- United States

- /

- Aerospace & Defense

- /

- NYSE:AIR

How Investors May Respond To AAR (AIR) Securing Exclusive KC-46 and C-40 Defense Distribution Rights

Reviewed by Simply Wall St

- AmSafe Bridport recently announced it has signed a multi-year exclusive defense distribution agreement with AAR CORP., making AAR the exclusive distributor of KC-46 and C-40 platform products for global defense and military aftermarket sales, including to the US Defense Logistics Agency, US Armed Services, and Japanese defense market.

- This agreement expands AAR's defense portfolio into cargo handling products and strengthens its presence in key global government and military supply chains, supported by improved intracompany coordination for contract fulfillment.

- We'll examine how AAR's expanded defense exclusivity for KC-46 and C-40 products could influence its broader investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

AAR Investment Narrative Recap

Investors in AAR typically believe in the company's ability to grow by capturing long-term demand in global aerospace and defense supply chains, while mitigating its exposure to the more variable commercial aviation cycles. The new AmSafe Bridport agreement expands AAR’s defense offerings, but it does not materially change the most immediate catalyst, securing larger, multi-year government contracts, nor does it eliminate the prominent risk of margin pressure if OEMs deepen their push into aftermarket services.

Among recent developments, the April partnership with the U.S. Defense Logistics Agency is most closely related, further affirming AAR’s growing profile in key defense logistics networks. Together with the AmSafe Bridport deal, these agreements support AAR’s ongoing shift toward revenue streams that may be less correlated with commercial aviation cycles but still face underlying competitive and margin headwinds.

On the other hand, investors should watch for signs of intensifying competition from OEMs, particularly when assessing the long-term impact of new contracts and shifting relationships within the aftermarket supply chain...

Read the full narrative on AAR (it's free!)

AAR's narrative projects $3.2 billion in revenue and $296.0 million in earnings by 2028. This requires 4.8% yearly revenue growth and a $283.5 million increase in earnings from the current $12.5 million.

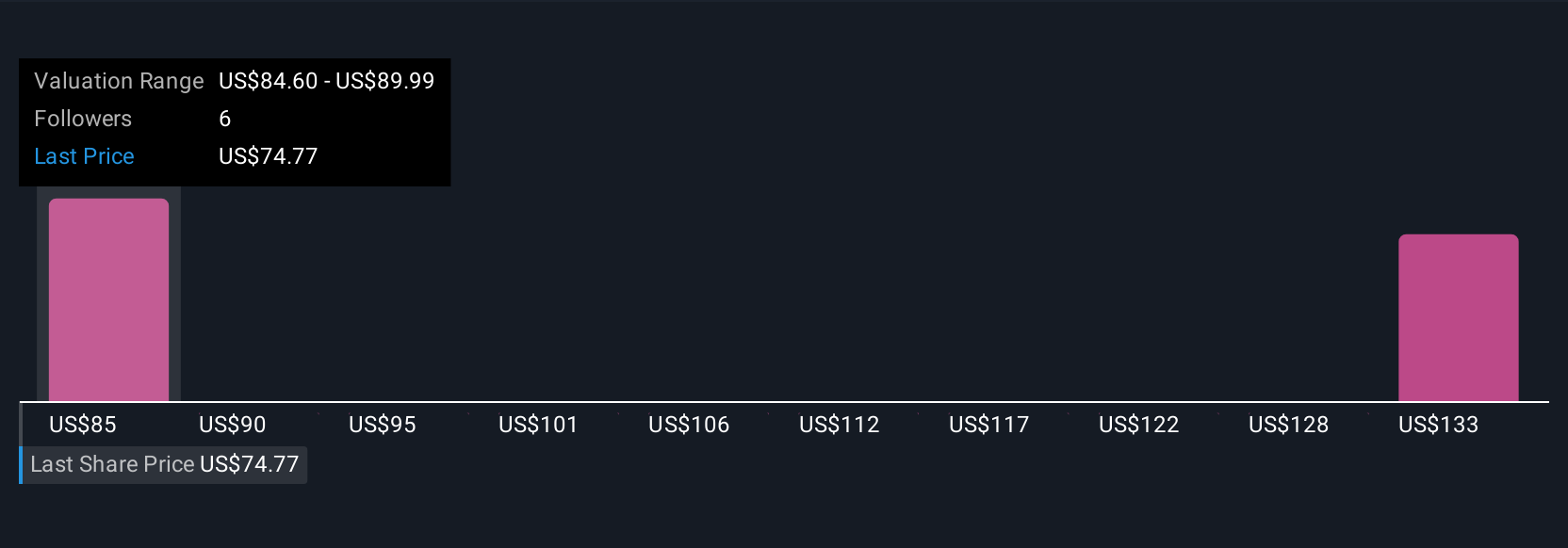

Uncover how AAR's forecasts yield a $84.60 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members value AAR shares anywhere from US$84.60 to US$139.21, based on 2 independent calculations. With OEM competition still a key risk, it’s clear that investor opinions can diverge significantly and you may want to explore several viewpoints before making up your mind.

Explore 2 other fair value estimates on AAR - why the stock might be worth as much as 82% more than the current price!

Build Your Own AAR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AAR research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free AAR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AAR's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIR

AAR

Provides products and services to commercial aviation, government, and defense markets in North America, Europe, Africa, Asia, and internationally.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives