- United States

- /

- Machinery

- /

- NasdaqGM:SYM

A Look at Symbotic's (SYM) Valuation Following Regulatory Clarity and Board Appointment

Reviewed by Simply Wall St

Symbotic (SYM) investors just got the kind of clarity markets crave. The company announced that the SEC has finished its investigation into alleged compliance matters and restated revenue, without recommending any action. Closing the book on this chapter removes a regulatory cloud that was hanging over Symbotic, leaving the business and its shareholders much better positioned to focus on the future. To top it off, Symbotic has brought veteran leader Andy Ross onto its Board, tapping his decades of operational experience and industry know-how.

The end of regulatory uncertainty came after a year marked by major stock swings. Despite a choppy month, Symbotic has delivered a gain of over 158% in the past year, with strong upward momentum especially noticeable since spring. Alongside the regulatory news, the addition of Mr. Ross, who has served as President and COO at Parker-Hannifin, may further bolster confidence in the company’s leadership and long-term direction. These moves come as Symbotic continues to outpace revenue expectations and rapidly scale its automation footprint.

The big question now is whether Symbotic’s recent rally is just the beginning or if today’s price already reflects the company’s forward growth prospects. Is there room for investors to take advantage?

Most Popular Narrative: 2.1% Undervalued

The most widely tracked view among analysts sees Symbotic as slightly undervalued, based on expectations of accelerated automation growth and financial improvement driven by e-commerce trends.

Continuous innovation in proprietary robotics and AI-powered automation, such as the new storage structure and increased bot capabilities, is enabling Symbotic to command premium pricing and realize higher gross and net margins as systems become faster to deploy and less costly to operate.

Ready to discover what’s fueling this valuation? The secret is not just about flashy tech. It hinges on a bold vision of profitability and revenue acceleration, built on a surprisingly ambitious set of financial assumptions. What factors do analysts believe will transform Symbotic’s fortunes in just a few years? Find out how these projections could change everything for investors watching this stock.

Result: Fair Value of $48.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including potential delays from Symbotic’s next-generation transition and the company’s high reliance on key customers such as Walmart.

Find out about the key risks to this Symbotic narrative.Another View: Testing the Numbers with a Different Lens

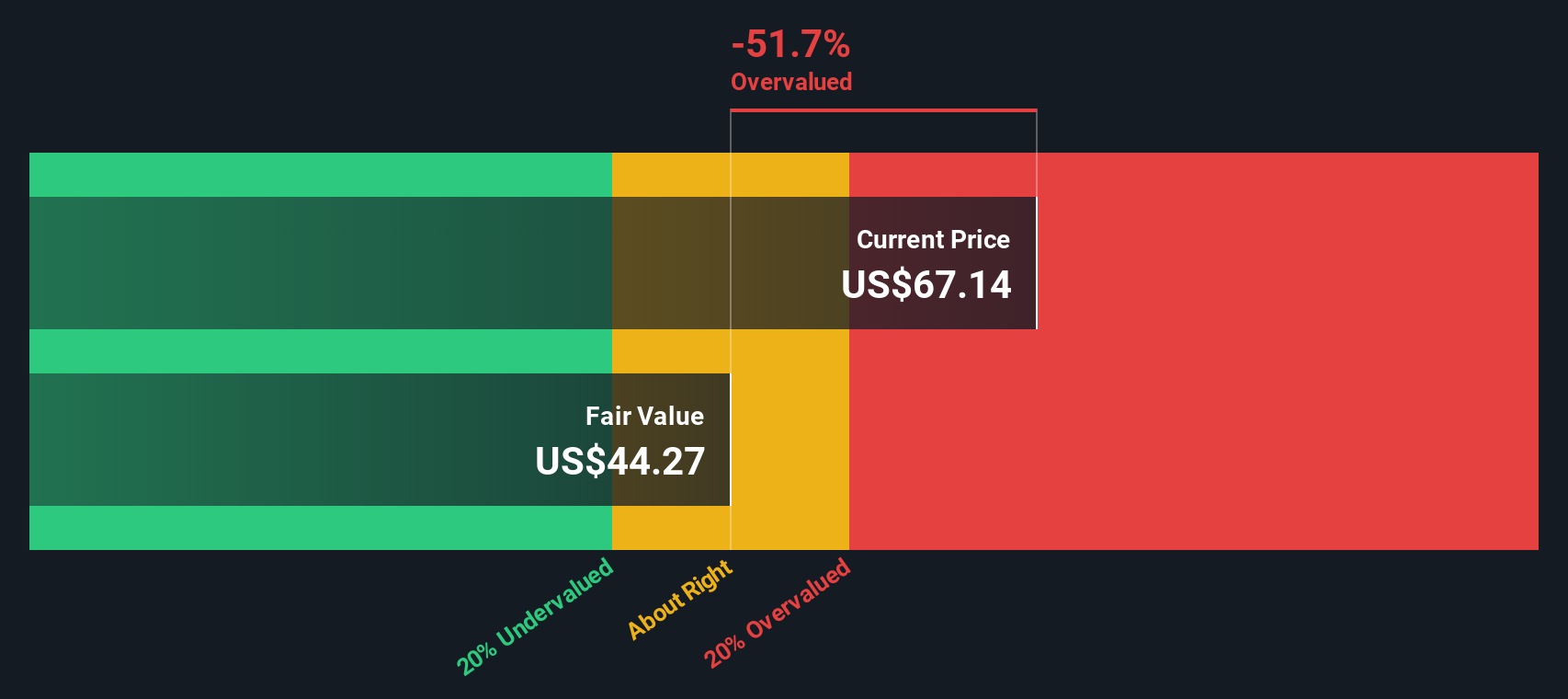

Looking through a different lens, our DCF model tells a much less optimistic story for Symbotic. It considers future cash flows instead of sales or profit multiples and suggests the stock might actually be overvalued. Could the growth story be just a bit too far ahead of itself, or are the models missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Symbotic Narrative

If you see things differently or like to dig into the details yourself, you can build a fresh Symbotic narrative in under three minutes. Do it your way

A great starting point for your Symbotic research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let exciting investment opportunities pass you by. Use the Simply Wall Street Screener to uncover stocks with unique potential and spark your next smart move.

- Tap into market-shifting potential by evaluating penny stocks with strong financials. Use penny stocks with strong financials as your guide to robust growth stories most investors overlook.

- Position yourself for the next tech leap by focusing on companies at the cutting edge of artificial intelligence, all highlighted through the power of AI penny stocks.

- Secure value for your portfolio by finding overlooked stocks whose current prices do not reflect their true future cash flows. All of these are surfaced through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGM:SYM

Symbotic

An automation technology company, develops technologies to enhance operating efficiencies in modern warehouses.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)