- United States

- /

- Construction

- /

- NYSE:AGX

Argan (AGX): Examining Valuation Following Strong Q2 and Half-Year Earnings Growth

Reviewed by Simply Wall St

If you are watching Argan (AGX) after its latest earnings announcement, you are not alone. The company just posted its second quarter and half-year results, and both sales and net income jumped sharply compared to last year. Investors are clearly taking notice as profits more than doubled, adding a fresh momentum to the story and catching the eye of anyone considering what’s next for the stock.

This surge comes against a backdrop of mixed short-term performance. Over the past month, Argan’s shares have dropped by 15%, erasing previous gains, and momentum has faded in the past quarter. Still, when looking at a longer-term perspective, the stock has shot up 120% over the past year, with sustained multi-year growth beyond most of its peers. This year’s rally, combined with earnings growth, signals that investor expectations and risk perceptions may be shifting after the latest results.

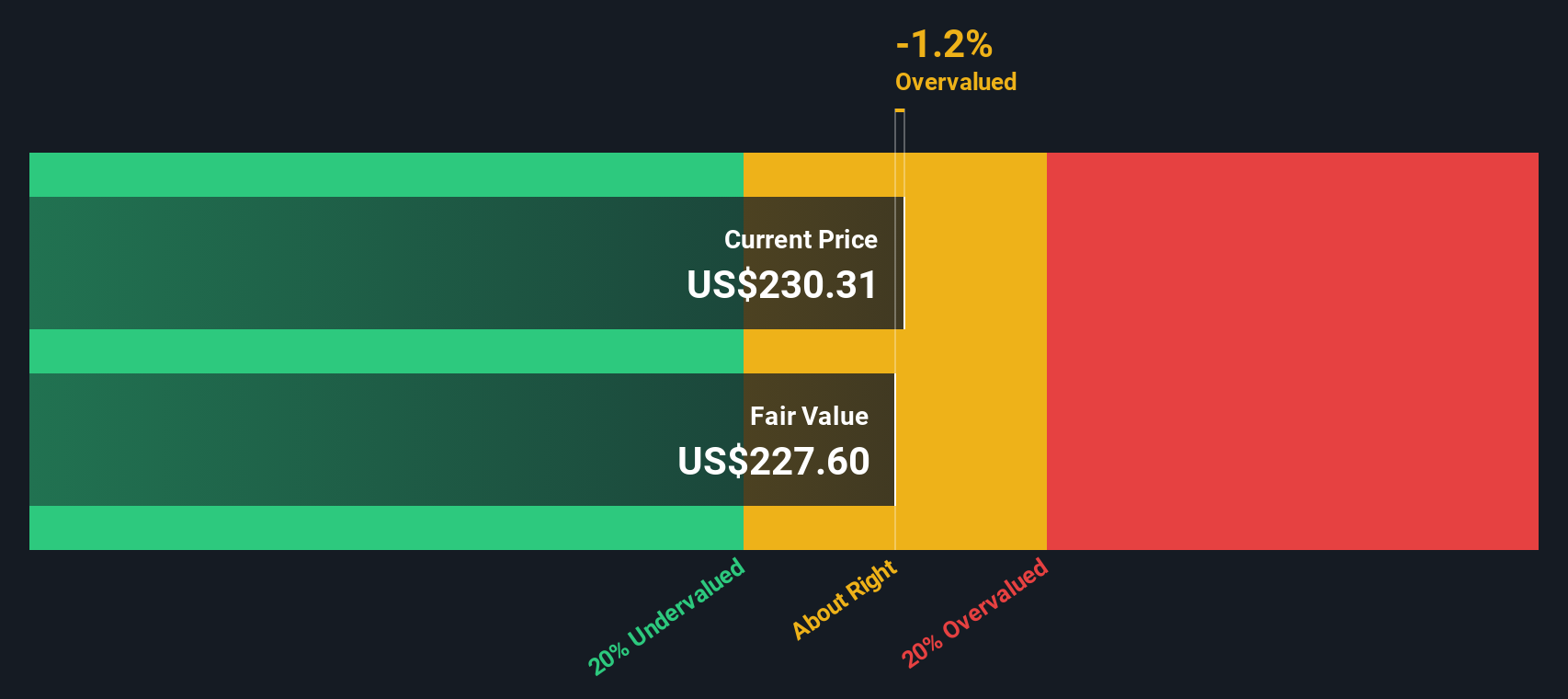

After such a rapid jump in both earnings and share price over twelve months, the question arises: is Argan undervalued on the back of strong fundamentals, or is the market already pricing in more ambitious future growth?

Most Popular Narrative: 28% Undervalued

According to the most widely followed narrative, Argan shares are trading at a significant discount to fair value. The narrative suggests that the company is undervalued based on projected growth trends and robust fundamentals.

Argan’s project backlog is a major growth catalyst and has exceeded $1 billion as of the latest reports. This backlog includes a significant mix of renewable energy projects and provides strong revenue visibility for future quarters. Recent contract wins, particularly in infrastructure and power generation, have bolstered investor confidence and set the stage for sustained top-line growth.

Curious what is fueling this bullish price target? The secret recipe is found in expectations of future revenue acceleration and profit levers that rivals rarely achieve. If you want to discover the unique growth expectations and the margins supporting this call, you’ll want to review the detailed financial blueprint underlying the narrative’s projection.

Result: Fair Value of $284.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, material and labor cost inflation, or unforeseen project losses, could quickly dampen the bullish view and trigger renewed caution among investors.

Find out about the key risks to this Argan narrative.Another View: Discounted Cash Flow Perspective

Looking at Argan through the lens of our DCF model, we see a result that supports the previous view. Shares appear undervalued when plugging in conservative growth assumptions. But can one model tell the whole story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Argan for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Argan Narrative

If you’re interested in diving deeper or see the numbers differently, you have the tools to build your own view in just minutes. Do it your way.

A great starting point for your Argan research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Missing out on the next big opportunity is easy if you only focus on one stock. Make your investment shortlist stronger with these tailored ideas from Simply Wall Street’s Screener, designed to match your goals and style.

- Uncover potential in fast-growing opportunities by checking out penny stocks with strong financials with strong balance sheets and real momentum behind their numbers.

- Power up your portfolio with AI penny stocks leading the way in artificial intelligence breakthroughs and innovation across industries.

- Lock in steady potential income with dividend stocks with yields > 3% that offer solid yields above 3% and robust track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:AGX

Argan

Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market in the United States, Republic of Ireland, and the United Kingdom.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion