- United States

- /

- Electrical

- /

- NYSE:BW

Lacklustre Performance Is Driving Babcock & Wilcox Enterprises, Inc.'s (NYSE:BW) 31% Price Drop

The Babcock & Wilcox Enterprises, Inc. (NYSE:BW) share price has softened a substantial 31% over the previous 30 days, handing back much of the gains the stock has made lately. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

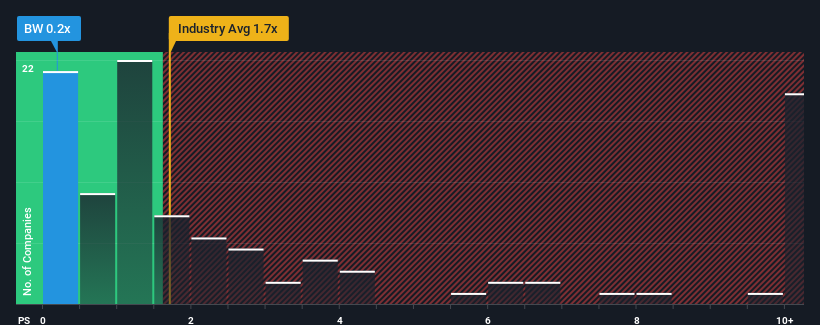

After such a large drop in price, Babcock & Wilcox Enterprises may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Electrical industry in the United States have P/S ratios greater than 1.7x and even P/S higher than 6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Babcock & Wilcox Enterprises

How Has Babcock & Wilcox Enterprises Performed Recently?

Babcock & Wilcox Enterprises hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Babcock & Wilcox Enterprises will help you uncover what's on the horizon.How Is Babcock & Wilcox Enterprises' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Babcock & Wilcox Enterprises' is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 29% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 3.9% as estimated by the four analysts watching the company. With the industry predicted to deliver 23% growth, that's a disappointing outcome.

In light of this, it's understandable that Babcock & Wilcox Enterprises' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Babcock & Wilcox Enterprises' P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that Babcock & Wilcox Enterprises maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Babcock & Wilcox Enterprises' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Babcock & Wilcox Enterprises (1 is concerning!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Babcock & Wilcox Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BW

Babcock & Wilcox Enterprises

Provides energy and emissions control solutions to industrial, electrical utility, municipal, and other customers in the United States, Canada, the United Kingdom, Indonesia, and Philippines.

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives