- United States

- /

- Building

- /

- NYSE:CARR

Is Now the Right Moment for Carrier Global Shares After Recent Price Drop?

Reviewed by Bailey Pemberton

If you’re holding Carrier Global stock or considering jumping in, you’re probably asking yourself: is this the right time, or am I better off waiting on the sidelines? After all, it hasn’t exactly been a smooth ride lately. Over the last year, Carrier Global’s price dipped by nearly 26%, and the stock is down 13.4% so far in 2024. Even the past month put a dent in portfolios, with a 9.7% retreat. But step back a little and the longer-term view paints a much brighter picture. Shares have actually soared 75.7% over three years and nearly doubled over five.

Much of the recent volatility seems to come down to shifting market sentiment around economic conditions and interest rates, as well as sector moves for industrials. With Carrier positioned as a global leader in smart climate and energy solutions, optimistic headlines about infrastructure investment and green technology have fueled growth hopes. This has also left the stock sensitive to changing risk appetite when broader macro stories shift. Some of those bigger headlines lately may have made investors a little more cautious, but the long-term fundamentals haven’t gone unnoticed.

So, how does Carrier actually stack up on value? By checking the numbers across six standard valuation screens, the company comes in as undervalued on three. That puts its value score at 3 out of 6, enough to suggest some opportunity, but not enough to shout “bargain” from the rooftops. Next, let's break down exactly what these valuation methods are, and how Carrier measures up on each. Stick around, because we’ll also look at a smarter way to get the full story on what the numbers really mean for your investment strategy.

Why Carrier Global is lagging behind its peers

Approach 1: Carrier Global Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For Carrier Global, this approach looks closely at the cash Carrier generates and how that might grow over time, adjusted for present-day value.

Carrier’s most recent reported Free Cash Flow (FCF) stands at $522 million. Analysts provide FCF estimates for the next five years, with projections growing each year. For 2026, the FCF is forecasted at about $2.67 billion, with subsequent years increasing to $3.08 billion in 2027 and close to $3.41 billion in 2028. By 2029, forecasts suggest FCF will reach $3.58 billion. Beyond the analyst window, further projections are made using extrapolation methods.

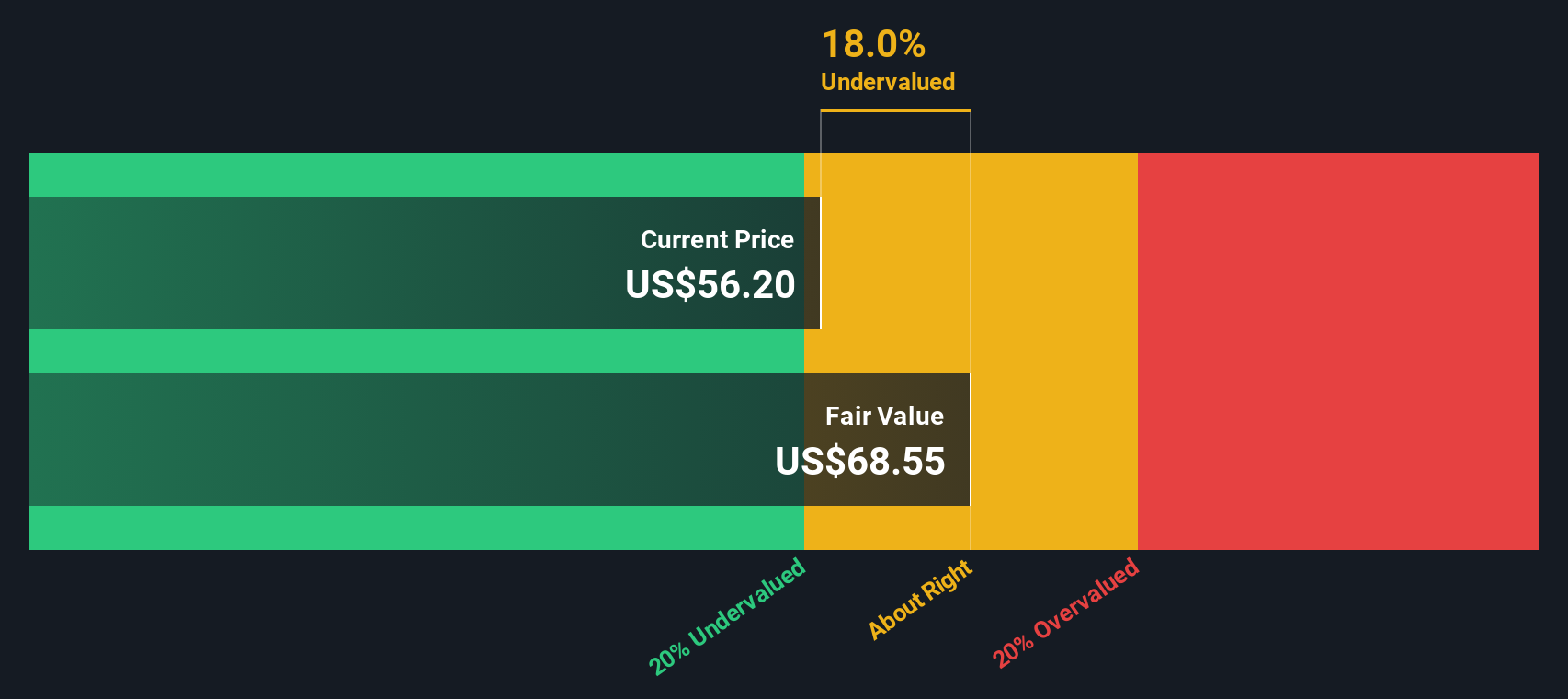

After running these numbers through the DCF model, Carrier Global’s estimated fair value is $69.05 per share. This result implies that the stock is currently trading at a 14.3% discount, making Carrier appear undervalued by this standard.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Carrier Global is undervalued by 14.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Carrier Global Price vs Earnings

For profitable companies like Carrier Global, the Price-to-Earnings (PE) ratio is often the go-to metric for valuation. It provides a clear picture of how much investors are willing to pay for each dollar of earnings, which makes it a trusted benchmark for stocks with established profit streams.

The “right” PE ratio, however, is not a fixed number. It depends heavily on how quickly a company is expected to grow its profits and how much risk investors are taking on. Higher growth typically commands a higher PE, while higher risk often leads to a discount.

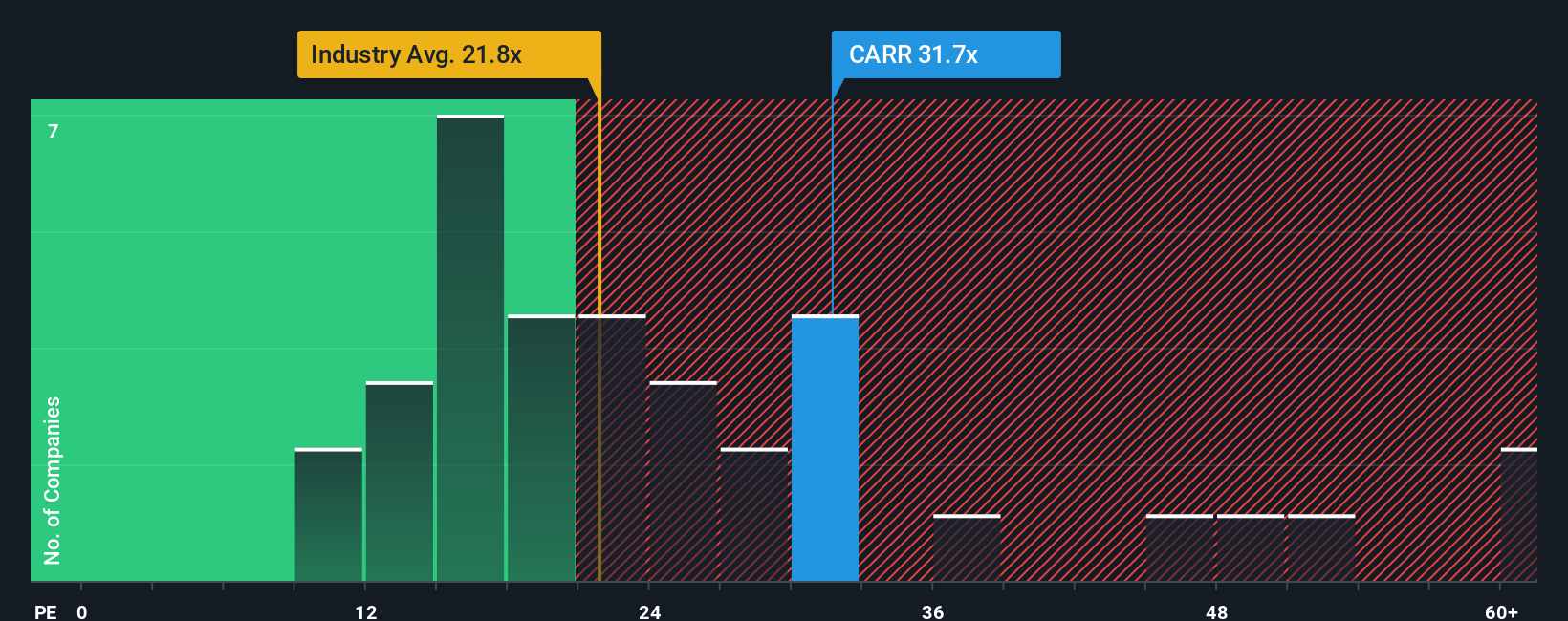

Currently, Carrier Global is trading at a PE ratio of 32.8x. To put that in perspective, the average for its Building industry peers is 22.1x, and the peer group average sits at 28.9x. At first glance, Carrier’s multiple does seem somewhat elevated compared to these benchmarks.

This is where the Simply Wall St “Fair Ratio” comes into play. The Fair Ratio for Carrier’s PE is currently assessed at 34.6x. Unlike a straight industry or peer comparison, this proprietary metric accounts for Carrier’s expected earnings growth, margins, sector, company size, and overall risk, offering a rounded picture of what the market should reasonably pay for Carrier’s shares.

By comparing Carrier’s actual PE (32.8x) to the Fair Ratio (34.6x), it appears that the stock is valued very close to where it should be, given all the relevant growth and risk factors taken into account.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Carrier Global Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique take on a company’s future. It is a story you craft about where you believe the business is headed, then connect to your own estimates of revenue, earnings, margins and ultimately your fair value for the shares.

With Narratives, you’re not just tracking financial ratios, but anchoring your investment thesis to the bigger picture, from key business developments to changes in demand and innovation. Each Narrative on Simply Wall St’s Community page makes it easy to set your assumptions about Carrier Global’s growth, profitability and risks, and see how that translates into a dynamic fair value that updates automatically whenever new news or earnings are reported.

This structure allows you and other investors to compare your fair value to the current market price and decide whether it is time to buy, sell, or hold. For example, on Carrier Global, some community Narratives see a bullish future with a fair value as high as $100 per share, while others are more conservative at just $65, depending on each investor’s outlook for growth, margins, or headwinds.

Do you think there's more to the story for Carrier Global? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CARR

Carrier Global

Provides intelligent climate and energy solutions in the United States, Europe, the Asia Pacific, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives