- United States

- /

- Trade Distributors

- /

- NYSE:AL

Revisiting Air Lease’s Valuation After New Airbus Deliveries and Ongoing Growth Momentum

Reviewed by Simply Wall St

Most Popular Narrative: 8.6% Undervalued

According to community narrative, Air Lease is currently considered undervalued, with analysts projecting a fair value that is noticeably higher than the current share price. This narrative is based on future expectations around revenue growth, profit margins, and market dynamics within the aircraft leasing industry.

Airlines' growing preference for leasing over ownership, driven by a need for capital flexibility and balance sheet optimization, continues to expand Air Lease's addressable market. This is evident in high placement rates (100% through 2026), strong lease extensions, and long average lease terms. These factors contribute to recurring revenue and steady earnings growth.

What is fueling this bullish outlook? The key behind the valuation is a combination of revenue growth, margin changes, and how much investors are willing to pay for future profits. The notable aspect is that the full calculation assumes changes that could position Air Lease differently compared to its peers. Interested in the specific financial shifts that support a higher price? The numbers behind this assessment might offer a new perspective on the industry.

Result: Fair Value of $65.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, persistent supply delays or an unexpected rise in financing costs could quickly challenge the bullish case for Air Lease’s future earnings growth. Find out about the key risks to this Air Lease narrative.Another View: Discounted Cash Flow Tells a Different Story

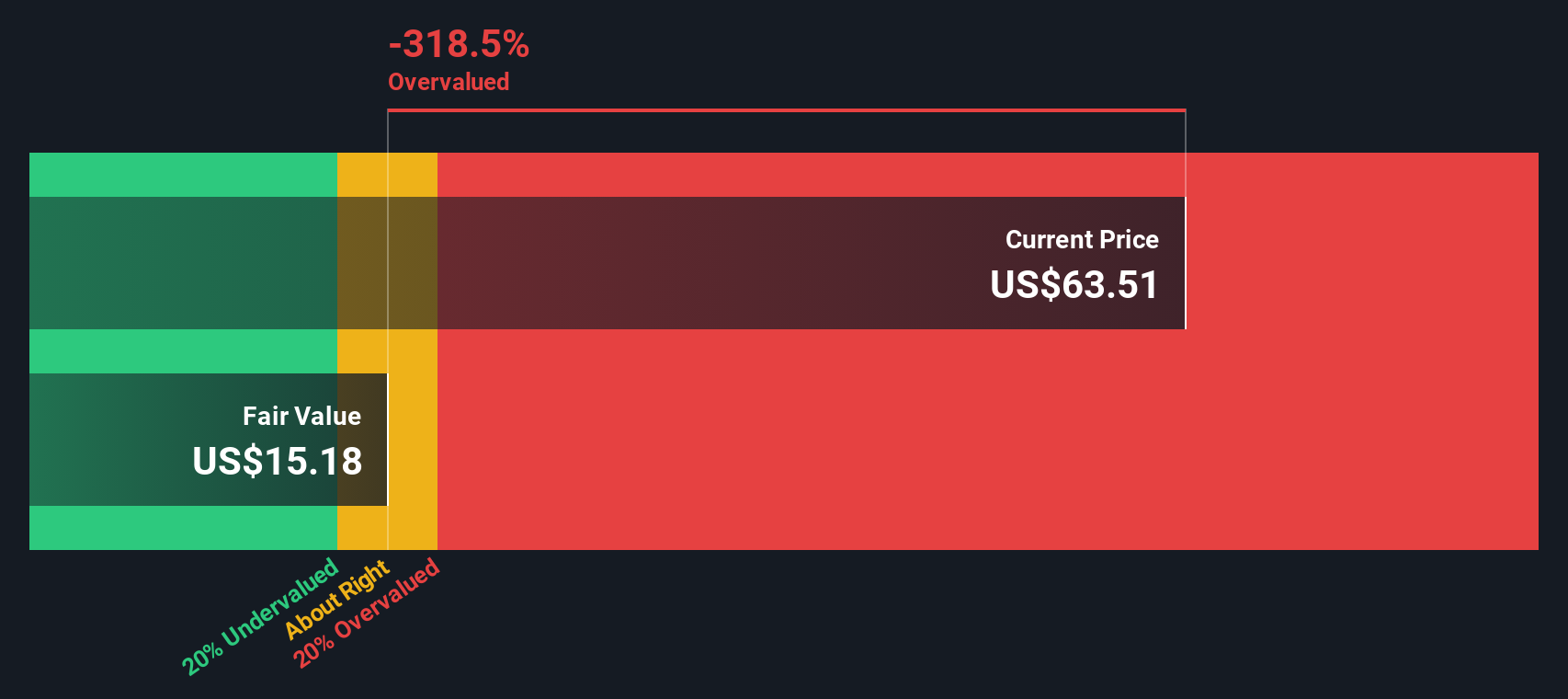

While the fair value estimate relies on future earnings and market multiples, our DCF model takes a closer look at long-term cash flow projections. In this case, it signals that the shares might be overvalued. This could suggest the market is looking too far ahead.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Air Lease for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Air Lease Narrative

If you see things differently or want to reach your own conclusions, you can analyze the figures and shape your own story in just minutes. do it your way.

A great starting point for your Air Lease research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Seize your chance to stay ahead of the curve by exploring curated stock themes that match your investing ambitions. The market rewards those who take initiative, so don't let good opportunities pass you by.

- Uncover resilient companies payout seekers love by checking out dividend stocks with yields > 3%, and see which stocks boast attractive yields above 3%.

- Tap into technology’s brightest frontier by browsing healthcare AI stocks to spot healthcare innovators transforming AI-driven diagnostics and patient care.

- Catch bold moves in financial innovation by reviewing cryptocurrency and blockchain stocks, with stocks riding the wave of cryptocurrency and blockchain breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AL

Air Lease

An aircraft leasing company, engages in the purchase and leasing of commercial jet aircraft to airlines in the Asia Pacific, Europe, the Middle East, Africa, Mexico, Central America, South America, the United States, and Canada.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives