- United States

- /

- Trade Distributors

- /

- NYSE:CNM

Core & Main, Inc.'s (NYSE:CNM) Shares May Have Run Too Fast Too Soon

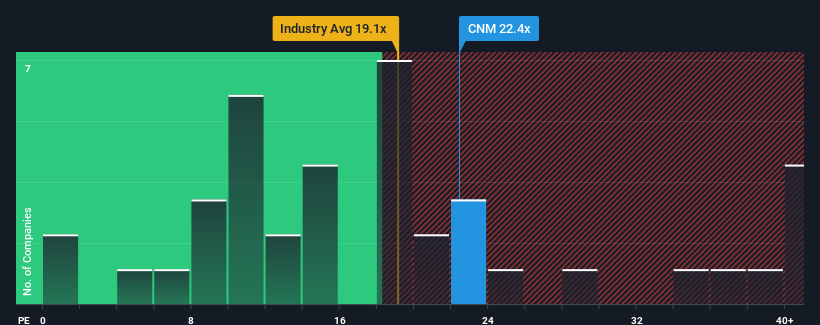

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider Core & Main, Inc. (NYSE:CNM) as a stock to potentially avoid with its 22.4x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Core & Main could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Core & Main

Does Growth Match The High P/E?

Core & Main's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow EPS by an impressive 282% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 13% over the next year. With the market predicted to deliver 14% growth , the company is positioned for a comparable earnings result.

In light of this, it's curious that Core & Main's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Core & Main currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Core & Main, and understanding should be part of your investment process.

If you're unsure about the strength of Core & Main's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CNM

Core & Main

Distributes water, wastewater, storm drainage, and fire protection products and related services in the United States.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives