- United States

- /

- Electrical

- /

- NYSE:BE

Bloom Energy (BE) Expands Manufacturing as Oracle Data Center Deal Highlights AI Infrastructure Opportunity

Reviewed by Simply Wall St

- Earlier this year, Bloom Energy announced plans to double its manufacturing capacity to 2 gigawatts by 2026, supported by a major supply order with MTAR Technologies and an agreement to provide on-site power to Oracle’s data center operations.

- The collaboration with Oracle underscores the growing importance of reliable, clean energy solutions for data centers amid accelerating AI and cloud service expansion.

- We'll assess how Bloom Energy's expanded role in powering high-demand AI data centers affects its investment narrative and growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Bloom Energy Investment Narrative Recap

To own Bloom Energy shares, investors need confidence in the company’s ability to capitalize on rapidly growing demand for reliable data center power, driven by AI and cloud expansion. The news of doubled manufacturing capacity and major supply agreements directly supports this growth catalyst, while execution risk around scaling production remains the most important short-term concern; recent developments appear material to near-term prospects for meeting data center demand but do not eliminate the risk of overcapacity if demand slows.

Bloom Energy’s recent agreement to power Oracle’s data centers is especially relevant here, highlighting not just the urgency of hyperscaler power needs but also Bloom’s role as a preferred partner for on-site, resilient energy solutions at a time when grid constraints and surging AI workloads are reshaping utility infrastructure requirements.

By contrast, investors should also be aware that execution risk around Bloom’s large capacity build remains...

Read the full narrative on Bloom Energy (it's free!)

Bloom Energy's narrative projects $2.7 billion revenue and $395.4 million earnings by 2028. This requires 19.0% yearly revenue growth and an increase in earnings of $371.7 million from $23.7 million today.

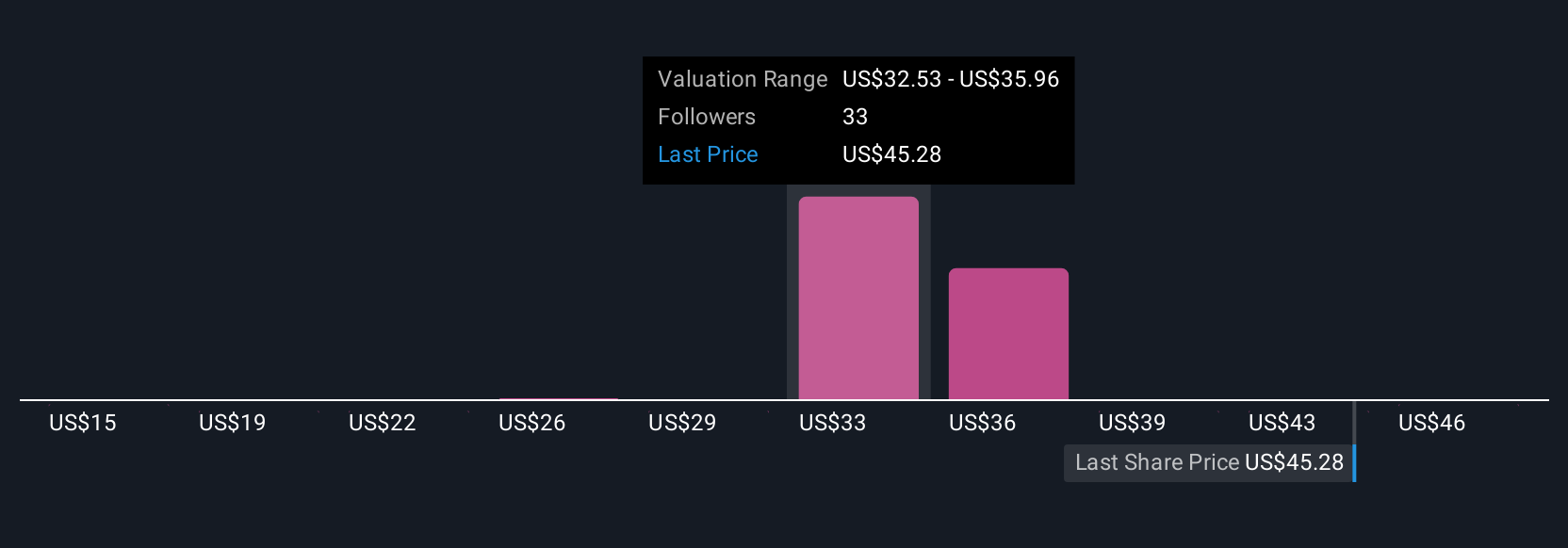

Uncover how Bloom Energy's forecasts yield a $34.77 fair value, a 48% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set Bloom Energy’s fair value as low as US$15.38 and as high as US$94.19, based on seven unique forecasts. While many are optimistic about new data center deals as a growth driver, the outlook on execution risk for expansion leaves plenty of room for debate.

Explore 7 other fair value estimates on Bloom Energy - why the stock might be worth as much as 40% more than the current price!

Build Your Own Bloom Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bloom Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Bloom Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bloom Energy's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BE

Bloom Energy

Designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives