- United States

- /

- Machinery

- /

- NasdaqGS:TWIN

Here's Why Shareholders Should Examine Twin Disc, Incorporated's (NASDAQ:TWIN) CEO Compensation Package More Closely

Twin Disc, Incorporated (NASDAQ:TWIN) has not performed well recently and CEO John Batten will probably need to up their game. At the upcoming AGM on 28 October 2021, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. From our analysis, we think CEO compensation may need a review in light of the recent performance.

View our latest analysis for Twin Disc

Comparing Twin Disc, Incorporated's CEO Compensation With the industry

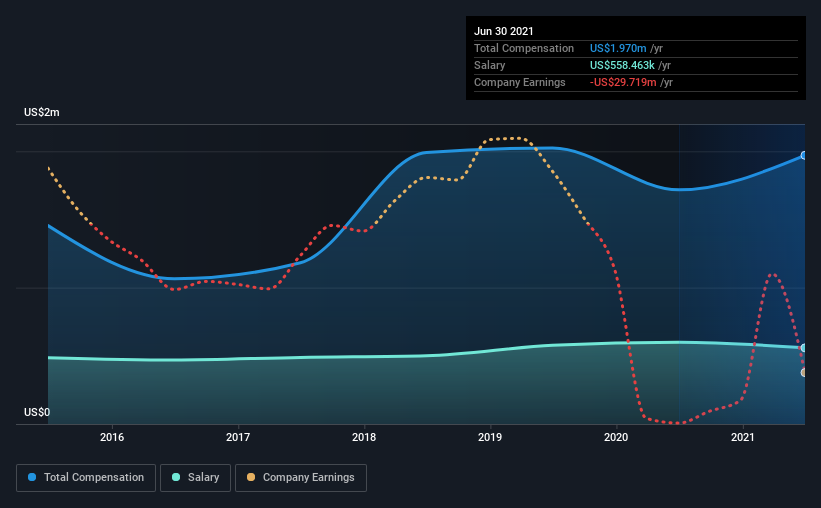

At the time of writing, our data shows that Twin Disc, Incorporated has a market capitalization of US$167m, and reported total annual CEO compensation of US$2.0m for the year to June 2021. That's a notable increase of 15% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$558k.

In comparison with other companies in the industry with market capitalizations ranging from US$100m to US$400m, the reported median CEO total compensation was US$929k. Accordingly, our analysis reveals that Twin Disc, Incorporated pays John Batten north of the industry median. What's more, John Batten holds US$33m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | US$558k | US$600k | 28% |

| Other | US$1.4m | US$1.1m | 72% |

| Total Compensation | US$2.0m | US$1.7m | 100% |

Speaking on an industry level, nearly 20% of total compensation represents salary, while the remainder of 80% is other remuneration. According to our research, Twin Disc has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Twin Disc, Incorporated's Growth Numbers

Over the last three years, Twin Disc, Incorporated has shrunk its earnings per share by 92% per year. Its revenue is down 11% over the previous year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Twin Disc, Incorporated Been A Good Investment?

Few Twin Disc, Incorporated shareholders would feel satisfied with the return of -36% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 1 warning sign for Twin Disc that investors should look into moving forward.

Important note: Twin Disc is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Twin Disc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:TWIN

Twin Disc

Engages in the design, manufacture, and sale of marine and heavy duty off-highway power transmission equipment in the United States, the Netherlands, China, Australia, Italy, and internationally.

Flawless balance sheet second-rate dividend payer.