- United States

- /

- Trade Distributors

- /

- NYSE:CNM

Core & Main (CNM): Assessing Valuation After Recent Share Price Pullback and Long-Term Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Core & Main.

Bigger picture, Core & Main's share price slipped more than 16% over the past three months, trimming some of its strong gains from earlier in the year. Despite this short-term pullback, the company boasts an impressive 12% total shareholder return over the past year and a massive 135% total return over three years. This signals solid long-term growth even as current momentum eases.

If you're watching for opportunities beyond the usual suspects, now is a smart moment to broaden your search and discover fast growing stocks with high insider ownership

With recent gains and a healthy long-term track record, the big question is whether Core & Main is trading below its true value or if today’s price already reflects all its future growth potential. Is there still a buying opportunity ahead?

Most Popular Narrative: 12% Undervalued

Compared to the latest closing price of $51.94, the current narrative places Core & Main's fair value at $59, suggesting shares are attractively priced based on future expectations. The most widely followed view points to upcoming catalysts that could unlock further upside.

Core & Main's strategy includes significant expansion efforts, such as opening new locations and acquiring complementary businesses. This contributes to a wider geographical reach and product offering, which is likely to enhance future revenue growth. Continued investment in private label products, anticipated to rise from 4% to over 10% of sales, is expected to drive gross margin expansion because private labels typically yield higher margins than branded products.

Want to know why this narrative puts Core & Main ahead of the pack? The key could be hidden in bold expansion moves and profit ambitions that outpace the status quo. Could new revenue streams or margin plays be fueling this valuation? See what assumptions are moving the needle before the rest of the market catches up.

Result: Fair Value of $59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, leadership changes or unexpected cost pressures could put Core & Main's optimistic outlook at risk. This could potentially challenge its current growth narrative.

Find out about the key risks to this Core & Main narrative.

Another View: Pricing Multiple Signals Caution

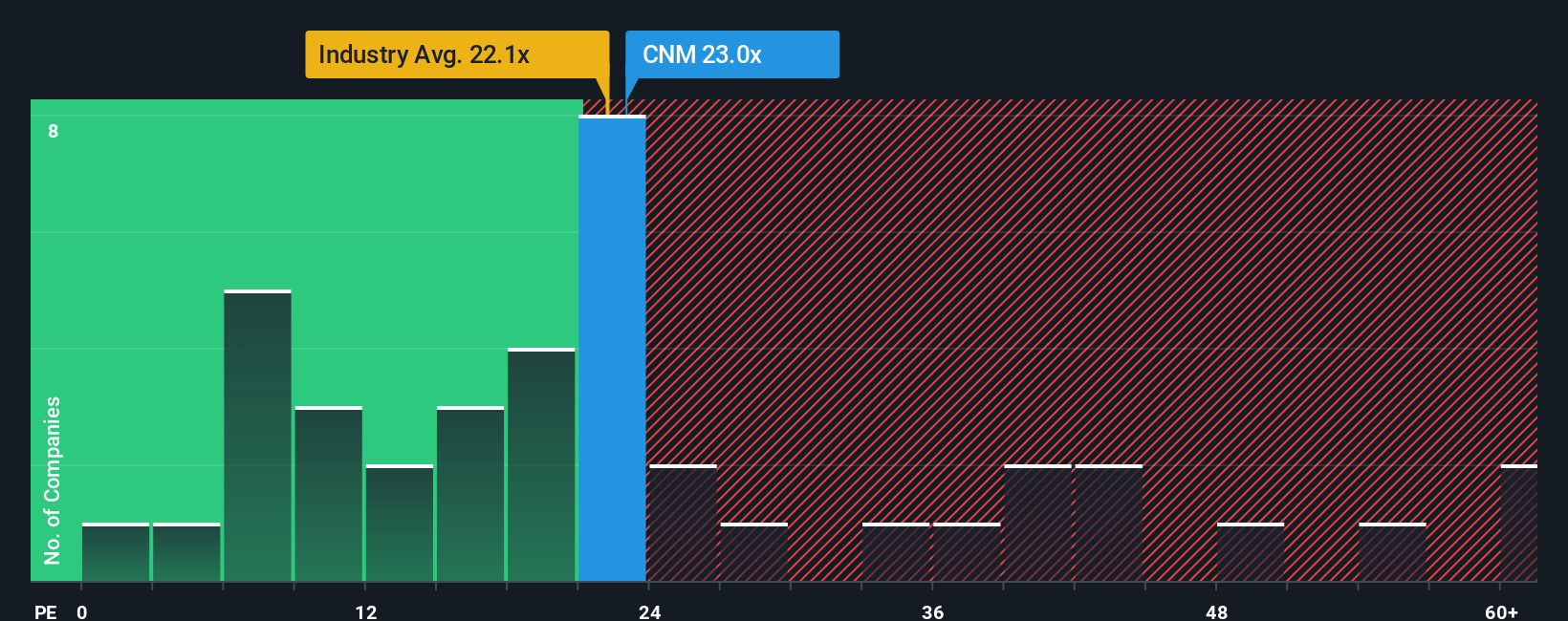

Looking from a different angle, Core & Main currently trades at a price-to-earnings ratio of 22.9. This is noticeably higher than both its industry average of 21.8 and peer average of 19.2. While that signals investor confidence, it also suggests less margin for error if performance disappoints. Interestingly, the current multiple still sits below its fair ratio of 27.4. Are high expectations justified, or could the stock re-rate lower if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Core & Main Narrative

If you want to dig into the numbers yourself or take a different view, building your own Core & Main story is quick and easy. Just Do it your way.

A great starting point for your Core & Main research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Market leaders never limit their potential to a single stock. Take charge of your investment journey and spot breakthrough opportunities with the right tools at your fingertips.

- Unlock the upside in digital finance when you tap into these 79 cryptocurrency and blockchain stocks, featuring companies building tomorrow’s blockchain landscape.

- Secure regular income by checking out these 18 dividend stocks with yields > 3%, where high-yield opportunities await those aiming for steady growth.

- Capitalize on technological breakthroughs in medicine by exploring these 33 healthcare AI stocks to find innovators at the forefront of healthcare and artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNM

Core & Main

Distributes water, wastewater, storm drainage, and fire protection products and related services in the United States.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives