- United States

- /

- Aerospace & Defense

- /

- NYSE:ATI

ATI (ATI) Valuation: How Analyst Upgrades and Boeing Deal Shape the Investment Case

Reviewed by Kshitija Bhandaru

ATI (ATI) has captured attention this week thanks to upbeat analyst commentary, stronger earnings projections, and a long-term Boeing supply agreement. All of these factors highlight reasons for growing investor interest in the stock.

See our latest analysis for ATI.

ATI's momentum has been hard to ignore, with upbeat news and the Boeing agreement helping fuel optimism. The stock’s share price is up 45% so far this year, and total shareholder return over three and five years stands out at 188% and an impressive 750% respectively, signaling strong performance and rising confidence among investors.

If ATI’s climb has you wondering what else might be poised for major moves, you can uncover similar trends with our See the full list for free..

But with strong analyst support and ATI still trading below its price target, the big question remains: are investors looking at an undervalued stock with further upside, or is future growth already reflected in the current price?

Most Popular Narrative: 22.9% Undervalued

With ATI’s fair value placed nearly 23% above its last close, the prevailing narrative implies there is meaningful upside potential still not reflected in the share price. The following excerpt sheds light on one driver that shapes this outlook.

Recent long-term contract expansions with both Boeing and Airbus, including new titanium alloy sheet supply and broader product offerings, lock in higher volumes and minimums, expand ATI's share, and feature inflation pass-through and attractive pricing, directly supporting reliable, higher-margin revenue growth and a structurally improved earnings base through the decade.

Wondering how analysts arrive at such a bullish price difference? The secret lies in their confidently optimistic forecasts for the next few years. They project growth, margin expansion, and a future profit multiple that diverges from the typical playbook. Only by diving into the entire narrative will you uncover which financial assumptions make this target so aggressive.

Result: Fair Value of $103.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in commercial aerospace demand or growing supply chain competition could quickly shift ATI’s outlook and temper current bullish expectations.

Find out about the key risks to this ATI narrative.

Another View: Multiples-Based Valuation

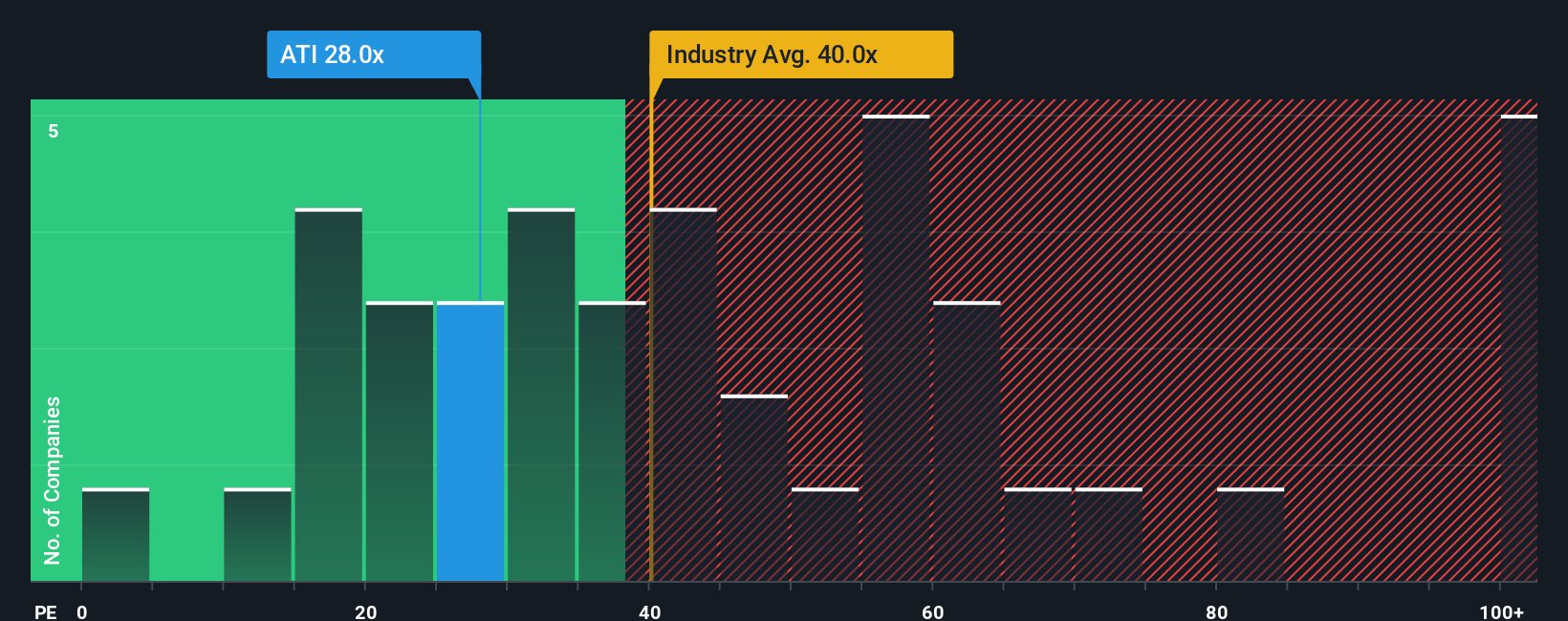

Taking a look from the price-to-earnings perspective, ATI trades at a ratio of 26.4, which is notably lower than both its peer average of 29.2 and the broader US Aerospace & Defense industry at 38.9. Interestingly, the fair ratio stands at 32.5. This suggests the market could still re-rate ATI higher. But does this gap point to untapped upside or hidden risks?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ATI for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ATI Narrative

If you think there's another way to interpret ATI's outlook, or enjoy digging into the numbers yourself, you can quickly build your own perspective. No expertise required. Do it your way

A great starting point for your ATI research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Opportunity does not wait around. Expand your portfolio with innovative investment concepts that could reshape your returns, all using the Simply Wall Street Screener.

- Tap into the untapped potential of companies pushing the boundaries in cryptocurrencies by starting with these 79 cryptocurrency and blockchain stocks.

- Capitalize on the surging demand for healthcare technology by reviewing these 33 healthcare AI stocks to spot emerging leaders in artificial intelligence for health.

- Secure steady income streams when you check out these 19 dividend stocks with yields > 3% featuring high-yielding businesses surpassing the 3% mark.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATI

ATI

Produces and sells specialty materials and complex components worldwide.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives