- United States

- /

- Aerospace & Defense

- /

- NYSE:CDRE

Cadre Holdings, Inc.'s (NYSE:CDRE) Shareholders Might Be Looking For Exit

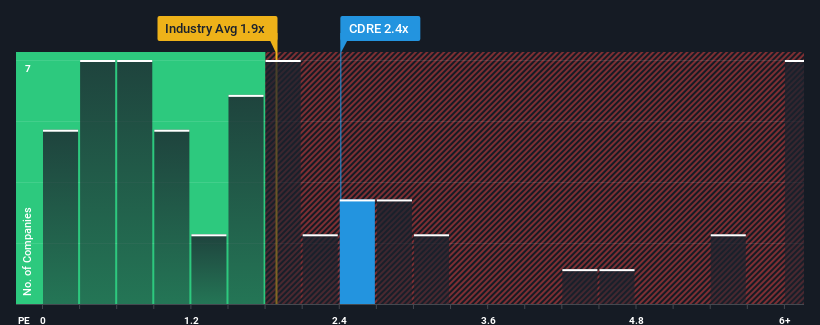

When close to half the companies in the Aerospace & Defense industry in the United States have price-to-sales ratios (or "P/S") below 1.9x, you may consider Cadre Holdings, Inc. (NYSE:CDRE) as a stock to potentially avoid with its 2.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Cadre Holdings

How Cadre Holdings Has Been Performing

Recent revenue growth for Cadre Holdings has been in line with the industry. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cadre Holdings.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Cadre Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 10% last year. The latest three year period has also seen a 19% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 3.9% as estimated by the eight analysts watching the company. With the industry predicted to deliver 10% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Cadre Holdings is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Cadre Holdings' P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've concluded that Cadre Holdings currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for Cadre Holdings you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CDRE

Cadre Holdings

Manufactures and distributes safety that provides protection to users in hazardous or life-threatening situations in the United States and internationally.

Good value with reasonable growth potential.