- United States

- /

- Aerospace & Defense

- /

- NYSE:CRS

Should You Reconsider Carpenter Technology Stock After Its 58% Surge and Industry Momentum in 2025?

Reviewed by Bailey Pemberton

If you’re weighing what to do next with Carpenter Technology stock, you’re not alone. This is one of those names that keeps surprising people, and not just with its big price gains. In the past year, Carpenter’s share price has jumped an impressive 58.3%, and if you zoom out to the last five years, you’re looking at a jaw-dropping 1,345.3% return. Even this year, shares are racing ahead, up 43.6% year-to-date. These numbers catch the eye, and they’re not just driven by investor excitement. Recent market tailwinds for industrial metals and specialty manufacturing have played a role in pushing the stock higher. Along the way, perceptions of risk and potential seem to be shifting as Carpenter’s business becomes more central to supply chains that are being reimagined worldwide.

The recent momentum isn’t without its nuances. Over the past week, you saw another 4.4% added to the stock’s price, reflecting renewed interest that’s likely connected to broader optimism around advanced manufacturing and infrastructure development. Still, looking at a 1.9% rise over the past month, it’s clear the stock can also move in fits and starts as the market recalibrates its outlook.

Of course, past returns are only one part of the story. For investors who want to know if Carpenter Technology is undervalued, the numbers offer something to consider: the company scores a 3 on our six-point valuation check. That means it’s undervalued in three out of six measures we use, which is a solid signal but not a slam dunk. Next, we’ll dive into what these different valuation approaches actually say about Carpenter. Stick around, because we’ll also talk about a smarter way to cut through the noise at the end.

Approach 1: Carpenter Technology Discounted Cash Flow (DCF) Analysis

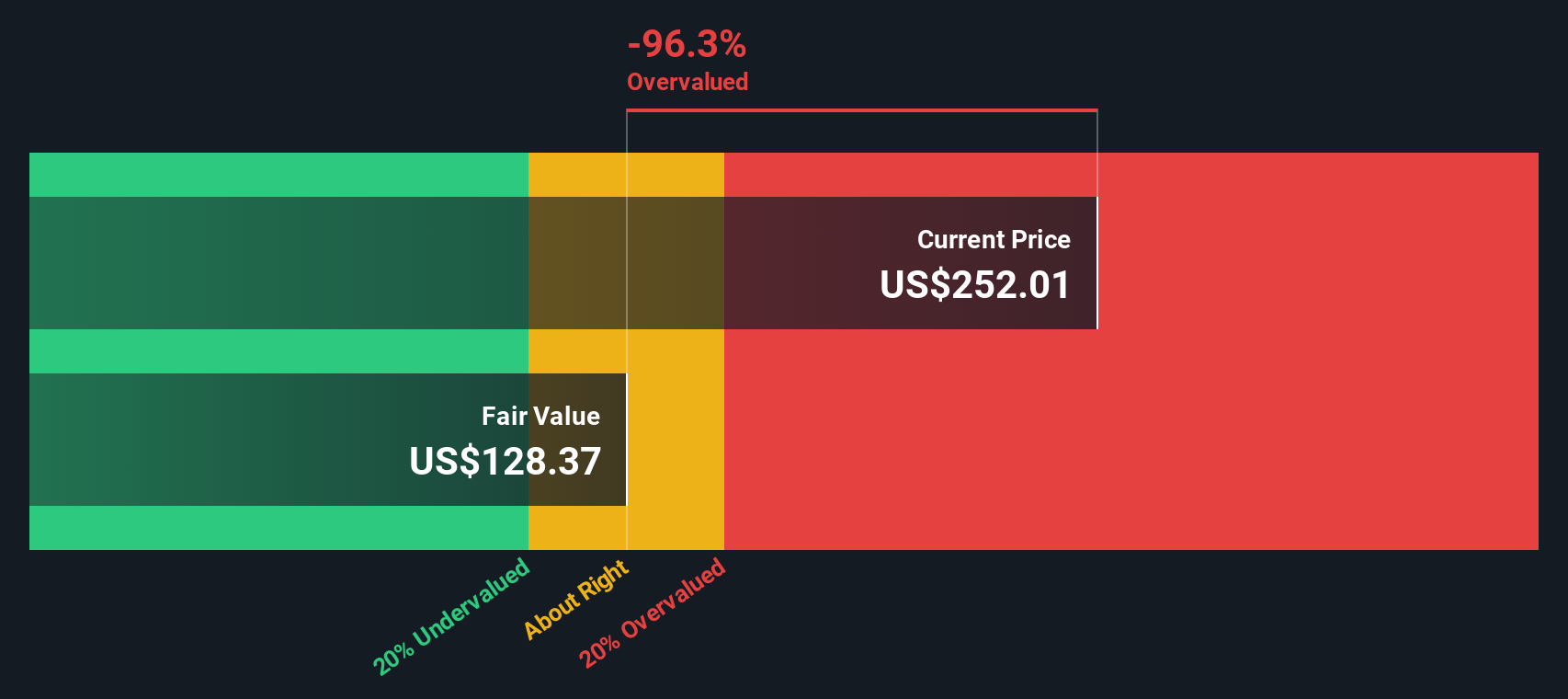

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to today, giving investors a sense of what the business is really worth based on its cash-generating potential. For Carpenter Technology, this DCF analysis uses a two-stage free cash flow to equity method to evaluate long-term performance.

Currently, Carpenter Technology’s free cash flow stands at $323.3 million. Analyst estimates extend five years out, with free cash flow expected to reach $359 million in 2030. Growth beyond that point is projected by Simply Wall St, but the near-term estimates provide the most confidence. Over the years, projected annual cash flows, all in millions of dollars, gradually increase with 2026 at $272.3 million, 2027 at $373.7 million, and so on through 2035.

Based on these projections, the DCF model calculates an intrinsic value of $128.37 per share. Compared to the current share price, the DCF model suggests the stock is 96.3% overvalued. This means the market price is far above what conservative cash flow assumptions would justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Carpenter Technology may be overvalued by 96.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Carpenter Technology Price vs Earnings

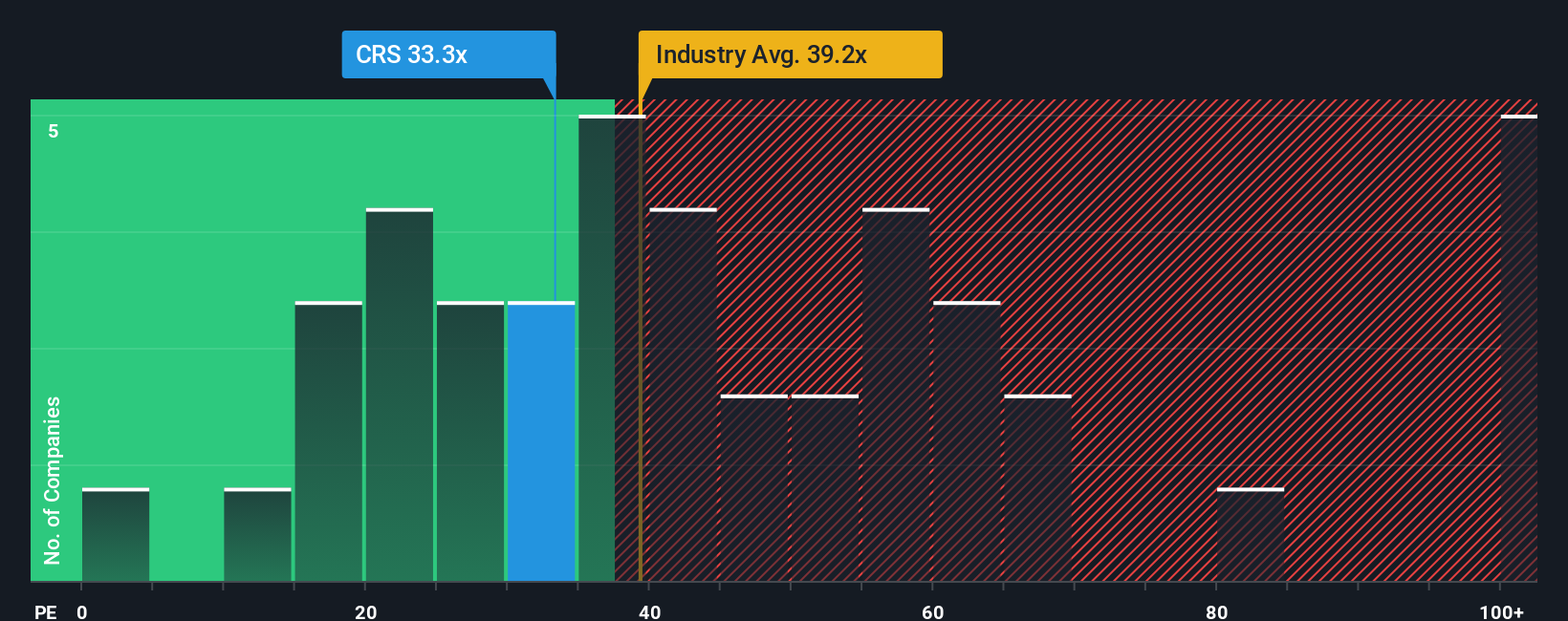

The Price-to-Earnings (PE) ratio is a classic valuation method for profitable companies like Carpenter Technology because it measures how much investors are willing to pay for a dollar of reported earnings. For businesses with steady earnings and positive profits, it is a straightforward way to compare value across companies.

Interpreting PE ratios is not always simple. A higher PE can reflect investor optimism about the company’s future growth and profitability, while a lower PE can point to slower expected growth or higher perceived risk. What is considered “fair” is often dynamic and influenced by broader industry trends and company-specific fundamentals.

Carpenter Technology’s current PE ratio sits at 33.4x, which is just below the peer group average of 34.3x and well under the Aerospace & Defense industry average of 39.9x. While these readouts provide context, Simply Wall St also calculates a proprietary “Fair Ratio” of 31.8x for Carpenter. Unlike a basic industry comparison, the Fair Ratio incorporates the company’s unique growth outlook, margins, size, and risk profile. This tailored benchmark gives a more nuanced sense of value than broad averages alone.

With a current PE just 1.6x above its Fair Ratio, Carpenter Technology’s shares are priced a bit ahead of what its fundamentals justify, suggesting the stock is slightly overvalued on this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Carpenter Technology Narrative

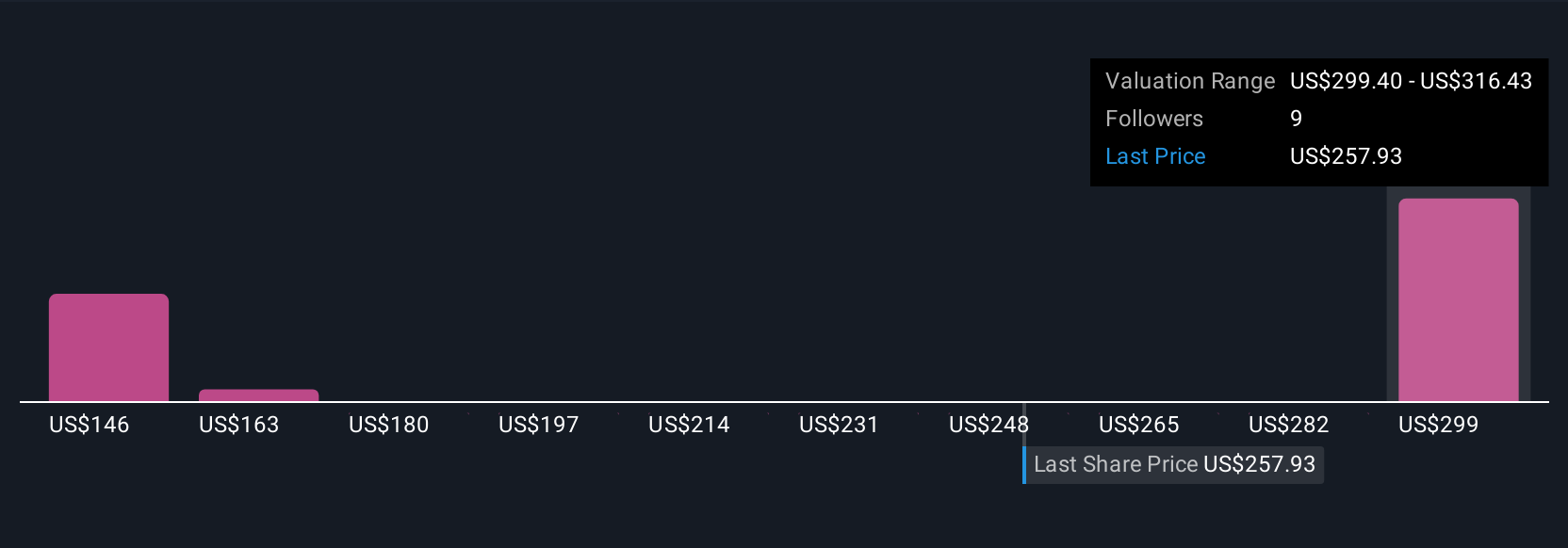

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your investment story. It connects your personal perspective on a company to your own estimates for things like future revenue, earnings, and margins, and links them directly to a fair value. Narratives take financial analysis beyond static ratios by letting you bring together what you know about the business, industry context, and your expectations, all in one place.

On Simply Wall St’s Community page, you can easily create and update your own Carpenter Technology Narrative, or explore those shared by millions of investors. Whenever the news changes or fresh numbers come out, Narratives update the fair value automatically, so your outlook stays relevant. This empowers you to make sharper buy or sell decisions by comparing a Narrative’s fair value to the current share price, bridging company fundamentals with market momentum in real time.

For example, for Carpenter Technology, some investors envision strong aerospace tailwinds and ongoing margin expansion, justifying a bullish fair value near $375 per share. Others are more cautious, seeing risks in expansion costs and industry cycles, and set their fair value closer to $305. Narratives give you a flexible, transparent way to understand and act on your own market view, whatever that may be.

Do you think there's more to the story for Carpenter Technology? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRS

Carpenter Technology

Engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives