- United States

- /

- Aerospace & Defense

- /

- NYSE:ACHR

Archer Aviation (NYSE:ACHR) Shares Up 14% This Week As Midnight Program Launches

Reviewed by Simply Wall St

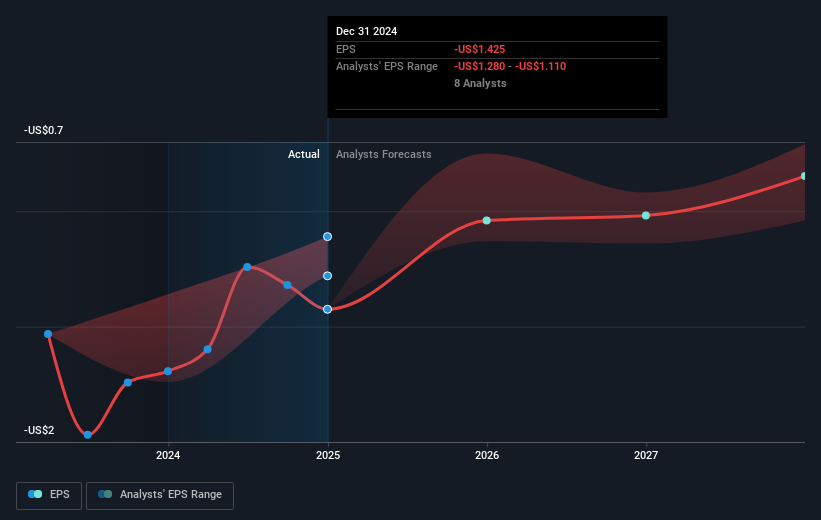

Archer Aviation (NYSE:ACHR) announced a partnership with Palantir Technologies to develop AI-driven solutions for next-generation aviation, potentially catalyzing its recent 14% share price increase. This collaboration, along with the launch of the Midnight aircraft commercialization program, signals Archer's active push into urban air mobility. The company's efforts are set against the backdrop of a slightly recovering market, where the S&P 500 and Nasdaq have begun to stabilize after weeks of declines. Archer's focus on innovation and growth could be encouraging investors, despite challenging financial results from its recent earnings report.

Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

Over the past three years, Archer Aviation has delivered total returns of 66.27%, reflecting significant progress in its ventures, although the company remains unprofitable. Recently, Archer's moves, such as acquiring a certificate of occupancy for a high-volume manufacturing facility in Georgia by December 2024, are directly linked to its Midnight aircraft production, aimed to commence early 2025. Additionally, the exclusive partnership with Anduril Industries in December 2024 to develop a hybrid VTOL aircraft for defense underlines Archer’s expansion into new markets.

The company’s drive for innovation extends to a partnership with Soracle Corporation formed in November 2024, targeting the Japanese market with plans to deploy 100 Midnight aircraft. Despite having filed a follow-on equity offering for US$128.23 million in January 2025, aimed at strengthening its capital for these endeavors, substantial insider selling over recent months reflects varied sentiments within the investor community.

Our valuation report unveils the possibility Archer Aviation's shares may be trading at a discount.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACHR

Archer Aviation

Designs and develops aircraft and related technologies and services in the United States and internationally.

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives