- United States

- /

- Trade Distributors

- /

- NasdaqGS:RUSH.A

Does Rush Enterprises’ (RUSH.A) Shareholder Payouts Signal Lasting Confidence Amid Soft Truck Demand?

Reviewed by Sasha Jovanovic

- Rush Enterprises recently reported third quarter earnings that exceeded analyst expectations, alongside a new US$0.19 per share dividend declaration and confirmation of continued share repurchases, despite ongoing softness in the commercial vehicle market.

- Ongoing strength in aftermarket and light-duty vehicle sales, coupled with company-led expansion initiatives, helped counterbalance weaker new truck demand in the past quarter.

- We'll explore how Rush Enterprises' focus on aftermarket growth and shareholder returns may influence its investment narrative moving forward.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Rush Enterprises Investment Narrative Recap

To be a shareholder in Rush Enterprises, you need to believe in the company’s ability to offset cyclical downturns in new truck sales with steady aftermarket growth and disciplined capital allocation. The recent earnings beat, coupled with consistent dividends and share repurchases, does not materially shift the main short-term catalyst: a potential rebound in new truck demand if regulatory and freight market uncertainties clear. However, the primary risk remains the ongoing softness in new truck orders, which could weigh on margins if it persists. Among Rush Enterprises’ latest announcements, the US$0.19 per share dividend declaration stands out, reinforcing management’s commitment to shareholder returns. While encouraging, it does not address the underlying pressure from a freight recession and delayed fleet spending, which continue as headwinds for new truck sales growth. Yet despite these strengths, investors should also be aware that prolonged periods of weak freight demand could…

Read the full narrative on Rush Enterprises (it's free!)

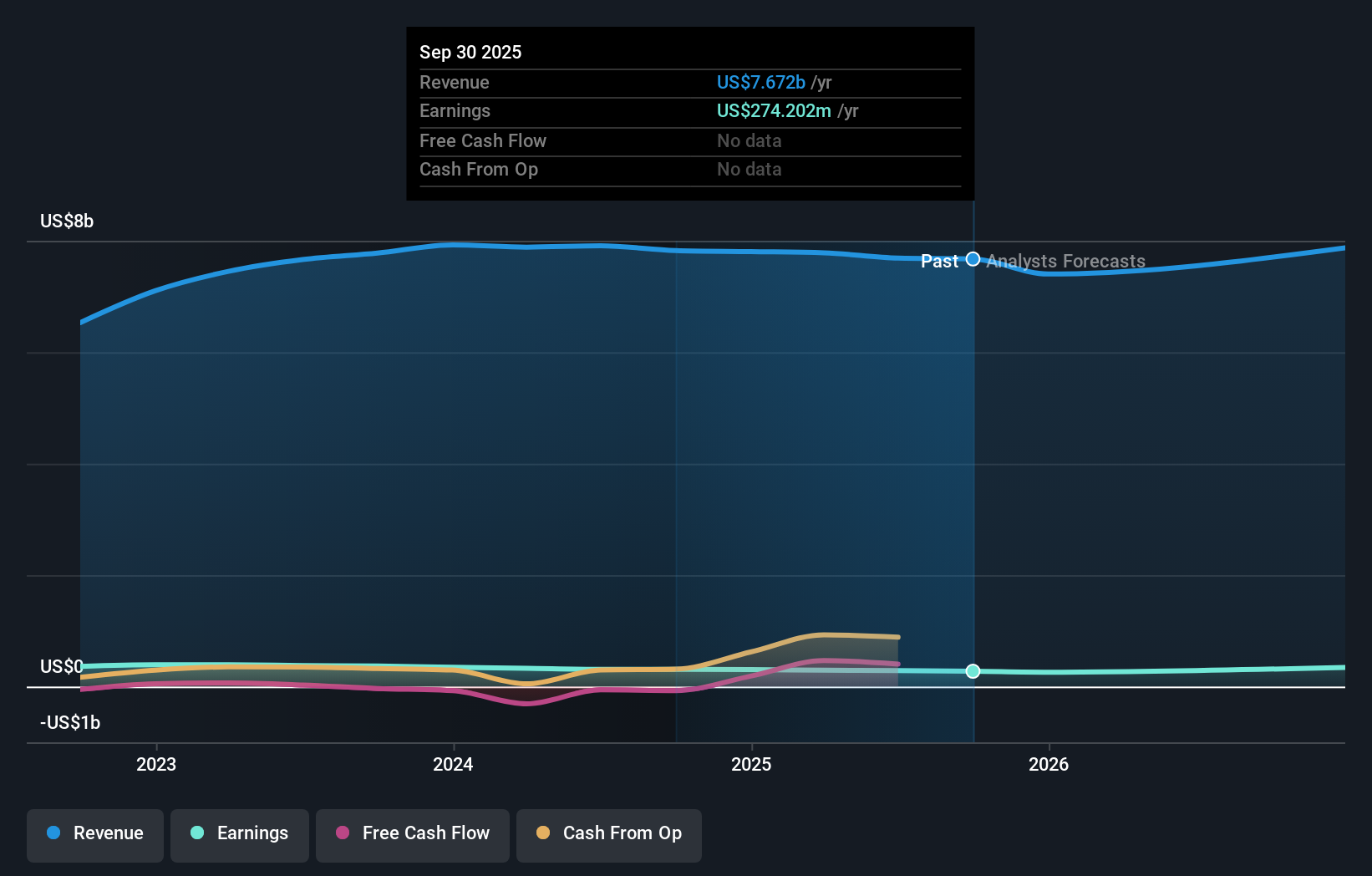

Rush Enterprises' narrative projects $7.6 billion revenue and $440.7 million earnings by 2028. This requires a 0.3% annual revenue decline and a $154 million earnings increase from $286.6 million currently.

Uncover how Rush Enterprises' forecasts yield a $60.00 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate of US$60 is available from the Simply Wall St Community, offering a single perspective rather than a range. As views may differ across the market, remember that Rush’s high reliance on cyclical vehicle sales means that risks tied to freight demand and regulatory actions could sharply impact near-term performance.

Explore another fair value estimate on Rush Enterprises - why the stock might be worth just $60.00!

Build Your Own Rush Enterprises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rush Enterprises research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Rush Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rush Enterprises' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RUSH.A

Rush Enterprises

Through its subsidiaries, operates as an integrated retailer of commercial vehicles and related services in the United States and Canada.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives