- United States

- /

- Electrical

- /

- NasdaqGS:RUN

Sunrun Inc.'s (NASDAQ:RUN) 70% Share Price Surge Not Quite Adding Up

Sunrun Inc. (NASDAQ:RUN) shares have had a really impressive month, gaining 70% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 25% over that time.

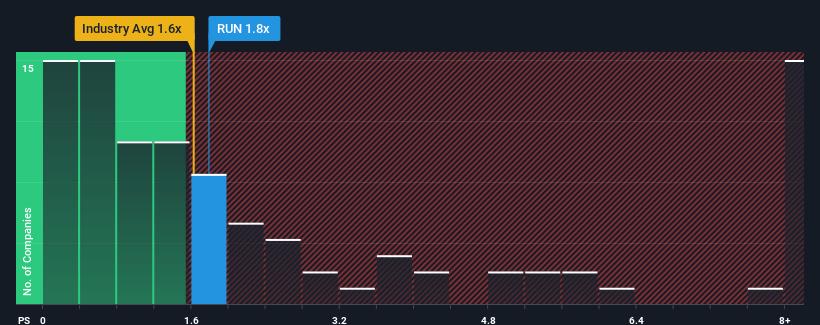

Although its price has surged higher, you could still be forgiven for feeling indifferent about Sunrun's P/S ratio of 1.8x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in the United States is also close to 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Sunrun

How Has Sunrun Performed Recently?

Sunrun could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sunrun.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Sunrun's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 9.5%. Pleasingly, revenue has also lifted 178% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 9.4% per year as estimated by the analysts watching the company. With the industry predicted to deliver 68% growth each year, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Sunrun's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Sunrun's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that Sunrun's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Before you take the next step, you should know about the 5 warning signs for Sunrun (1 can't be ignored!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RUN

Sunrun

Designs, develops, installs, sells, owns, and maintains residential solar energy systems in the United States.

Fair value low.

Similar Companies

Market Insights

Community Narratives