- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Small Wins do not Offset Big Losses for The Boeing Company (NYSE:BA)

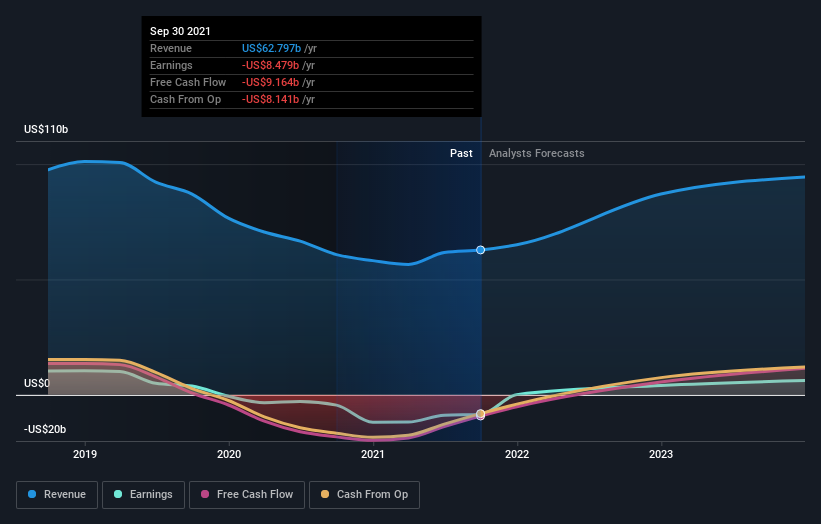

After a disastrous 2020, The Boeing Company ( NYSE: BA ) spent 2021 restructuring and unwinding the 737 MAX aftermath.

Yet, even though the company will likely double the deliveries Y/Y, the stock significantly underperformed the market, with few large institutional investors recently trimming their stakes.

View our latest analysis for Boeing

You Win Some, and You Lose More

Lately, Boeing news has been mixed. The company managed to stay on the right track to double the deliveries, with 302 aircraft delivered up to November (mostly 737 Max). Also, sales exceeded cancellations for 10 months straight.

Furthermore, the company landed an extension to the US Navy contract worth US$366.46m. The extension is related to F/A-18 Super Hornet aircraft maintenance is expected to last until May 2024.

On the other hand, the 787 Dreamliner remains on pause, disrupted by the quality control issues that already generated high costs and slowed down production.

Furthermore, Boeing keeps losing key orders. The most recent example includes Air France – KLM fleet renewal that opted for Airbus as a supplier for 100 narrowbody jets, with an option for an additional 60. While details of the deal are not known, it is likely worth several billion dollars. Similarly, Qantas Airways ( ASX QAN ) committed to buying 40 aircraft with an option for 94 more, switching from Boeing to Airbus.

Losing those clients is a significant blow to Boeing, as it ties them up to their competitor for years for orders that reach half of the current yearly order book, at minimum.

Who Currently Owns Boeing?

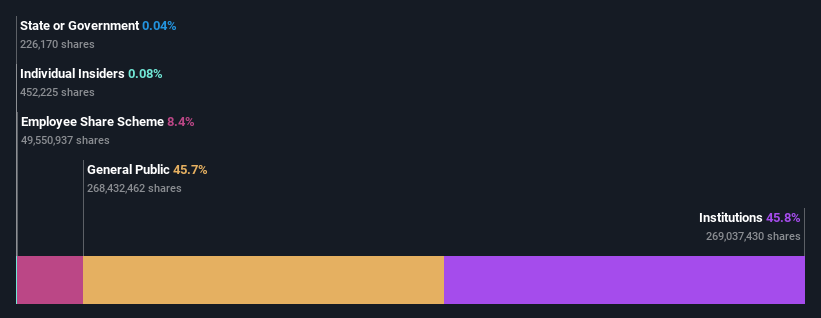

Boeing has a market capitalization of US$113b, so it's too big to fly under the radar. We'd expect to see both institutions and retail investors owning a portion of the company.In the chart below, we can see thatinstitutional investors have bought into the company.

Let's take a closer look to see what the different types of shareholders can tell us about Boeing.

What Does The Institutional Ownership Tell Us About Boeing?

Institutional investors commonly compare their returns to a commonly followed index. So they generally do consider buying larger companies included in the relevant benchmark index.

As you can see, institutional investors have a fair amount of stake in Boeing.This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does.If multiple institutions change their view on a stock simultaneously, you could see the share price drop fast.

It's, therefore, worth looking at Boeing's earnings history below.

The Boeing Company Employee Savings Plans Master Trust is currently the company's largest shareholder, with 8.4% of shares outstanding. In comparison, the second and third largest shareholders hold about 7.3% and 5.2% of the stock.

On studying our ownership data, we found that 25 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

Insider Ownership Of Boeing

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, too much power is concentrated within this group on some occasions.

Our information suggests that The Boeing Company insiders own under 1% of the company.Being so large, we would not expect insiders to hold a large proportion of the stock. Collectively, they own US$87m of stock. Arguably recent buying and selling are just as important to consider. You can click here to see if insiders have been buying or selling.

General Public Ownership

The general public, who are usually individual investors, has a 46% stake in Boeing. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Conclusion

Boeing has been performing poorly despite improving the order book and fending off the cancelations. The stock rallied back 50% from the Pandemic lows but failed to reverse the trend, which remains overall bearish. The contracts that the company is landing fade compared to those that it fails to get, which is concerning.

Furthermore, it is interesting that some large institutions like Wellington Management Group, which used to have a significant stake in the company, are now all but divested. Their current stake is down to US$120m , while it used to be over US$5b in 2020.

It's always worth thinking about the different groups who own shares in a company. But to understand Boeing better, we need to consider many other factors. For instance, we've identified 3 warning signs for Boeing (1 is potentially serious) that you should be aware of. Luckily, you can check this free report showing analyst forecasts for its future .

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

If you're looking to trade Boeing, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives