- United States

- /

- Construction

- /

- NasdaqGS:ROAD

Should ROAD Investors Reconsider Construction Partners' Long-Term Trajectory After Major Houston Asphalt Acquisition?

Reviewed by Sasha Jovanovic

- Construction Partners, Inc. recently acquired eight hot-mix asphalt plants, along with crews and equipment, from affiliates of Vulcan Materials Company to expand its operations in the Houston, Texas metro area.

- This acquisition, following the earlier purchase of Durwood Greene Construction Co., meaningfully increases Construction Partners' production capacity and presence in one of the country's largest infrastructure markets.

- We'll look at how the addition of eight Houston asphalt plants could impact Construction Partners' long-term growth narrative and industry positioning.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Construction Partners Investment Narrative Recap

To be a shareholder in Construction Partners, you need to believe that ongoing state and federal infrastructure investment, along with the company's strategic expansion in high-growth regions, can sustain long-term revenue and profitability. The recent acquisition of eight Houston asphalt plants significantly supports the key catalyst of expanding presence in fast-growing markets, yet it does not materially reduce the company's reliance on public infrastructure funding, which remains the largest short-term risk due to potential government budget changes.

The most relevant recent announcement is the August acquisition of Durwood Greene Construction Co., which laid the foundation for Construction Partners’ entry into the Houston market and set the stage for this latest expansion. Together, these moves give the company more scale and operational efficiency in Texas, deepening its exposure to anticipated infrastructure demand in the region.

However, despite near-term optimism, investors should pay close attention to the effects if state or federal infrastructure budgets suddenly ...

Read the full narrative on Construction Partners (it's free!)

Construction Partners' narrative projects $4.1 billion revenue and $286.4 million earnings by 2028. This requires 18.3% yearly revenue growth and a $211.9 million earnings increase from $74.5 million today.

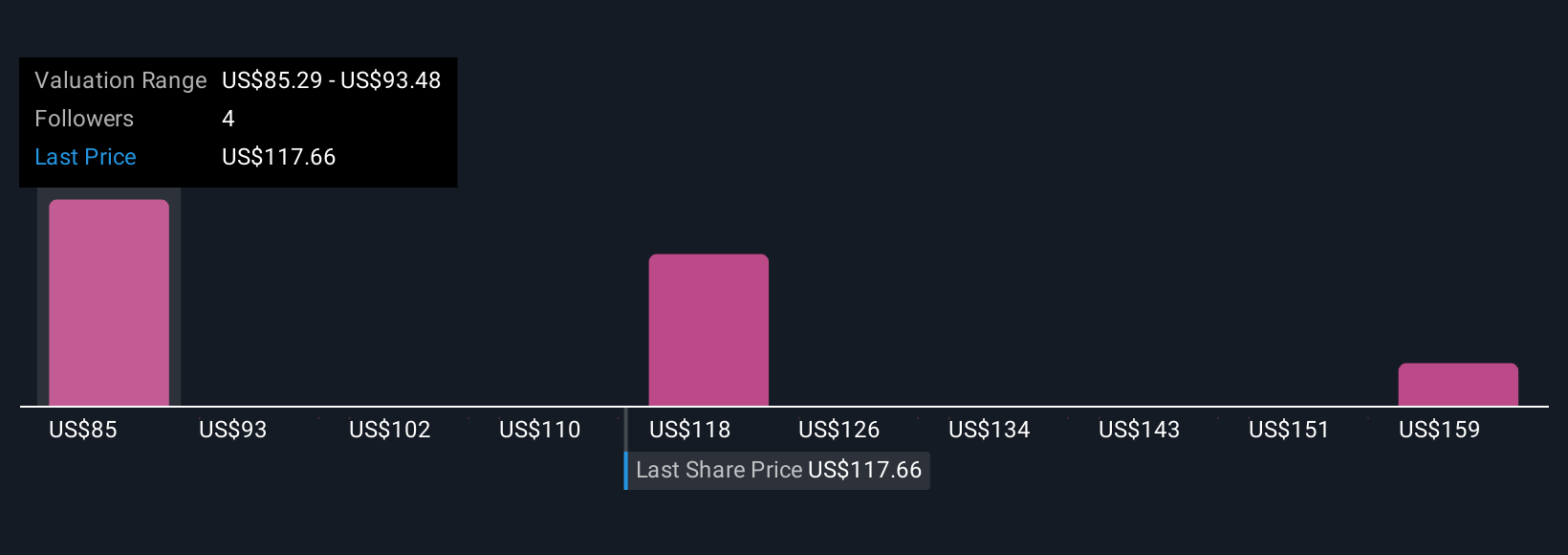

Uncover how Construction Partners' forecasts yield a $120.17 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Fair value estimates from two Simply Wall St Community contributors range from US$74.31 to US$120.17, highlighting wide diverging opinions. With the company’s growth plans tied closely to federal and state funding pipelines, it is worth considering how shifts in public budgets might affect such forecasts.

Explore 2 other fair value estimates on Construction Partners - why the stock might be worth as much as $120.17!

Build Your Own Construction Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Construction Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Construction Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Construction Partners' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROAD

Construction Partners

A civil infrastructure company, constructs and maintains roadways in Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Texas.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives