- United States

- /

- Electrical

- /

- NYSE:BE

Does Surging AI Data Center Demand and New 900-MW Deal Redefine the Bull Case for Bloom Energy (BE)?

Reviewed by Sasha Jovanovic

- In the past week, rising analyst optimism and sector demand due to AI-driven power needs have brought Bloom Energy into focus, supported by a succession of positive earnings estimate revisions, bullish coverage, and a new 900-MW fuel cell contract tied to data center growth.

- Bloom Energy’s partnerships with leading hyperscalers and increasing adoption in power-hungry data centers highlight its importance as a clean, on-site power solutions provider amid the AI boom and evolving energy landscape.

- We’ll explore how increasing demand from AI-driven data centers could influence Bloom Energy’s investment narrative and long-term outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Bloom Energy Investment Narrative Recap

To be a shareholder in Bloom Energy, you must believe that sustained growth in AI-driven data center power demand will offset the challenges tied to natural gas reliance and intense competition. While analyst momentum and news of major contract wins remain central short-term catalysts, the recent HSBC downgrade primarily flagged valuation caution, not changes in Bloom’s underlying operational outlook or core risks. Accordingly, it does not materially impact either the demand-driven catalyst or the key risks facing the company at this time.

Of the recent announcements, Bloom's 900-MW fuel cell deal for a new data center project stands out, reaffirming its pivotal role supporting large-scale hyperscalers as data center expansion continues. This development ties directly to the ongoing surge in on-site power solutions for AI, which remains the business's biggest potential growth lever as more hyperscalers seek resilient, scalable clean energy infrastructure from reliable partners like Bloom.

By contrast, investors should not overlook the ongoing risk that alternative zero-emissions energy solutions could begin eroding Bloom Energy’s competitive edge in...

Read the full narrative on Bloom Energy (it's free!)

Bloom Energy's outlook anticipates $2.7 billion in revenue and $395.4 million in earnings by 2028. This scenario requires 19.0% annual revenue growth and an earnings increase of $371.7 million from the current $23.7 million.

Uncover how Bloom Energy's forecasts yield a $57.63 fair value, a 34% downside to its current price.

Exploring Other Perspectives

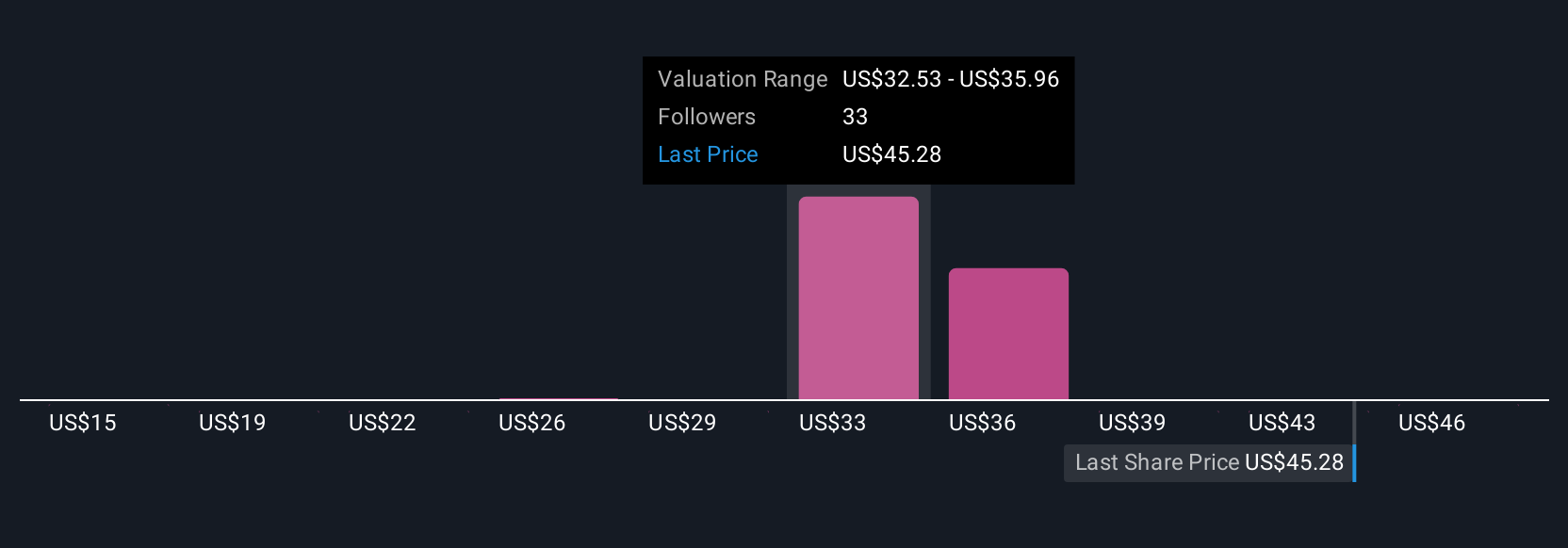

Ten individual fair value estimates from the Simply Wall St Community span US$15.38 to US$230.14 per share. As more hyperscalers turn to on-site fuel cell power, your view on how fast adoption accelerates could define your outlook.

Explore 10 other fair value estimates on Bloom Energy - why the stock might be worth over 2x more than the current price!

Build Your Own Bloom Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bloom Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Bloom Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bloom Energy's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BE

Bloom Energy

Designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives