- United States

- /

- Machinery

- /

- NYSE:CAT

The Bull Case for Caterpillar (CAT) Could Change Following New Data Center Energy Collaboration With Vertiv

Reviewed by Sasha Jovanovic

- Vertiv and Caterpillar Inc. recently announced a partnership to integrate Vertiv’s power and cooling systems with Caterpillar’s and Solar Turbines’ expertise in power generation and combined cooling, heat and power (CCHP) to offer modular, efficient energy solutions for data centers.

- This collaboration responds to growing demand for on-site data center energy infrastructure and positions Caterpillar to offer validated, pre-engineered systems to accelerate deployment and improve energy efficiency for customers.

- We’ll explore how Caterpillar’s expanded data center focus through this Vertiv alliance could influence its long-term investment outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Caterpillar Investment Narrative Recap

To be a Caterpillar shareholder today, you need to believe that the company's growing presence in data center energy infrastructure and a record order backlog can offset near-term risks such as tariff headwinds. The recent Vertiv partnership strengthens Caterpillar’s data center strategy, but the main short-term catalyst continues to be robust order flow in Energy & Transportation, while margin pressure from tariffs remains a material risk to watch.

Of Caterpillar’s recent announcements, its third-quarter earnings report is most relevant. Despite beating revenue and earnings estimates and confirming strong demand across segments, management reiterated that higher tariffs could pressure profitability, underscoring the importance of top-line growth to offset these cost challenges.

Yet, investors should also be aware that, despite new partnerships and backlog gains, Caterpillar’s ability to sustain margins could be challenged if tariff costs persist…

Read the full narrative on Caterpillar (it's free!)

Caterpillar's narrative projects $74.0 billion in revenue and $13.5 billion in earnings by 2028. This requires 5.5% yearly revenue growth and a $4.1 billion earnings increase from the current $9.4 billion.

Uncover how Caterpillar's forecasts yield a $587.67 fair value, in line with its current price.

Exploring Other Perspectives

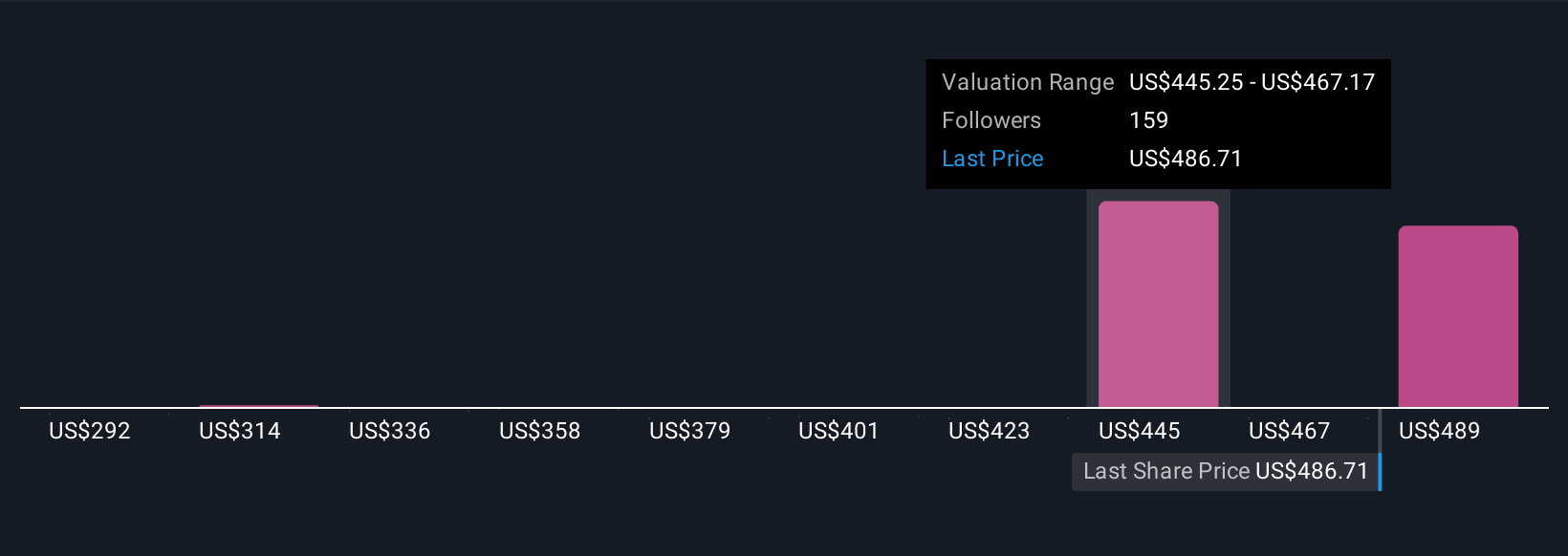

Nineteen individual fair value estimates from the Simply Wall St Community range from US$291.79 to US$587.67 per share. Ongoing tariff pressures and margin risks are central to the broader debate about Caterpillar’s earnings stability, so consider these perspectives as you form your own view.

Explore 19 other fair value estimates on Caterpillar - why the stock might be worth 49% less than the current price!

Build Your Own Caterpillar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Caterpillar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Caterpillar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Caterpillar's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.