- United States

- /

- Machinery

- /

- NYSE:CAT

Is Caterpillar's (CAT) Steady Dividend a Signal of Strategic Focus Amid Expanding Tech Ambitions?

Reviewed by Sasha Jovanovic

- The Board of Directors of Caterpillar Inc. previously voted to maintain the quarterly dividend at US$1.51 per share, payable on November 20, 2025, to shareholders of record as of October 20, 2025.

- This decision highlights Caterpillar’s emphasis on consistent shareholder returns, while the company is also actively expanding its footprint in the AI data center power and mining technology sectors.

- We’ll explore how Caterpillar’s dividend consistency and moves into data center power solutions shape its investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Caterpillar Investment Narrative Recap

To invest in Caterpillar, you need to believe in the company’s ability to benefit from long-term infrastructure and industrial trends while adapting to new technology shifts, like data center power demand. The recent decision to maintain the quarterly dividend at US$1.51 per share aligns with Caterpillar’s reputation for reliable shareholder returns; however, it does not materially alter the most important current catalyst, robust demand for power solutions from the AI data center sector, or alleviate the biggest risk, which remains evolving global trade tariffs.

Among recent developments, Caterpillar’s acquisition of Australian mining software provider RPMGlobal is especially relevant. This move expands the company’s technology capabilities in mining, a sector closely tied to the ongoing catalysts of global infrastructure development and rising commodity demand, two areas that underpin optimism for future growth.

Yet, against this backdrop of opportunity, investors should keep watch for the persistent risk posed by unpredictable trade policy shifts and tariff-related costs...

Read the full narrative on Caterpillar (it's free!)

Caterpillar's outlook anticipates $74.0 billion in revenue and $13.5 billion in earnings by 2028. This implies a 5.5% annual revenue growth rate and a $4.1 billion increase in earnings from the current level of $9.4 billion.

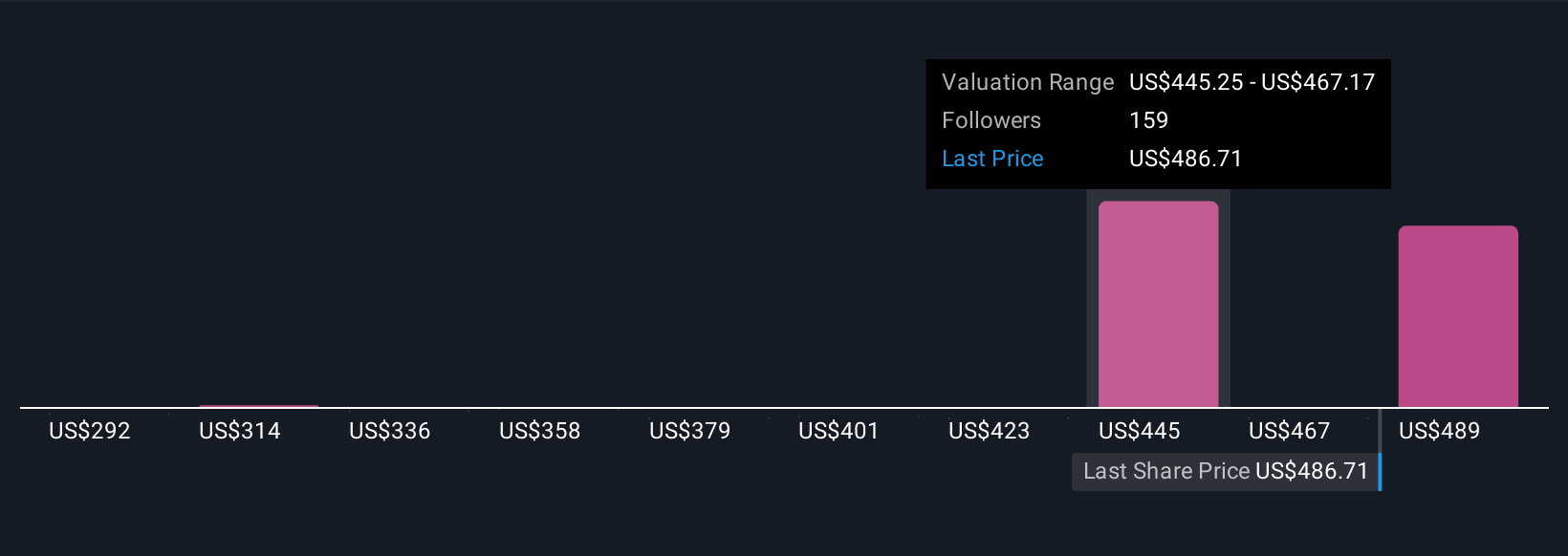

Uncover how Caterpillar's forecasts yield a $467.96 fair value, a 11% downside to its current price.

Exploring Other Perspectives

Nineteen fair value estimates from the Simply Wall St Community put Caterpillar’s potential worth anywhere from US$276.21 to US$496.88 per share. As opinions differ, the critical challenge remains the effect of shifting global trade tariffs on Caterpillar’s future profitability and consistency, so consider a range of viewpoints before drawing your own conclusions.

Explore 19 other fair value estimates on Caterpillar - why the stock might be worth 48% less than the current price!

Build Your Own Caterpillar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Caterpillar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Caterpillar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Caterpillar's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives