- United States

- /

- Construction

- /

- NYSE:AGX

Argan (NYSE:AGX) Surges 15% In One Week Following Strong Earnings Announcement

Reviewed by Simply Wall St

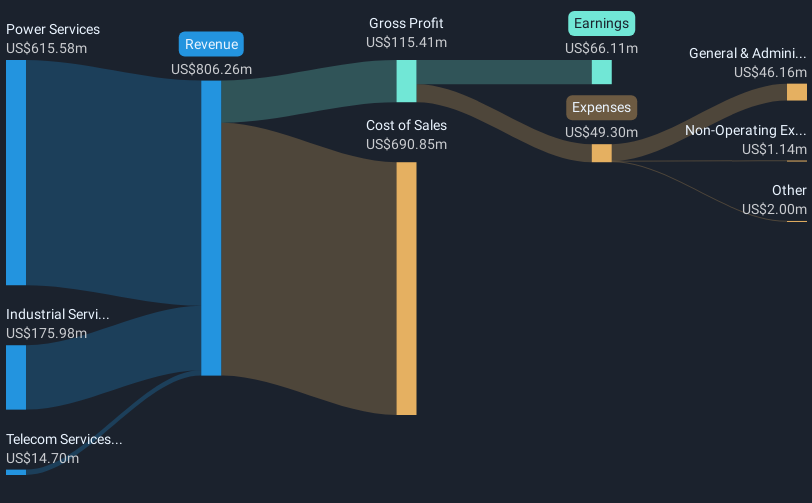

Argan (NYSE:AGX) experienced a remarkable price increase of 15% over the last week. This movement aligns with its notable earnings announcement on March 27, 2025. The company reported a substantial rise in sales and net income from the previous year, showcasing strong financial growth. These positive financial indicators likely fueled investor optimism, driving the stock's price higher despite a broader market downturn triggered by new tariffs announced by President Trump. While major indices like the Dow Jones witnessed significant declines, Argan's strong earnings performance seemed to counteract these market pressures, propelling its stock upward in this challenging economic climate.

We've discovered 2 warning signs for Argan that you should be aware of before investing here.

Over the past five years, Argan, Inc.'s total shareholder return, including share price and dividends, has grown by 340.81%. This impressive performance can be attributed to a series of successful expansions and strategic moves. Primarily, the increase in project backlog by 80%—now worth US$1.4 billion—has been a critical factor. Key projects, such as the 1.2 gigawatt gas facility in Texas and the 405 megawatts solar initiative in Illinois, underpin this expansion and showcase Argan's adaptation to growing energy demands.

Furthermore, the company's financial stability, highlighted by US$525 million in cash and zero debt, has supported continuous dividend increases and a significant buyback program, repurchasing 18.42% of its common shares. Argan's recent fiscal performance, including robust earnings growth exceeding 160% over the past year, and surpassing the broader market and industry returns, has solidified investor confidence. These elements collectively explain the substantial long-term returns shareholders have experienced.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Argan, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGX

Argan

Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market in the United States, Republic of Ireland, and United Kingdom.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives