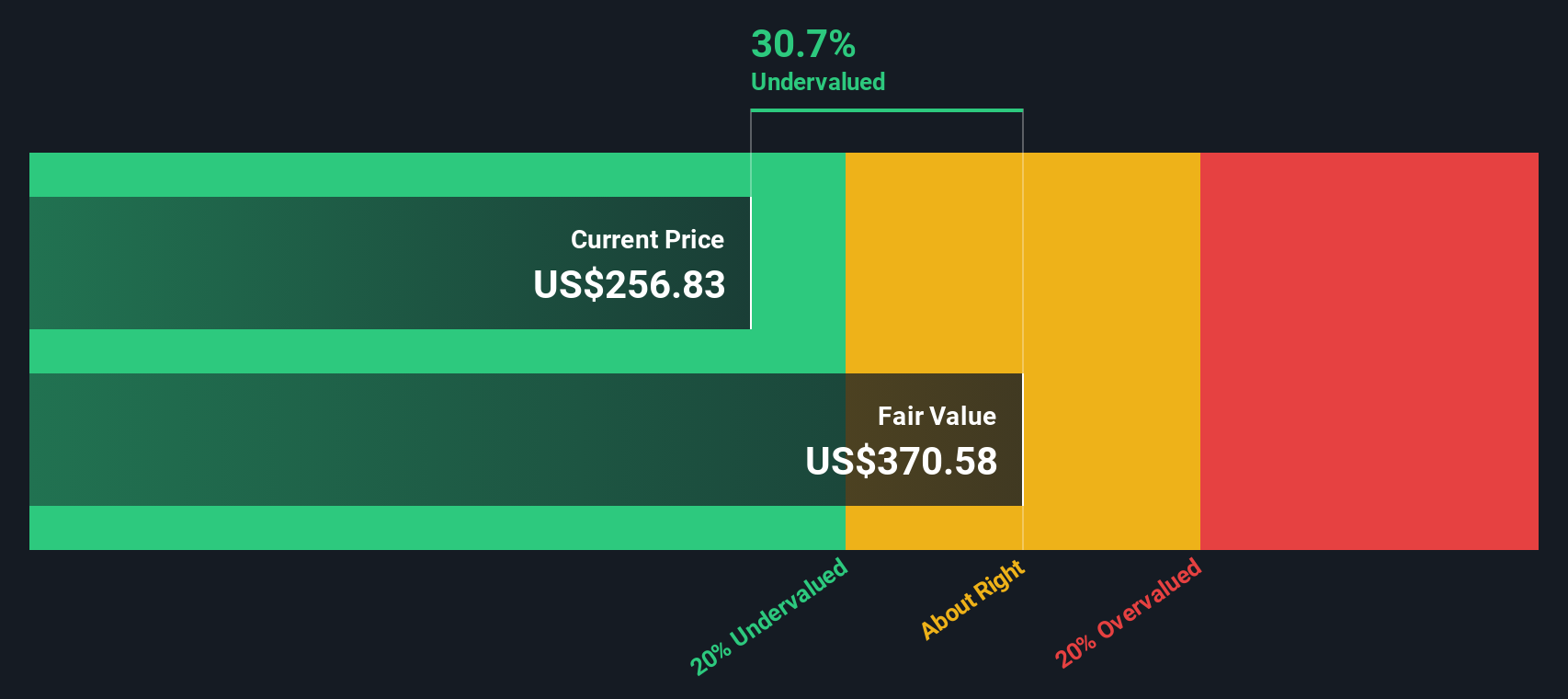

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. For CSW Industrials, this approach captures what the business might earn over the coming years and weighs it against its price right now.

According to the latest figures, CSW Industrials generated $148.8 million in Free Cash Flow (FCF) over the last twelve months. Projections show steady annual growth, with estimated FCF to reach $251 million by 2027 and longer-term analyst extrapolations putting FCF at roughly $436.4 million by 2035. These forecasts rely on analyst input through 2027, after which the outlook extends using educated trends.

After running this through the two-stage Free Cash Flow to Equity model, the estimated intrinsic value of CSW Industrials shares lands at $371.24. This figure implies the stock is currently trading at a 34.6% discount to its fair value, as the present share price of $242.77 falls well below what the model suggests is reasonable.

In short, by this measure, CSW Industrials appears to be meaningfully undervalued compared to its projected cash-generating potential.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for CSW Industrials.

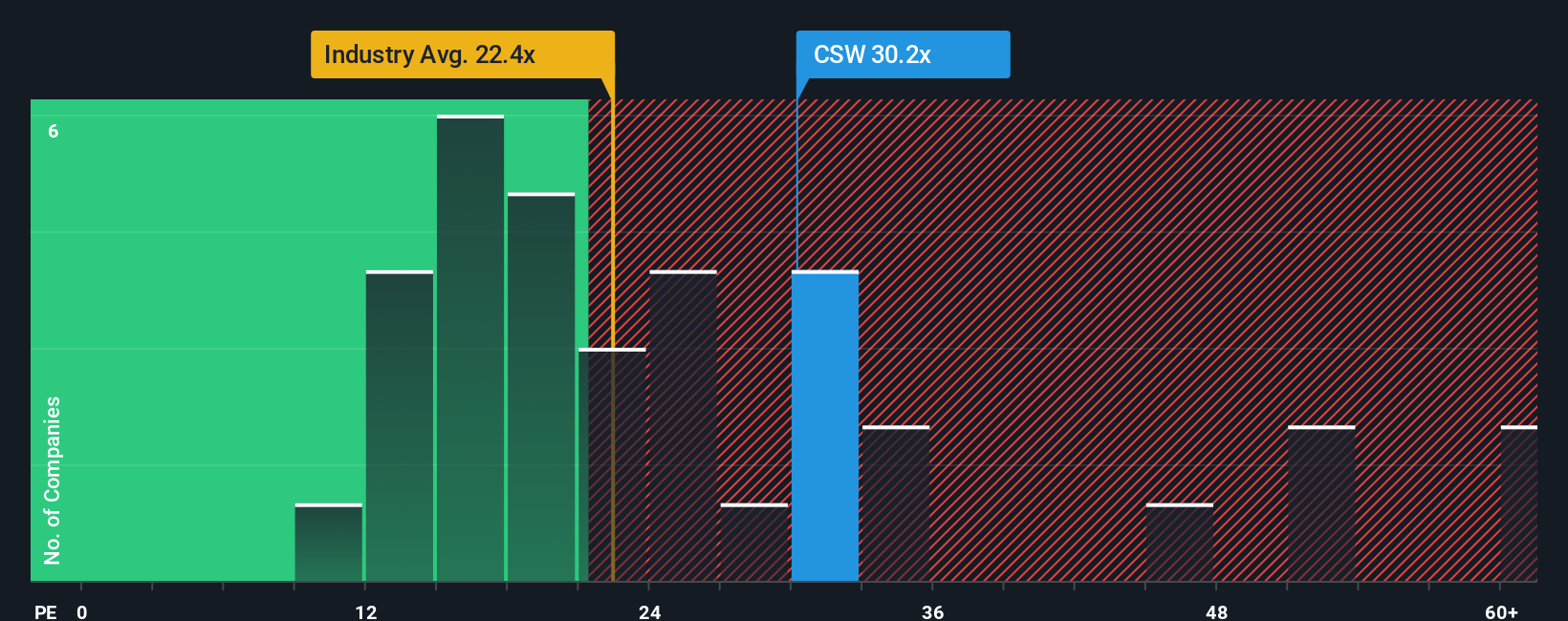

Approach 2: CSW Industrials Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is the preferred multiple for valuing profitable companies like CSW Industrials because it directly relates the market price to the company's actual earnings. For companies generating reliable profits, the PE ratio offers a straightforward snapshot of how much investors are willing to pay for each dollar of earnings.

However, it is important to note that what counts as a “normal” or “fair” PE ratio depends on a company’s expected growth and risk. Higher growth prospects often justify a higher PE, while greater risk or slower growth usually leads to a lower multiple.

Right now, CSW Industrials trades at a PE of 29.3x. This stands above the Building industry average of 21.8x and also outpaces the peer group, which averages 24.2x. While these comparisons are useful, they do not tell the whole story about whether the stock is actually fairly valued given its specific qualities.

That is where the Simply Wall St Fair Ratio comes in. This metric combines factors like future earnings growth, profit margins, industry dynamics, market capitalization, and risk into a custom benchmark. Unlike a straight peer or industry comparison, the Fair Ratio aims for a tailored, apples-to-apples view of value for CSW Industrials. The Fair Ratio for CSW Industrials is calculated at 21.9x. Since this is noticeably below the current PE of 29.3x, it suggests the stock is overvalued based on these nuanced factors.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your CSW Industrials Narrative

Earlier, we mentioned there is a more insightful way to gauge valuation, so let’s introduce you to Narratives. A Narrative is your personal story for a company, connecting what you believe about its industry, management, future prospects, and risks with your forecasts for revenue, earnings, and profit margins. This all culminates in your own fair value estimate.

Unlike static financial ratios, Narratives transform complex analysis into an accessible tool that lets any investor make sense of the numbers in context. On Simply Wall St’s Community page, you can explore or craft your own Narrative, used by investors worldwide. This approach links your view of a company’s future to a clear financial forecast and updates dynamically as new news or earnings arrive.

Narratives make the buy-or-sell call straightforward: easily check if your own Fair Value is above or below the current share price and decide if CSW Industrials is under- or overvalued in your eyes. For instance, some investors see robust industry demand and forecast a fair value as high as $340 per share for CSW Industrials, while others, more cautious about margin pressures or industry risks, estimate it closer to $269. Narratives make it simple to see these perspectives and decide which story, numbers, and price make sense to you.

Do you think there's more to the story for CSW Industrials? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CSW

CSW Industrials

Provides various industrial products in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives